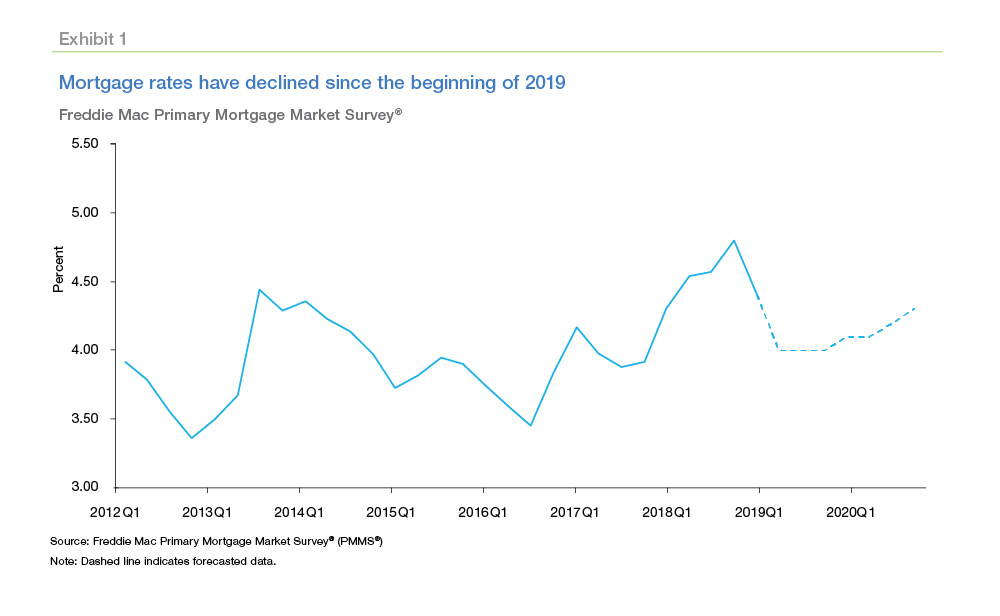

Freddie Mac's forecast for June sees more dark clouds than usual, but few of those are on the housing front. The company's Economic and Housing Research Group notes that some of those gathering clouds, concerns about global growth and the lingering trade problems, have pushed long-term interest rates to their lowest level since the fall of 2017, 3.82 percent as of the first week of June. That is good news for the industry and consumers.

The downturn is not viewed as a flash-in-the-pan and Freddie's economists have revised downward some of their earlier Treasury rate forecasts. The 10-year note yield is expected to decline to 2.4 percent and 2.5 percent in 2019 and 2020, respectively. They also lowered the 1-year Treasury rate forecast to 2.2 percent this year before increasing to 2.3 percent in 2020. Mortgage rates should follow suit, with the 30-year fixed-rate mortgage averaging 4.1 percent in 2019, before increasing modestly to 4.2 percent in 2020.

Strengthening homebuilder confidence (the forecast predates Monday's builder confidence report from the National Association of Home Builders which did post a small decline), an increase in the level of housing permits, and low mortgage rates are expected to translate into stronger housing starts and increased home sales. The forecast for the annual rate of housing starts has increased to 1.26 million and 1.35 million in 2019 and 2020, respectively while home sales are expected to reverse their 2018 slump. Freddie Mac is looking for total home sales of 6.03 million this year and 6.19 million in 2020. The latter will put sales back above the 2017 level. Prices are expected to increase by 3.6 percent in 2019 and then decline further to 2.7 percent, a slightly higher prediction than the economists made in May.

The decline in interest rates should be especially beneficial to lenders. Refinance originations are expected to grow by 20 percent this year and the dollar volume or all originations to be $1.8 trillion, moderating to $1.7 trillion in 2020.

Turning to the larger economy, the economic group sees the annual 3.1 percent growth in the GDP in Q1 unlikely to persist beyond mid-year. Second quarter growth looks to be, given data through May, at about half of the first quarter growth at 1.5 percent. They anticipate that trade tensions and the fading effects of last year's fiscal stimulus will push growth down to 2.2 percent for the year and 1.8 percent in 2020.

Consumer prices are expected to rise due to a surge in gasoline prices in the second quarter and their effects on other goods and services. Combined with trade effects Freddie is looking for an increase in consumer prices of 3.0 percent in the second and 2.4 percent in the third quarter of this year. This would result in an increase in consumer prices of 2.1 percent both this year and next.

The unemployment rate remained at 3.6 percent in May and the forecast is for continued strength in the labor market. The unemployment rate should edge up in the second half of the year but remain historically low. Those predictions are unchanged from the May report at 3.8 percent and 3.9 percent in 2019 and 2020, respectively.