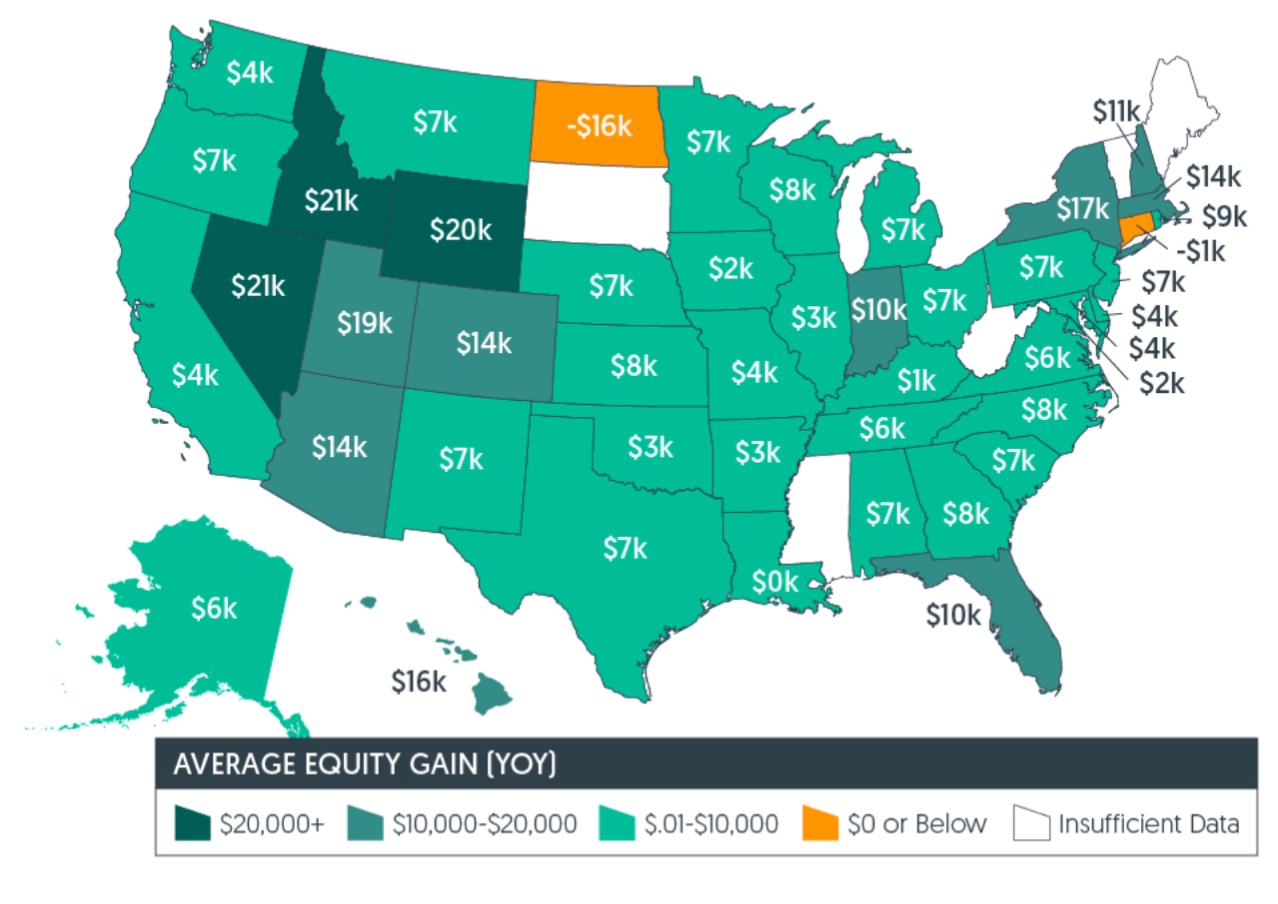

The increase in homeowner equity has slightly exceeded the pace of housing appreciation. CoreLogic says that the 63 percent of homeowners nationally who have a mortgage on their property saw their equity grow by 5.6 percent between the first quarter of 2018 and the same quarter in 2019.

The national increase in the value of homeowner equity aggregates to nearly $486 billion. On average, homeowners gained about $6,400 in housing wealth during the year that ended in the first quarter of 2019. Nevada had the highest year-over-year average increase at $21,000.

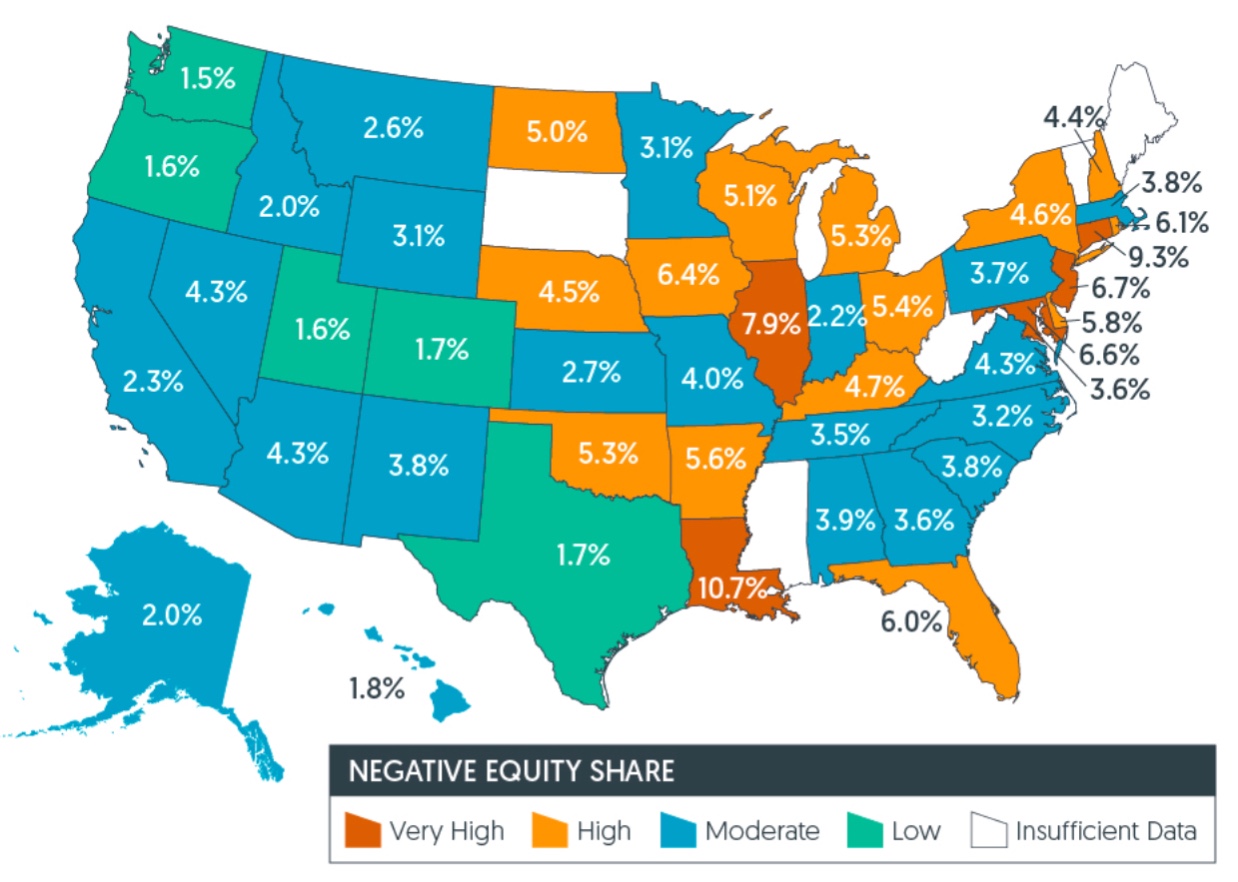

The number of homeowners who are upside-down in their mortgage, those owing more to the lender than the market value of their home, is declining, although the cost of that negative equity grew slightly. Underwater properties dipped by 1 percent from the fourth quarter and 11 percent year-over-year to 2.2 million homes or 4.1 percent of all mortgaged homes. The aggregate value of that negative equity grew to approximately $305.4 billion at the end of the first quarter, a $2.5 billion increase from the fourth quarter of 2018. Negative equity is caused by falling home prices, an increase in mortgage debt, or both.

CoreLogic's chief economists Frank Nothaft says the company's forecast for its Home Price Index is for another 4.5 percent gain in home value from the end of 2018 to December 31 of this year. "If all homes experience this gain," he says, "this would lift about 350,000 homeowners from being underwater and restore [their] positive equity."

Negative equity peaked at 26 percent of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis which began in the third quarter of 2009.

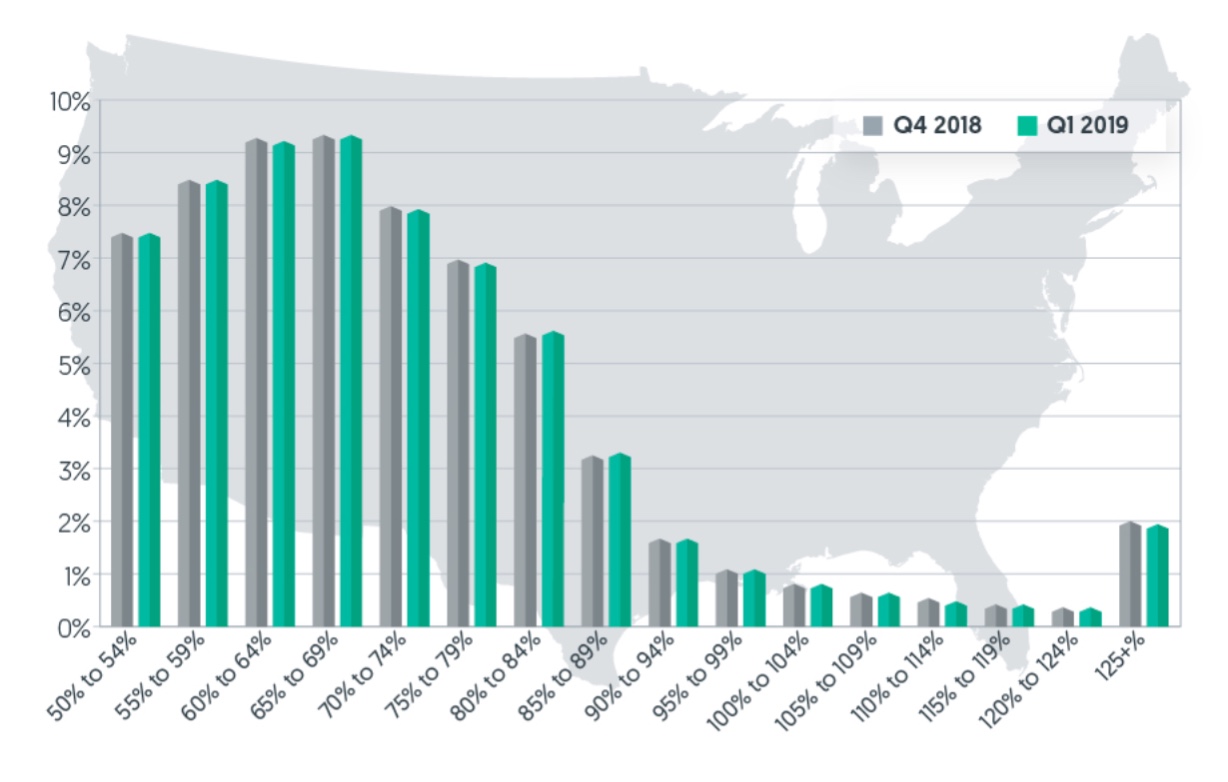

As can be seen in the graphic below, homeowners with near-negative equity, loan-to-value (LTV) ratios between 80 and 100 percent, present a danger of rapid growth in the negative statistics should home prices decline. while only a small share of the negative equity totals are among those with LTVs between 100 and 125 percent. Those with significant negative equity - LTV's higher than 125 percent, represent a large number of those who are still underwater.