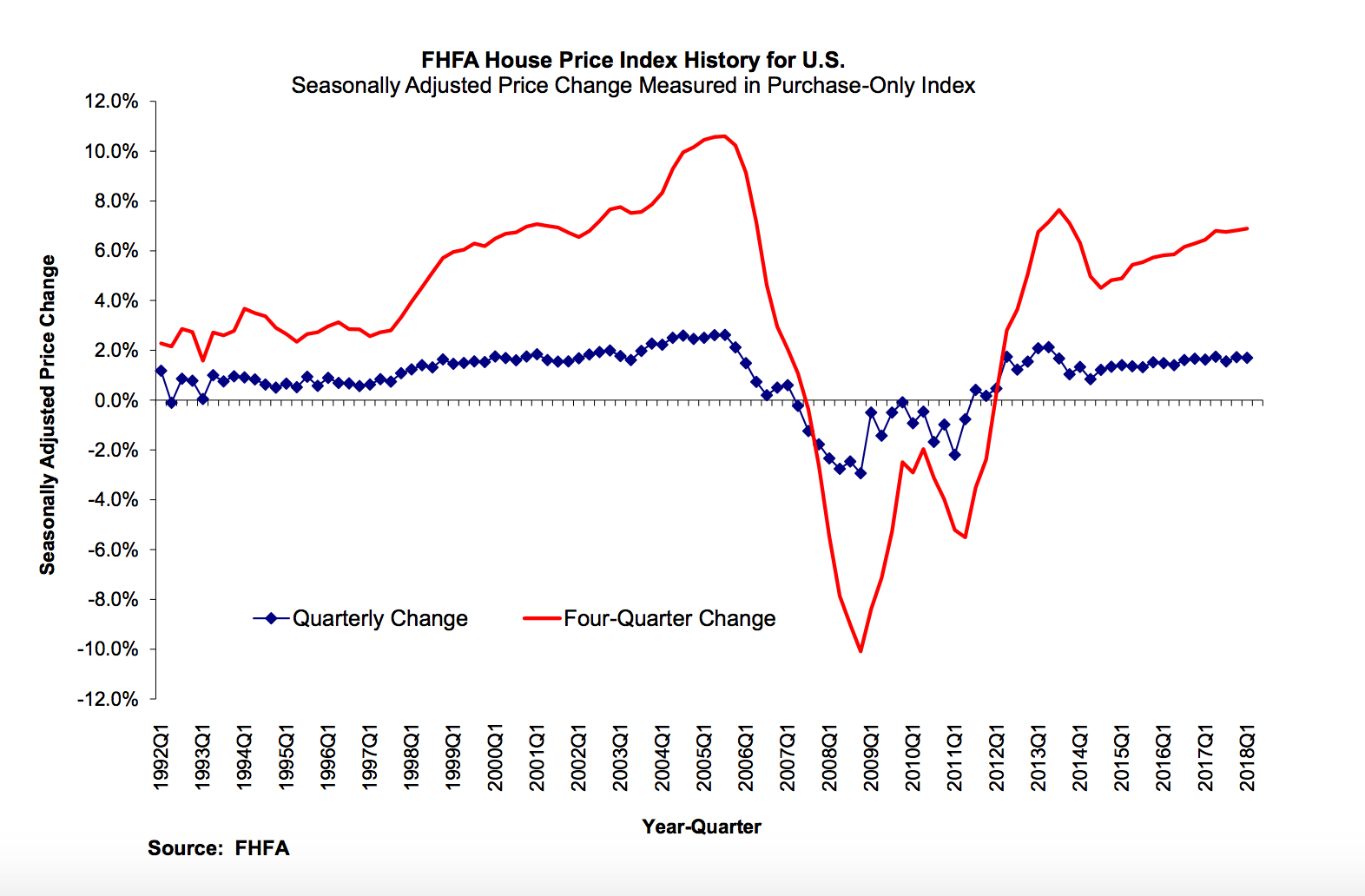

Home prices in the first quarter of 2018 were 1.7 percent higher than at the end of the fourth quarter of last year. The Federal Housing Finance Agency said its Housing Price Index (HPI) gained 6.9 percent when compared to the level at the end of March 2017. On a monthly basis prices were 0.1 percent higher than in February.

The month over month rate of increase in March was significantly higher than the 0.6 percent gain from January to February, but the annual increase slowed compared to the previous month. The rate of appreciation from February 2017 to February 2018 was 7.2 percent.

"Home prices continue to rise across the U.S. but there are signs of tapering," said Dr. William Doerner, FHFA's Senior Economist. "Since housing markets began to rebound in 2012, house price appreciation has been positive because demand has outpaced supply. In the last month, however, some regions reflect a slowing or even flattening of house price growth."

Home prices were up in all 50 states and the District of Columbia between the first quarter of 2017 and the first quarter of 2018. Nevada, still recovering from the housing crisis, saw prices rise 13.7 percent while there was a 13.1 percent gain in Washington State. The other states in the top five were Idaho at 11.1 percent; Colorado, 10.6 percent; and Utah, 9.9 percent.

Each of the 100 largest metro areas also saw annual increases. The degree of appreciation ranged from 0.8 percent in Tulsa to 17.1 percent in the Las Vegas area.

The Pacific was the census division with the greatest gains over four quarters, 9.5 percent and a single quarter increase of 2.6 percent. The weakest region was East South Central, but even there, prices were up 5.3 percent for the four-quarter period.

There were other signs of weakening appreciation. Four of the nine census divisions, Pacific, West South and East South Central, and New England, posted negative monthly numbers.

The FHFA HPI is calculated using home sales price information from mortgages sold to or guaranteed by the GSEs Fannie Mae and Freddie Mac. The HPI was indexed at 100 in January 1991. The current national HPI is 261.7