"The secondary mortgage market is being reconstructed. The players and the rules are changing rapidly. This is a time of tremendous opportunity for those with the knowledge and the drive to establish new relationships, enter new arenas and expand on new ideas. At the same time, unprecedented fluidity increases the challenges for businesses to keep up with shifting government policies and their impact on capital markets, small and large companies and even individual participants."

That is the message offered by the Mortgage Bankers Association, who will host the National Secondary Market Conference and Expo in New York City this week, which runs until Wednesday.

HERE is the schedule of events for this year's conference.

Key Events This Week:

Monday:

8:30― The Federal Reserve Bank of Chicago releases its Chicago Fed National Activity Index for April. The index read -0.07 in the prior month.

10:00 ― Following a near-7% jump in March, Existing Home Sales are expected to increase yet again, this time by 4.7%. That would push the annualized pace of sales from 535k to 560k, the highest rate in six months. Historically low mortgage rates, a jump in pending home sales, and the end of the government tax incentive on April 30 should all play a favorable role.

Looking farther ahead, however, economists at IHS Global Insight say it’s just a matter of time before the index declines precipitously.

“At some point, possibly in June, sales will plunge, payback for the second homebuyers' tax credit, which, for the most part, shifted sales from the second half of 2010 into the first,” they said. “We do expect sales to gain traction afterward as the labor market improves.”

Treasury Auctions:

- 11:30 ― 3-Month Bills

- 11:30 ― 6-Month Bills

Tuesday:

9:00 ― The most closely watched barometer of national home prices, the S&P Case-Shiller Index, is expected to decline by 0.3% in March, but increase by 2.4% compared to 12 months prior. In the index for February, house prices across the 20 metropolitan areas fell by 0.1%, the first monthly decline since May 2009. Released at the same time is the FHFA Home Price Index.

“The Case-Shiller 20-city house price index likely increased by 2.2% year-over-year in March,” said economists at Nomura Global Economics. “This forecast implies a month-over-month decline of 0.6% on a non-seasonally adjusted basis. Although they have witnessed a modest seasonal downswing, US house prices generally look quite stable.”

10:00 ― Consumer Confidence has improved for the past two straight months and economists expect a third improvement in May. The Conference Board measure has a strong correlation to labor markets, so recent job growth is cited as the primary reason for the index should improve. But consumers also watch TV and read newspapers, and in the past two weeks economic turmoil in Europe has spun out of control, plus the stock market lost almost 1,000 points in a matter of minutes ― two weeks later it’s still unclear why. In short, there’s plenty of reasons to be cautious.

“The Conference Board's consumer confidence index edged higher in April, moving to the highest level in the post-Lehman period,” said economists at Nomura. “The survey focuses mostly on employment conditions, which have generally been improving. However, the decline in the stock market may weigh on household sentiment.”

11:15 ― James Bullard, president of the St. Louis Federal Reserve, speaks on "The Road to Economic Recovery Following the Financial Crisis," to the European Economics and Financial Centre in London.

8:30pm ― Federal Reserve Chairman Ben Bernanke speaks on "Central Bank Independence, Transparency, and Accountability" before the 2010 Institute for Monetary and Economic Studies International Conference in Tokyo.

Treasury Auctions:

- 11:30 ― 4-Week Bills

- 1:00 ― 2-Year Notes

Wednesday:

8:30 ― Durable Goods are set to rise 1.5% in April, more than offsetting the 1.2% decline in March and adding growth to the 0.5% gain in February. Orders for capital goods ― non-defense capital goods excluding aircraft ― are expected to rise for the third straight month, building on an 11.6% gain in the first quarter. If regional indexes are accurate, growth is broad-based; but given the recent turmoil and uncertainty in Europe, some economists are reluctant to assume that international will hold steady.

“Although business confidence may take a step back with the onset of turmoil in financial markets, as of April, the capital spending recovery looked to be gathering momentum,” said economists at Nomura. “Industrial production of business equipment, for example, increased by 1% during the month, and results of most business surveys were quite positive. Due to the volatile nature of the durable goods report, we see some downside risk to our forecast.”

10:00 ― New Home Sales unexpectedly climbed nearly 27% in March, but in the broader context the index has seen little improvement over the past nine months. April, unfortunately, looks unlikely to repeat the surge in March. Economists look for the annualized pace of sales to be 425k, marginally up from 421k in March. And even if the report is more positive than expected, the opposite can be expected once the government tax incentive for first-time homebuyers expires.

“Unlike the existing home sales release, the new home sales report tracks signed, not closed home sales contracts,” said economists at Nomura. “New home sales should therefore peak in April in anticipation of the signing deadline for the homebuyer tax credit. We expect new home sales to fall in May, however, and the weakness in mortgage applications suggest the decline could be steep.”

