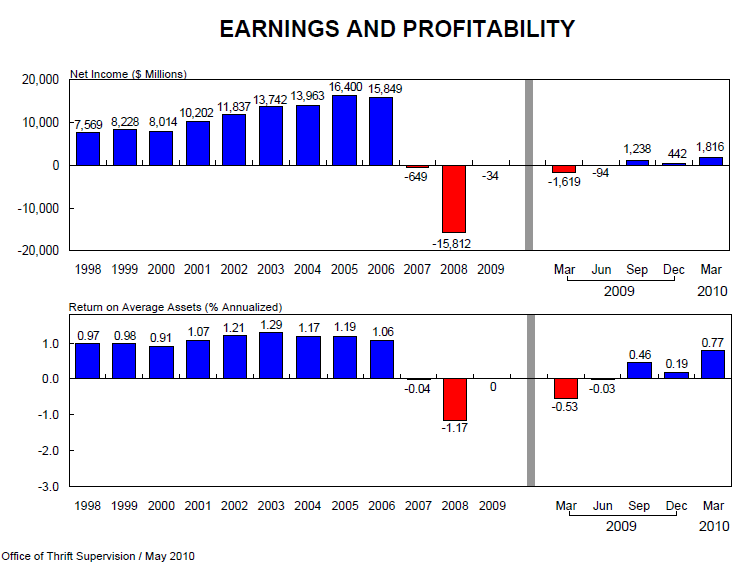

The Office of Thrift Supervision (OTS) said Monday that the industry it regulates appears to be stabilizing based on profits announced for the first quarter of 2010. Thrift institutions earned $1.82 billion during that period, a three-fold increase over the $442 million in net earnings in the fourth quarter of 2009. This is the third consecutive quarter in which the thrifts posted a profit and is a dramatic improvement over the first quarter of 2009 when the thrifts showed a $1.62 billion loss.

The term "thrift" generally refers to savings and loan institutions, credit unions, and savings banks.

The improvement in earnings was primarily due to higher gains on the sale of assets held for sale, the lower loan loss provisions, and to noninterest expenses which decreased from 2.89 percent in the prior quarter even though they were up from 2.57 percent year-over-year. These improvements were partially offset by lower gains on financial assets carried at fair value and taxes which increased to 0.43 percent of average assets from 0.25 percent the previous quarter and 0.18 percent a year ago.

The profits represented 0.77 percent of the average assets (ROA) of the industry. The Q4 and Q1 2009 figures represented a 0.19 percent and a negative 0.53 percent ROA respectively. The median ROA was 0.41 percent, up from 0.36 percent in the first quarter of 2009 and 0.31 percent in the prior quarter. Return on average equity (ROE) was 7.09 percent compared to 5.69 percent in the prior quarter and 1.76 percent one year earlier.

In addition to the stated profits, the industry put $2.7 billion or 1.15 percent of average assets into loan loss reserves. This was a decrease in terms of the percentage of average assets put aside, down from 1.70 percent last quarter and 1.91 percent one year ago, but still boosted the reserves to levels at or near record highs. OTS said that the higher-than-average levels of loss provisioning are due to high unemployment and persistent declines in home prices and said that the need for upcoming provisions will depend largely on trends in these two factors and in the commercial real estate markets.

The OTS announcement stressed that many analysts are increasingly focusing attention on "core" or operating earnings which exclude volatile or one-time occurrences such as branch sale gains or acquisition charges and provisions for loan losses. Operating earnings in the first quarter were 1.72 percent of average assets compared to 1.70 percent for 2009 and 1.29 percent for 2008. OTS said, "The combination of solid capital, bolstered loan loss reserves, and solid stable operating earnings will help the industry weather the economic and housing market distress facing the nation."

