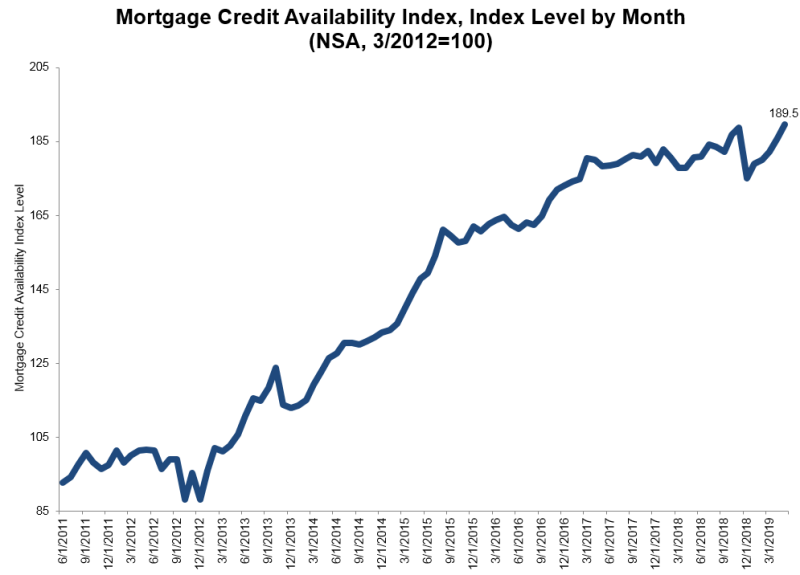

Mortgage access increased in May for the fifth consecutive month. The Mortgage Bankers Association (MBA) said its Mortgage Credit Availability Index (MCAI) rose 1.9 percent to 189.5. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

The MCAI has two component indices, the Government MCAI which measures the availability of loans backed by FHA, the VA, and the USDA, and the Conventional index which itself has components for both conforming and jumbo loans. The Government MCAI decreased 0.6 percent while the Conventional MCAI was up 4.4 percent driven by a 6.8 percent gain in jumbo lending. The Conforming MCAI rose 0.9 percent.

"Credit supply increased 2 percent in May, driven by the fifth straight gain in the jumbo index, which was up 7 percent and surpassed last month as the new all-time survey high," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "The conventional index continues to grow, while the government index has generally been lower this year. Government credit supply continues to decline since peaking in 2017, as there are fewer streamlined refinance programs being offered."

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.) gathered from over 95 lenders and investors. They are combined with data from an AllRegs proprietary product to calculate a summary measure indicating the availability of mortgage credit at a point in time

The MCAI and its components are designed to show relative credit risk/availability for their respective indices and were benchmarked in March 2012. The total MCAI, Conforming, and Jumbo indices were indexed at 100 while the Conventional and Government indices were indexed at 73.5 and 183.5 respectively to better represent where each index might have been relative to 100.