The Urban Institute says one solution to the nation's high rental costs is an old one, but financing may be making it unnecessarily inaccessible. Laurie Goodman, writing in the Institutes blog Urban Wire says that, in 2013 nearly 20 percent of rental apartments were located in two to four unit buildings. She says these buildings "play an essential role in the rental market because they are prevalent in underserved communities and more likely to be owned by minorities and affordable to very low income families than other rental units"

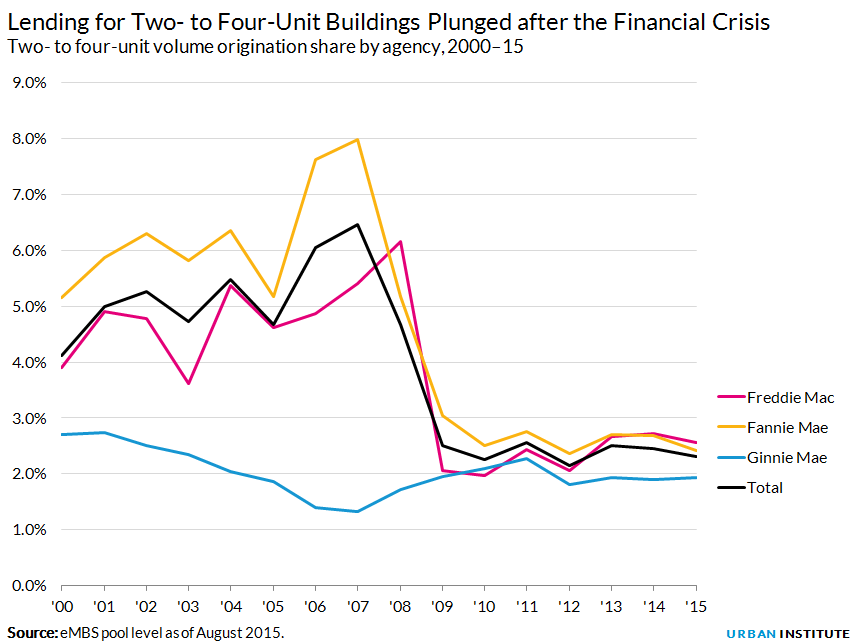

Goodman says two- to four-unit properties have always made up a tiny share of what is usually characterizes as single-family lending (as opposed to multi-family lending in buildings with five or more units) but their importance is unequivocal. From 2000 to 2007, these units comprised between just 5 and 6 percent of all single-family lending but provided 19 percent of the rental housing stock and an even higher share of the affordable housing stock.

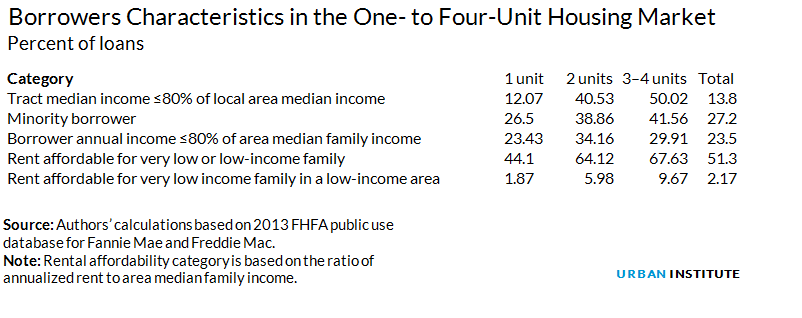

The author says these one to four unit buildings could further expand affordable housing if an effort is made both the expand financing opportunities and to assist the borrowers to better manage the properties. At present, owners of these buildings exhibit the following borrower characteristics:

Lending for these buildings dropped from over a 6 percent share of originations in 2006-2007 to only 2 to 3 percent today. Originations for Fannie Mae, the largest lender in this category fell from an 8 percent share to about 2.5 percent over the same period and Freddie Mac loans followed a similar if slightly more shallow path.

Goodman says rules established by the two government sponsored enterprises (GSEs) are causing lenders to "shy away" from borrowers who want to finance two to four unit buildings and asks if these standards are justified. She analyzes default and liquidation data from 14 million such mortgages from throughout the country and found that for every $1 million in loans the predicted losses over the 2001 to 2014 period were lowest for single-family owner-occupied properties at $4,600 and highest for two-unit investment properties at $10,900. In between in order were three-four unit owner-occupied ($5,800), three-four-unit investor ($5,900), two-unit owner-occupied ($7,800) and 2-unit investor ($8,600).

However, when she looked at 2014 alone, the range narrowed considerably from $1,000 for single-unit owner-occupied to $1,800 for two-unit investment while the order of risk remained the same.

She says that two details suggest that lending standards are too high for two-to-four unit properties. First, lenders are tolerating significantly less loss, increasing down payment and credit score requirements to reduce risk. This lower tolerance is consistent with other Urban Institute findings that mortgage lending today is predominantly accessible only to borrowers with nearly pristine credit. Second, lending on these small multi-unit properties feature about the same risk tolerance as single-family owner occupied ones.

Goodman concludes that given the importance of these small multi-unit properties in supporting affordable rental housing and increasing homeownership in underserved communities two policy changes would be in order.

- Ensure that borrowers for two to four-unit properties, particularly owner-occupants, have counseling on how to minimize and manage income variability, as well as how to be a landlord in a small building.

- Return the GSEs' down payment requirements to lower rates. Those requirements were increased out of concern over higher default rates but with losses on two-to-four family homes now on par with single-family owner-occupied ones it suggests that many potential owners are being squeezed out of the market. If this change were coupled with counseling for landlords, it could largely offset the costs.