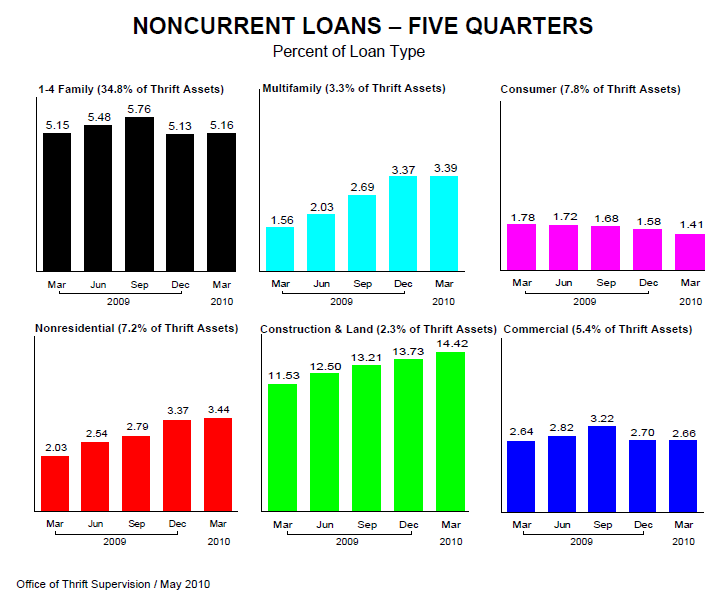

Troubled assets held by the thrifts fell to 3.27 percent of assets from 3.29 percent in the previous quarter and 3.35 percent in Q1, 2009. According to OTS, this ratio is similar to the ratio in 1990-91 when thrifts were failing by the hundreds. However, it said, the composition of troubled assets - non-current loans and repossessed assets - is much different. 65 percent of the troubled assets are 1 to 4 family mortgages, 27 percent are commercial real estate loans, and the remainder are nonmortgage loans. In the earlier period 68 percent of troubled assets were commercial real estate and 23 percent were residential mortgages.

Repossessed assets increased 18 basis points from the previous quarter to 0.52 percent of assets. Noncurrent 1-4 family loans were 5.16 percent of all 1-4 family loans at the end of the quarter compared to 5.15 percent a year earlier and 5.13 percent in Q4. Noncurrent consumer loans were down to 1.41 percent of all such loans from 1.78 percent a year earlier and troubled nonresidential mortgages increased to 3.44 percent from 2.03 percent.

Net interest margin improved to 305 basis points from 300 basis points in the prior quarter and 294 a year earlier. Total fee income including mortgage loan servicing fee income was 1.30 percent of average assets, up from 1.05 percent in the fourth quarter but down from 1.40 percent a year earlier.

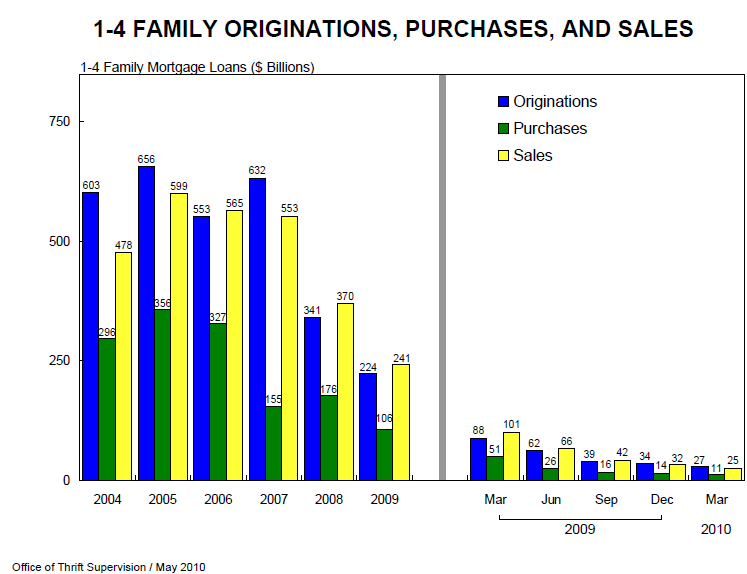

Total mortgage originations in the industry were down substantially from both of the previous quarters. Originations including multifamily and commercial loans totaled $32.4 billion during the quarter compared to $96.1 billion a year earlier and $40.7 billion in Q4. Residential mortgages were also down substantially from $88.1 billion in Q1 2009 and $34.3 billion in Q4 to $27.2 billion in the most recent period. Refinancing accounted for 51 percent of originations during the quarter compared to 45 percent in the previous quarter and 55 percent a year earlier.

Industry assets decreased by 22 percent over the year to $950 billion from $1.22 trillion with 34.8 percent of these assets invested in 1-4 family mortgages compared to 43.2 percent a year earlier. Deposits and escrows fell by 11 percent over the year to $667 billion from $752 billion and Federal Home Loan Bank advances were down from 15.9 percent one year ago to 9.0 percent of total assets. OTS said that capital measures for the industry continue to be "strong, stable and well in excess of minimum requirements. Equity capital at the end of the first quarter was 11.02 percent of assets, up from 9.80 percent one year earlier. At the end of the first quarter, 97.2 percent of the industry exceeded well-capitalized standards and 16 thrifts were less than adequately capitalized."

The number of problem thrifts rose to 50 at the end of the first quarter from 43 with composite examination rates of 4 or 5 at the end of 2009.

"The health of the thrift industry is improving but we cannot say the industry has fully recovered from the financial crisis," said OTS Acting Director John Bowman. "Until America gets back to full employment and more families are able to pay their monthly mortgages on time, the thrift industry will continue to face significant challenges."

At the end of the first quarter OTS was supervising 757 thrifts with total assets of $948.8 billion and 442 holding companies with $4.0 trillion in U.S. domiciled consolidated assets. Those holding companies owned 402 thrifts with total assets of $728 billion. The financial reform act passed by the Senate last week calls for the elimination of OTS.