The May edition of Freddie Mac's monthly Outlook, produced by its Economic & Housing Research Group, is focused on the resiliency of the American homebuyer. It notes that, "Through the first five months of 2018, home shoppers have battled the trifecta of climbing home prices, higher mortgage rates and low supply."

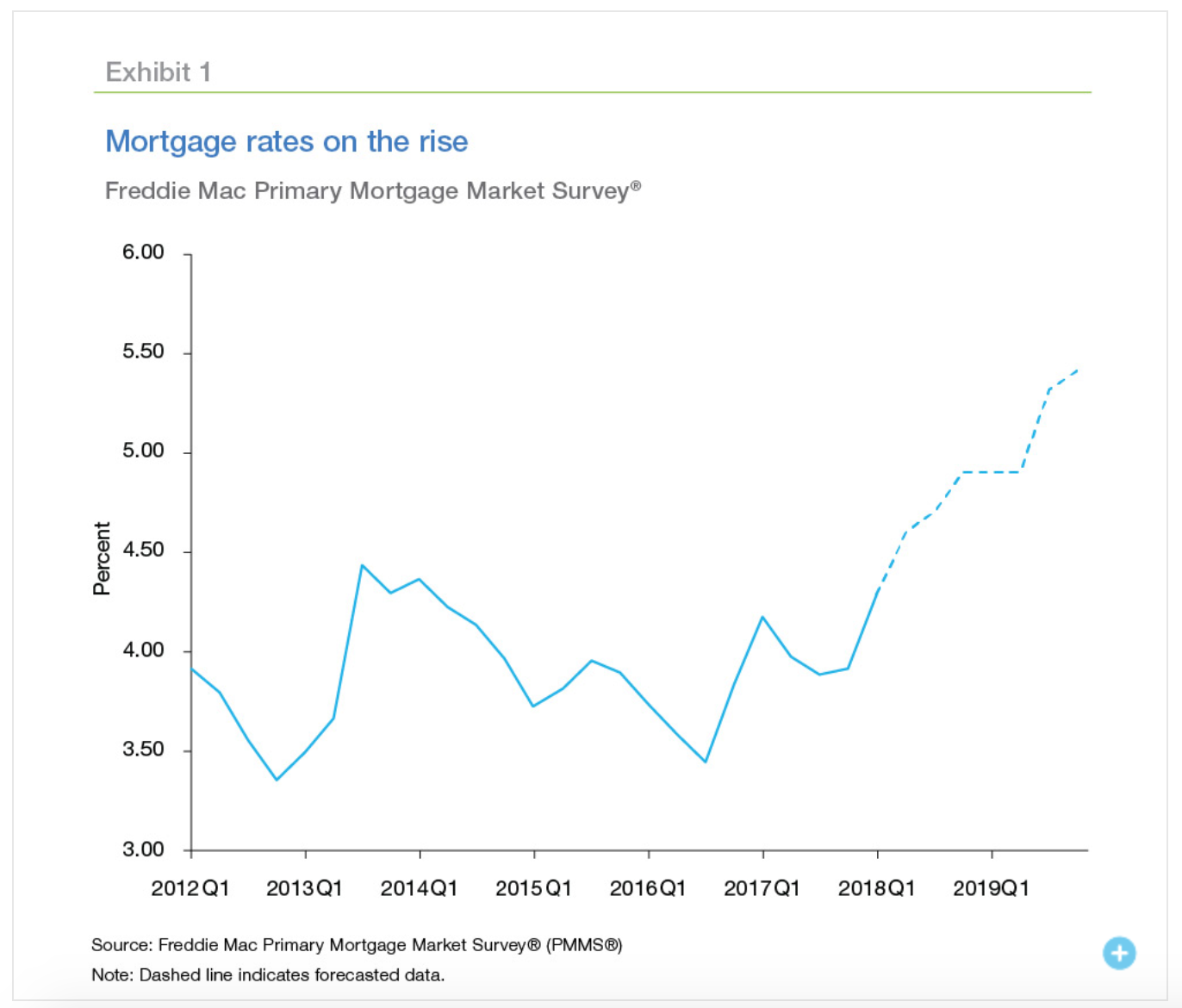

One entry in the trifecta is interest rates, and Freddie Mac's economists see firming inflation continuing to put upward pressure on rates in general, including mortgage rates. They continued to climb during May, reaching 4.66 percent by the middle of the month. Rates, according to their forecast, will average 4.9 percent in the fourth quarter of this year and 5.4 percent by the same quarter in 2019.

Higher mortgage rates have not yet slowed home purchase demand. Buyer resiliency in the face of higher rates reflects the healthy economy and strong consumer confidence and Freddie Mac sees home sales continuing to grow over the next two years, although more modestly. The prediction is that total new and existing home sales will increase to 6.32 million this year and to 6.44 million in 2019, respective year-over-year gains of 3 percent and 2 percent.

This healthy demand coupled with a limited supply of both new and existing homes continue to put pressure on prices which are now increasing nationally at around 7 percent per year. As rates continue to rise, higher borrowing costs along with the rising prices should temper demand. This will be helped along with more supply coming on line. The National Association of Realtors reported this week that inventories of existing homes jumped 9.8 percent between March and April, and housing starts are gradually rising. With easing demand, price gains should also moderate. The company is forecasting home prices to increase 7.0 percent this year, but moderate to 3.1 percent in 2019.

