Data released this morning by RealtyTrac indicate a more widespread recovery in home prices than has been evident from other data sources. It is generally accepted that home prices peaked in the U.S. in 2006 and bottomed out in early 2012. Despite strong price increases since the 2012 trough sources such as CoreLogic and Case-Shiller still peg national home prices at well below that pre-recession peak. Case-Shiller said this week that its 10- and 20-City Composites were about 20 percent below that peak in March, and Black Knight Financial Services puts its national Home Price Index at -12.8 percent.

Black Knight reports that Texas and Colorado have established new peak levels and that Denver, Houston, Dallas, Austin, and San Antonio have done so on nearly a monthly basis since last fall. CoreLogic says that Texas, Colorado, Wyoming, and North and South Dakota are at or above their pre-recession peak and puts another 15 within 8 percent. Few of the CoreLogic states suffered significant price declines during the recession.

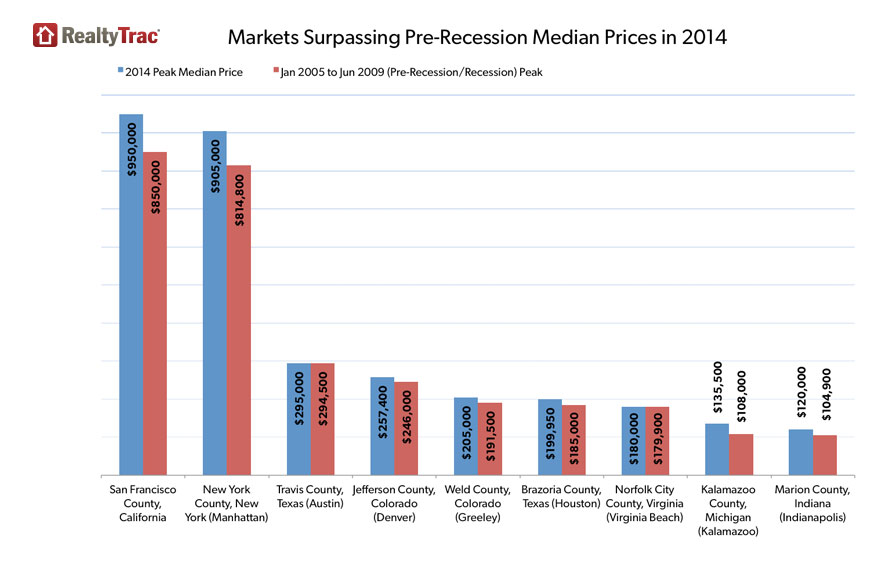

RealtyTrac says that new home price peaks were reached in 28 counties in the last two years, 10 percent of the counties it tracks; seven in April 2014. While several of these areas are among those mentioned in other reports - counties housing major Texas cities and Denver, there were also new peaks in counties in Indiana, Virginia, Michigan, New York, and California.

RealtyTrac also says that since the recession ended in June 2009, median prices of residential property have surpassed pre-recession and recession levels (Jan 2005 through June 2009) in 53 counties with populations of 200,000 or more.

RealtyTrac said that nationwide the median sale price of residential properties, both distressed and non-distressed, was $172,000 in April, up 4 percent from March and 11 percent compared to a year earlier and the largest year-over-year increase since median prices hit their low point in March 2012. April marked the 25th consecutive month where U.S. median prices increased on an annual basis.

Home sales fell slightly in April to an estimated annual rate of 5.2 million, down 1 percent from March but 4 percent higher than in April 2013.

"April home sales numbers are exhibiting the continued effects of low supply and still-strong demand that exist in many markets across the country," said Daren Blomquist, vice president at RealtyTrac. "Annualized sales volume nationwide decreased on a monthly basis for the sixth consecutive month and the 4 percent annual increase in April was the lowest year-over-year increase so far this year. Meanwhile median home prices nationwide increased to the highest level since December 2008.

"U.S. median home prices have now increased 21 percent since hitting bottom in March 2012, although they are still 28 percent below their pre-recession peak of $237,537 in August 2006," Blomquist continued. "There are a surprising number of markets, however, where median home prices have surpassed their previous peaks since the Great Recession ended in June 2009."

Counties where the post-recession median home price peak is furthest above the pre-recession/recession median home price peak included Denver County, Colorado (+16.6 percent), District of Columbia (+14.5 percent), Arlington County, Virginia (+12.6 percent), San Francisco County (+11.8 percent), New York County (+11.1 percent), and Oklahoma County, Oklahoma.

Some previously hot markets are seeing declining sales. Thirteen states and the District of Columbia and 28 or the 50 largest counties had lower annualized sales volume in April than they did a year earlier. The states included California, Nevada, Arizona, Florida, Maryland and Michigan and the metro areas with the biggest declines were Fresno, Boston, Orlando, San Francisco, Los Angeles, and Phoenix.