4:15 ― Jeffrey Lacker, president of the Richmond Fed, speaks on "The Regulatory Response to the Financial Crisis: An Early Assessment" at a conference at the Institute for International Economic Policy in Washington.

Treasury Auctions:

- 5-Year Notes

Thursday:

8:30 ― Revised data is anticipated to kick up GDP from 3.2% to 3.5% in the first quarter, following a much-stronger 5.6% leap in Q4 2009. The upward improvement is expected to come from private consumption and a narrower trade balance. With more recent developments dominating investor decisions, one can probably assume that any minor revisions are unlikely to have much sway in the markets.

8:30 ― Initial Jobless Claims surprised economists by jumping to a five-week high of 471k in the week ending May 22. More attention could be placed on the May’s final survey, as a return to the 450k level would show the jump was merely a blip, while another high number could change assumptions about near-term labor data.

“We interpreted the rise as statistical noise and do not think firing activity suddenly increased in mid-May,” said economists at Nomura. “We believe the four-week moving average of claims (454k) remains at a level consistent with private sector job growth.”

2:30 ― James Bullard, president of the St. Louis Fed, speaks on central bank policy challenges to the Swedbank Economic Outlook Conference in Stockholm.

Treasury Auctions:

- 1:00 ― 7-Year Notes

Friday:

8:30 ― The key report of the week is the Personal Income and Spending report, which should show incomes rising, spending closely following suit, and prices remaining benign. Economists look for income to rise 0.5% in April, contributing to the 0.3% gain in March and the 0.1% advance in February. Spending should be less strong at +0.2%, following a 0.6% jump in March and a 0.5% increase in February. Core inflation, which excludes volatile energy and food components, should repeat its +0.1% print from last month.

“Private wages and salaries should be up about 0.4–0.5% in April, based on April's solid employment report,” said economists at IHS Global Insight. They added that consumer spending should flatten out as auto sales fell, but they noted rising consumer spending on services.

As for core prices, the IHS economists said that a 0.1% gain would put its annual gain to 1.1%, the lowest annual reading since 1963.

9:45 ― The Chicago Business Barometer should remain in firm expansion territory at 62.0 in May, but the growth is anticipated to be a pinch less rapid than in April, when it soared 5 points to 63.8. Predictions are pretty wide, ranging from 55.0 to 64.0, reflecting uncertainty about near-term growth.

10:00 ― Unlike the Conference Board’s consumer confidence report, which is closely related to labor conditions, the U of Michigan / Reuters’ Consumer Sentiment report is not anticipated to improve in May. Economists look for the index to continue at 73.3, as falling stock markets offset any optimism from last month’s positive jobs headline.

“The University of Michigan's measure of consumer sentiment is highly sensitive to financial market developments,” said economists at Nomura. “We therefore think it could soften from the preliminary May report due to the decline in stock prices and negative news about the European financial system.”

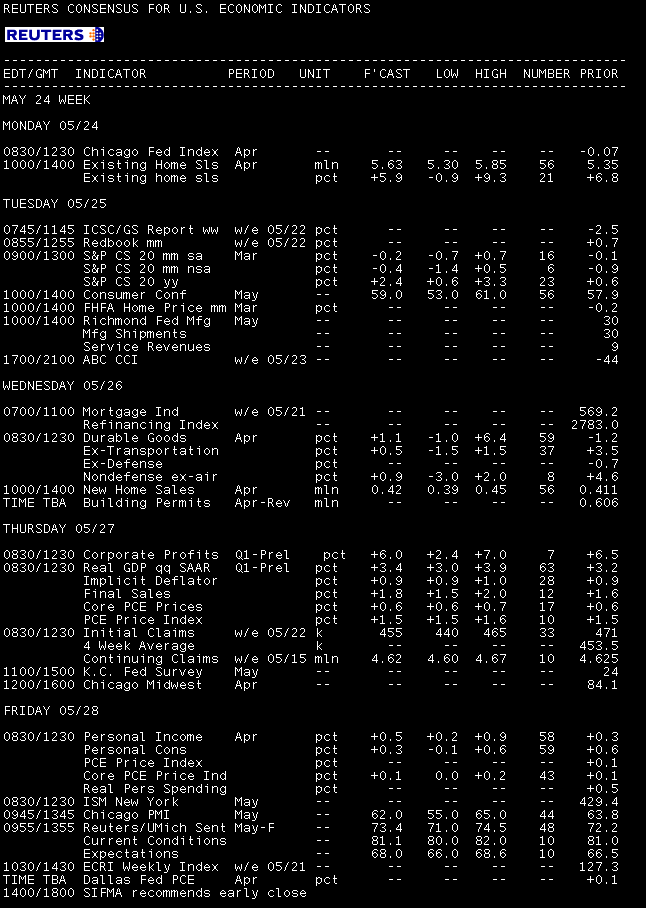

Here is a calendar from Reuters: