The War is over. That would be the bidding war. And maybe not over, but there seems to be a cease-fire.

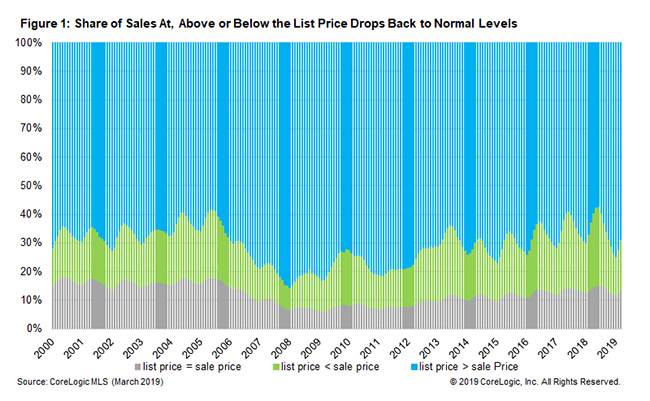

CoreLogic's Shu Chen says that the share of homes that sell above their list price, often because of competition among multiple prospective buyers, has returned to normal levels. Not that normal is necessarily a leisurely pace. Thirty-one percent of homes sold at or above the ask in March, about the same percentage as in 2000 and 2001.

Chen says, at the peak in the second quarter of 2018, more than 40 percent of homes brought in a higher price than asked. That was nearly triple the share at the trough in January 2008. With home prices reaching many homebuyers' budget limits, appreciation began to slow in the third quarter of last year and the share of buyers who were able to negotiate a better deal started to rise.

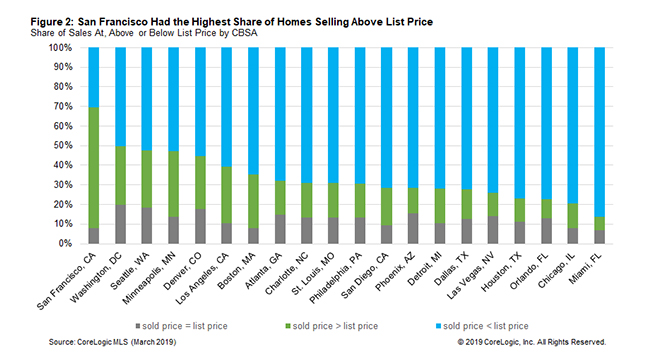

In some cities, notably San Francisco, sellers are still in a pretty favorable position. In that metro, 70 percent of sales were at or above the list price and only a fraction of those sales sold at that price. This was significantly higher than the metros in second and third place, Washington, DC and Minneapolis, where about half of sales were actually below the list.

The list/sell ratio is of course correlated to available inventories. Chen notes that price pressures begin to increase once inventories drop below a 3-month supply. For example, in March San Francisco had among the smallest reserve of homes for sale in the nation, a 2.3-month supply and buyers paid an average of 4.6 percent above the listing price. In Miami, which had the lowest share of at or over listing price sales among the 20 metros studied at14 percent, there was an inventory of 11 months. Buyers were able to negotiate discounts averaging 7.8 percent.