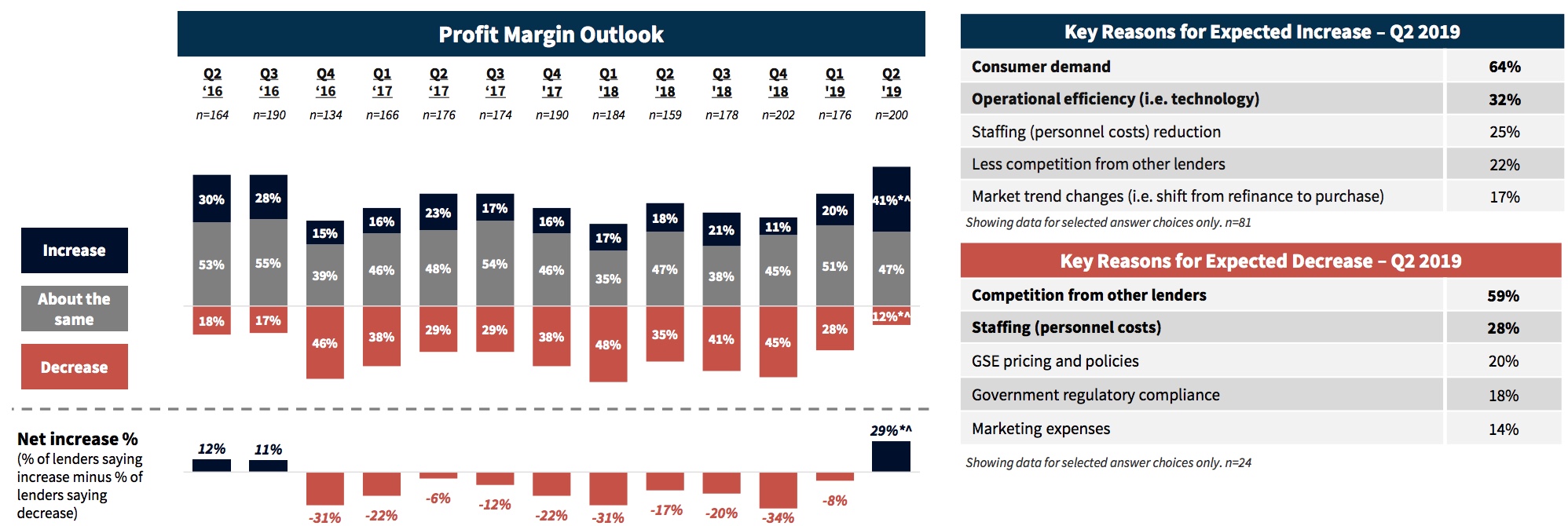

Lenders are singing a happier tune when it comes to their profit margin outlook with those hopes driven by rising confidence in mortgage demand. The net share of lenders' perceptions about both recent and upcoming demand has turned positive for the first time in nearly three years.

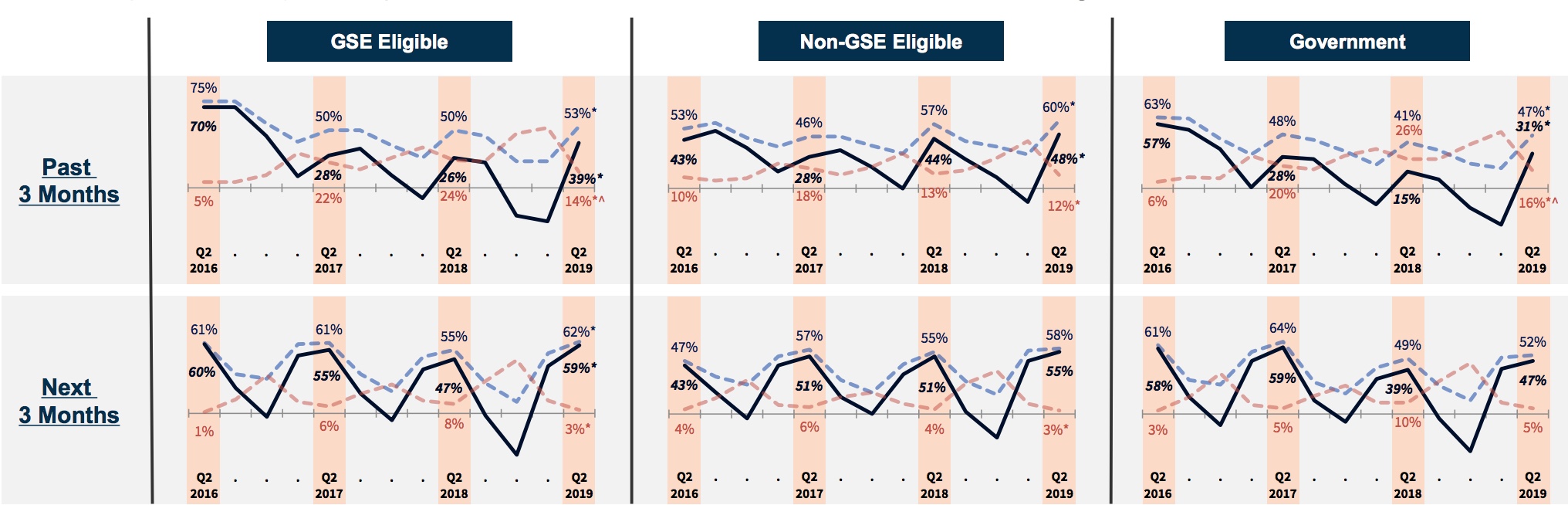

Fannie Mae's Q2 Mortgage Lender Sentiment Survey saw net positive responses rise across all three loan types (government, GSE-eligible, and non-GSE-eligible loans) when lenders reported on increases in demand for both purchase and refinance mortgages over the previous three months.

In all three cases, these measures had reached survey lows in the first quarter of the year. Net positive responses in the second quarter rebounded to reach the highest readings for any second quarter since 2016 for GSE-eligible and government loans and the highest since Q2 2015 for non-GSE-eligible loans.

Demand growth expectations for purchase mortgages over the next three months also improved. The net share of lenders reporting growth expectations for GSE-eligible loans reached the highest level for any second quarter over the past three years and was the highest in the survey's history for non-GSE-eligible loans.

Reports of prior quarter demand for refinancing turned positive for all loan types, ending nine quarters of negative net readings. Similarly, the net share expecting refinance demand to increase during the upcoming quarter continued to climb and is now positive for the first time since Q3 2016 for GSE-eligible loans and since Q1 2016 for non-GSE-eligible and government loans.

These demand expectations in turn have turned profit margin outlooks positive on net also for the first time in nearly three years. Doug Duncan, Fannie Mae senior vice president and chief economist said, "Lenders are signaling strong demand-driven mortgage market dynamics, with optimism for both their consumer demand and profitability outlooks reaching multi-year highs.

"Lender sentiment regarding both recent and expected purchase mortgage demand growth across all loan types was the most upbeat in at least three years. And for the first time in more than two years, lenders who are reporting or expecting growing refinance demand became the majority.

"With brighter volume expectations, the profit margin outlook improved markedly, helping the net share of lenders reporting rising profits turn positive for the first time in nearly three years, with consumer demand cited as the top reason for the rosier outlook, Duncan said. "A lift in lender sentiment from depressed levels is an encouraging sign; however, many challenges remain, including the continued shortage of entry-level housing. In addition, it appears that the meaningful easing of lending standards is a thing of the past."

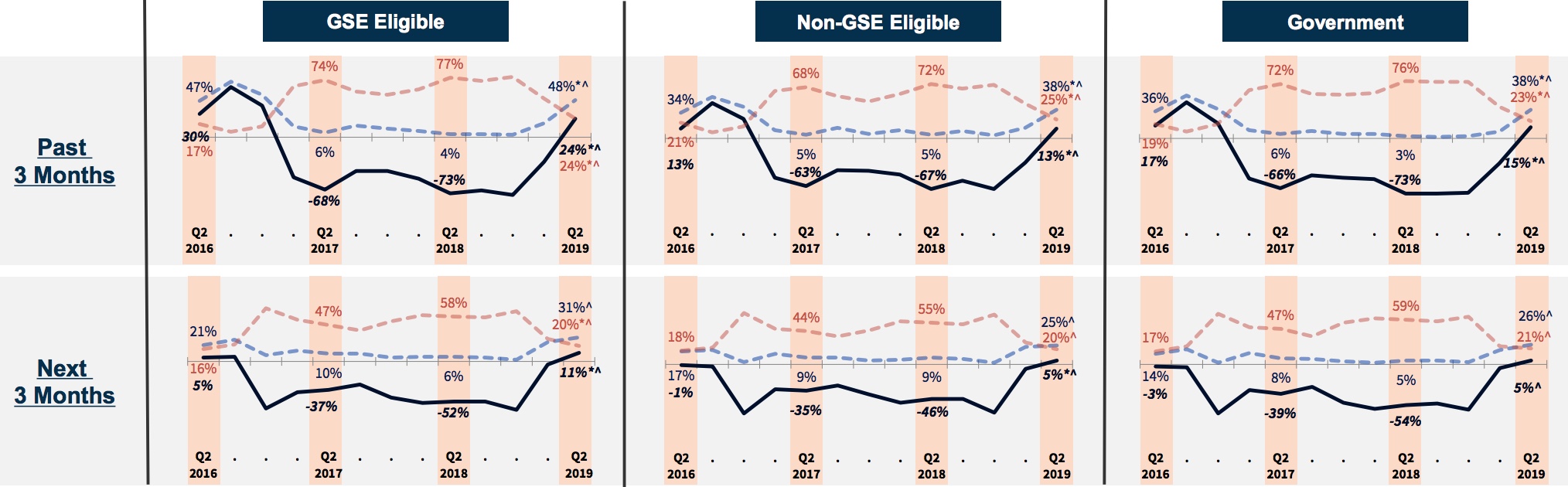

Lenders did concur that the pace of credit easing is trending down. Net perceptions about easing over the previous three months declined to the lowest levels since 2014 for GSE-eligible and government loans. Most lenders expect the trend to continue; the net of those expecting more easing was at the lowest level since 2014 as well.

The Mortgage Lender Sentiment Survey by Fannie Mae polls senior executives of its lending institution customers on a quarterly basis to assess their views and outlook across varied dimensions of the mortgage market. The Fannie Mae second quarter 2019 Mortgage Lender Sentiment Survey was conducted between May 1, 2019 and May 12, 2019.