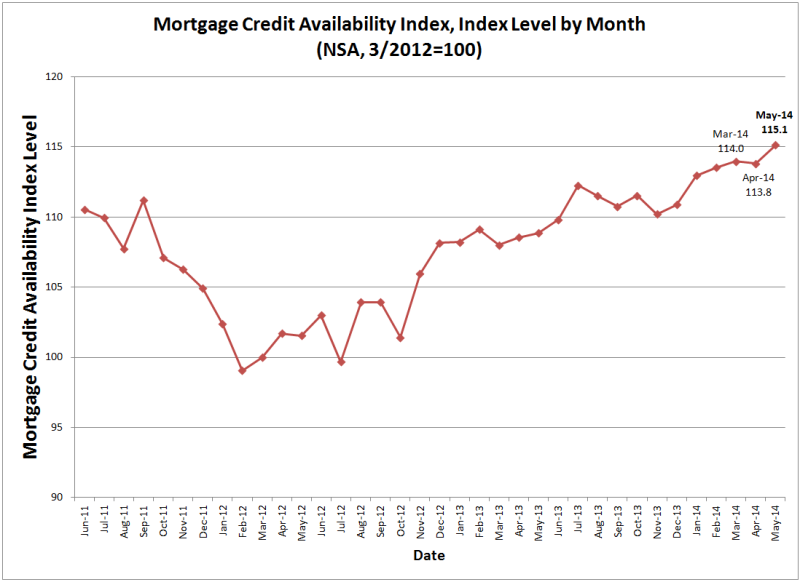

Mortgage credit was marginally more available in May than it was in April the Mortgage Bankers Association (MBA) said today. Its Mortgage Credit Availability Index (MCAI) inched up 1.14 percent to 115.1 compared to 113.8 in April.

The increase in the index, benchmarked to 100 in March 2012, was partially due to a slight uptick in the availability of jumbo loans. There was also a move by some investors toward lowering credit scores for FHA loans.

The MCAI is calculated using data from the AllRegs® Market Clarity® product and a proprietary formula derived by MBA. It takes into account several factors of borrower eligibility such as credit scores, loan type, and loan-to-value ratio taken from its regular survey of over 85 lenders and investors.

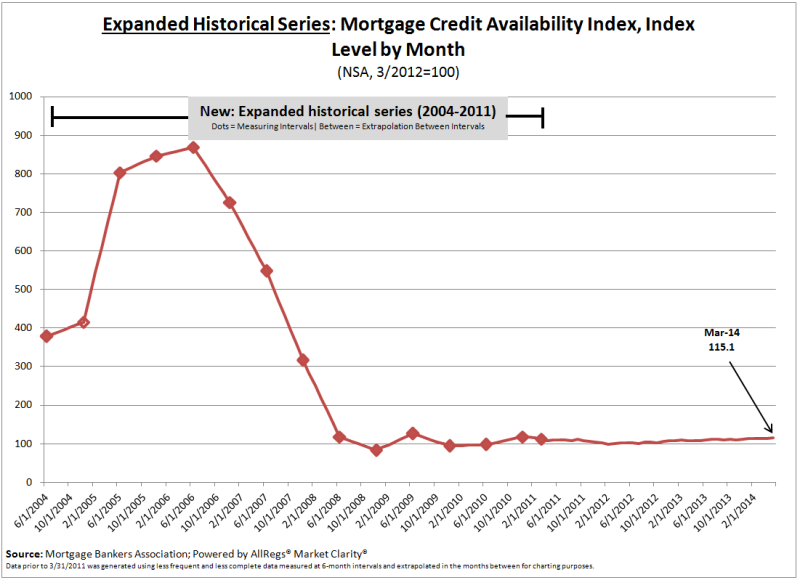

MBA has also produced a new expanded historical series which tracks credit availability over the previous ten years. This series permits historical perspective on credit availability since 2004, a period which includes both the housing boom and the ensuing recession.