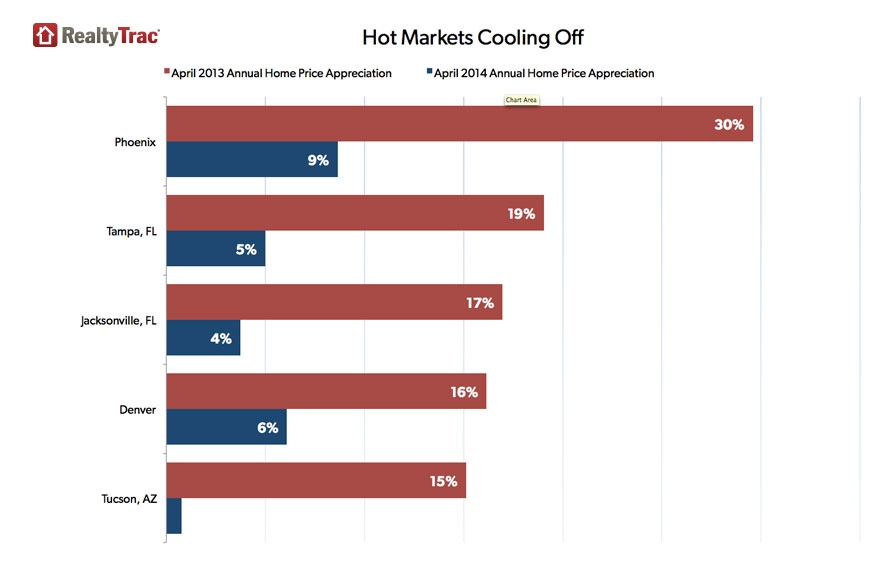

Price appreciation is also showing some signs of slowing, especially in previously fast appreciating markets such as Phoenix where annual price appreciation slowed from 30 percent in April 2013 to 9 percent last month. This was the lowest annual price appreciation for the city since March 2012. Similarly Denver's appreciation slowed from 16 percent to 6 percent, Jacksonville, Florida's from 17 percent to 4 percent, and Tampa's from 19 percent to 5 percent.

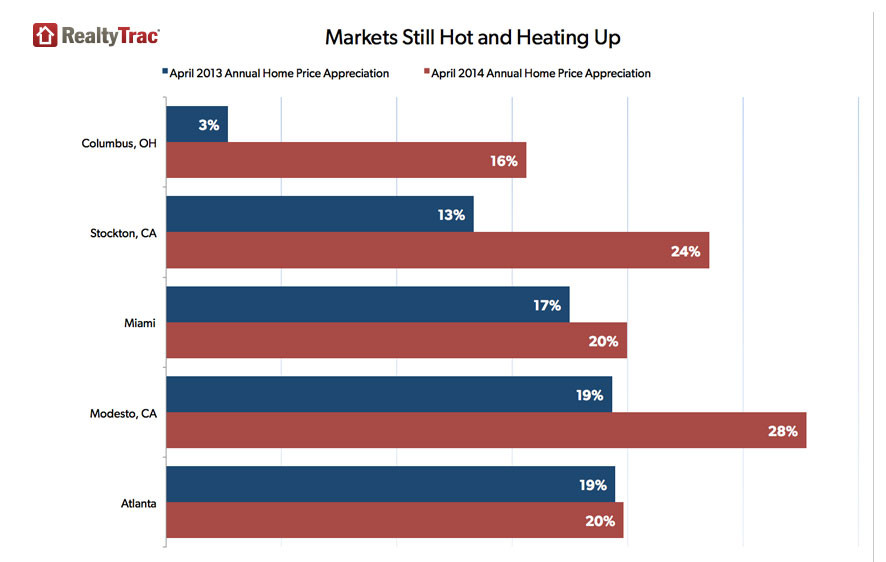

Although home price appreciation showed signs of cooling in several coastal California markets including as Los Angeles, San Diego and San Francisco, inland California markets posted three of the top five annual increases in median prices in April among metropolitan areas with a population of 500,000 or more. Topping the list was Modesto, Calif., with a 28 percent annual increase in median prices, followed by Stockton, up 24 percent, Riverside-San Bernardino-Ontario and Sacramento, each up 20 percent.

Short sales and distressed sales - in foreclosure or bank-owned - accounted for 15.6 percent of all sales in April, down from 16.5 percent of all sales in March, and down from 17.2 percent of all sales in April 2013. Short sales accounted for 5.2 percent of sales and REO properties for 9.2 percent, down from 5.5 percent and 10.0 percent of respective sales in March.