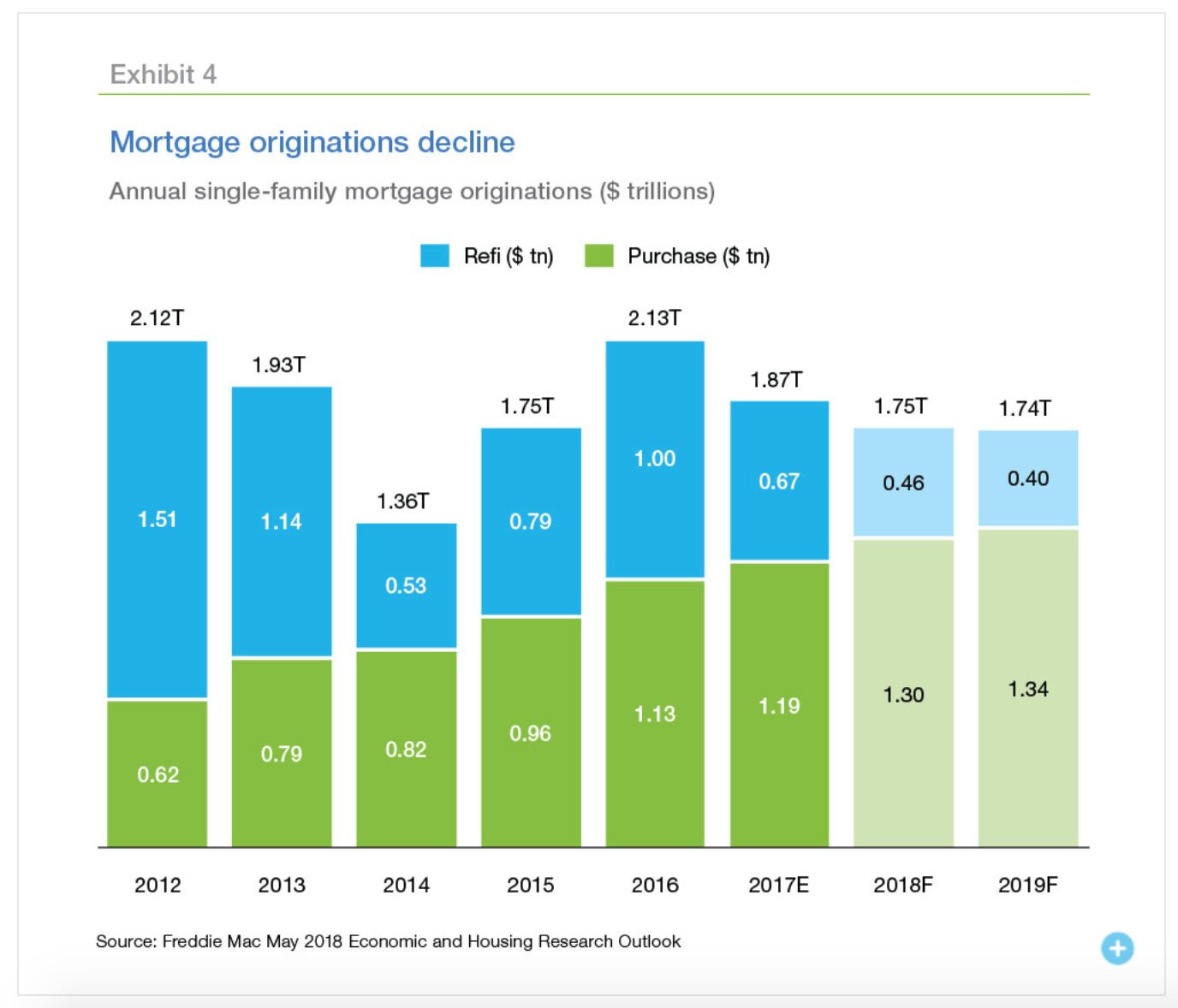

While buyer demand and the strong labor market are providing a lift to purchase mortgage originations, borrowing costs are taking a toll on refinancing and Freddie Mac sees the impact of higher mortgage rates on the latter will outweigh the positive factors lifting the former. Refinancing activity declined by $300 billion or 32 percent from 2016 to 201 and it is expected to fall back by another 26 percent or $175 billion this year. Higher home sales and larger loans due to rising prices will boost purchase originations by 5 percent, recouping about $60 billion of the refinancing losses. Full year originations are forecasted to fall about 6 percent in 2018 to $1.75 trillion and stabilize at $1.74 trillion in 2019.

"While this spring's sudden rise in mortgage rates are taking up a good chunk of the conversation, it's the stubbornly low inventory levels in much of the country that are preventing sales from really taking off like they should be," said Freddie Mac Chief Economist Sam Khater. "The underlying demand for buying a home is holding up, and will continue to do so, as long as the economy is generating solid job and income growth. Most markets simply need a lot more new and existing supply to cool price growth and give buyers enough choices."

Turning to the broader economic parts of the forecast, Freddie Mac says the U.S. labor market "keeps chugging along," generating many new jobs. Through April, the economy has added jobs for 91 consecutive months, helping to push the unemployment rate to 3.9 percent last month, the lowest level since 2000. Wage gains, however, have been tepid. Average hourly earnings increased 2.6 percent year-over- year last month, barely keeping ahead of the 2.5 percent annual increase in inflation. Freddie's economists are forecasting consumer prices to rise 2.7 percent this year and 2.5 percent in 2019.

Real Gross Domestic Product (GDP) faded in the first quarter of 2018, falling from 2.9 percent in the fourth quarter of 2017 to 2.3 percent, mainly because of the lowest growth in consumer spending in nearly five years. The "outlook" is for the stimulus from the tax cuts to kick in more vigorously later in the year and real GDP to kick up to 3.1 percent in the second quarter and 2.7 percent for the full year.