The National Association of Realtors today released Existing Home Sales data for April 2010.

Excerpts From The Release...

Existing-home sales rose again in April with buyers motivated by the tax credit, improving consumer confidence and favorable affordability conditions, according to the National Association of Realtors®.

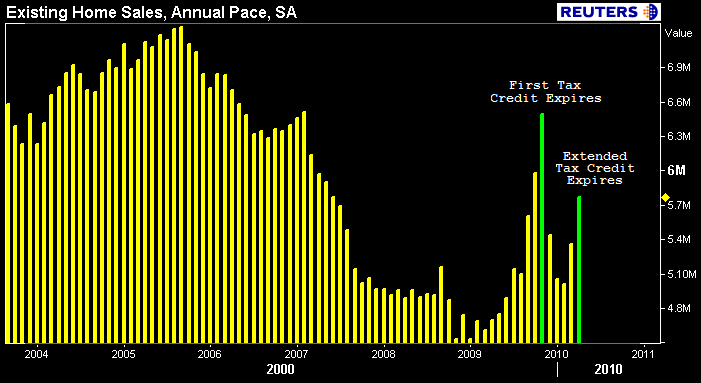

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 7.6 percent to a seasonally adjusted annual rate of 5.77 million units in April from an upwardly revised 5.36 million in March, and are 22.8 percent higher than the 4.70 million-unit pace in April 2009.

Lawrence Yun, NAR chief economist, said the gain was widely anticipated:

“The upswing in April existing-home sales was expected because of the tax credit inducement, and no doubt there will be some temporary fallback in the months immediately after it expires, but other factors also are supporting the market,” he said. “For people who were on the sidelines, there’s been a return of buyer confidence with stabilizing home prices, an improving economy and mortgage interest rates that remain historically low.”

Single-family home sales rose 7.4 percent to a seasonally adjusted annual rate of 5.05 million in April from a pace of 4.70 million in March, and are 20.5 percent above the 4.19 million level in April 2009. The median existing single-family home price was $173,400 in April, up 4.5 percent from a year ago.

Existing condominium and co-op sales jumped 9.1 percent to a seasonally adjusted annual rate of 720,000 in April from 660,000 in March, and are 42.3 percent above the 506,000-unit pace in April 2009. The median existing condo price5 was $171,000 in April, which is 0.6 percent below a year ago.

In the chart below I called attention to the level of Existing Home Sales at the expiration of the original tax credit and the level of Existing Home Sales at the expiration of the extended version. Notice that the expiration of the extended credit failed to match the momentum generated by the original credit. This implies a portion of normally seasonally supportive homebuyer demand was stolen by first time homebuyers when the original tax credit expried at the end of November 2009.

Regionally....

NORTHEAST: +21.1 percent to an annual level of 1.09 million. +41.6 percent YoY. The median price in the Northeast was $243,000, +2.1 percent from April 2009.

MIDWEST: +9.9 percent to annual pace of 1.33 million. +29.1 percent YoY. The median price in the Midwest was $146,400, +5.8 percent from April 2009.

SOUTH: +8.6 percent to an annual pace of 2.14 million.+23.0 percent higher YoY. The median price in the South was $150,000, +1.2 percent from April 2009..

WEST: -6.2 percent to an annual rate of 1.21 million. +5.2 percent YoY. The median price in the West was $212,400, +3.8 percent from April 2009.

The national median existing-home price for all housing types was $173,100 in April, up 4.0 percent from April 2009.

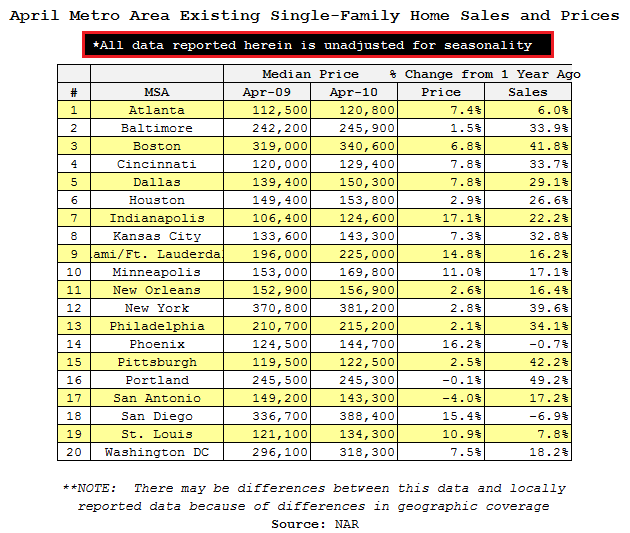

Single-family median prices rose in 18 out of 20 metropolitan statistical areas reported in April from a year ago; six of the areas experienced double-digit increases. In data recently reported for the first quarter, 91 out of 152 metros saw price gains.

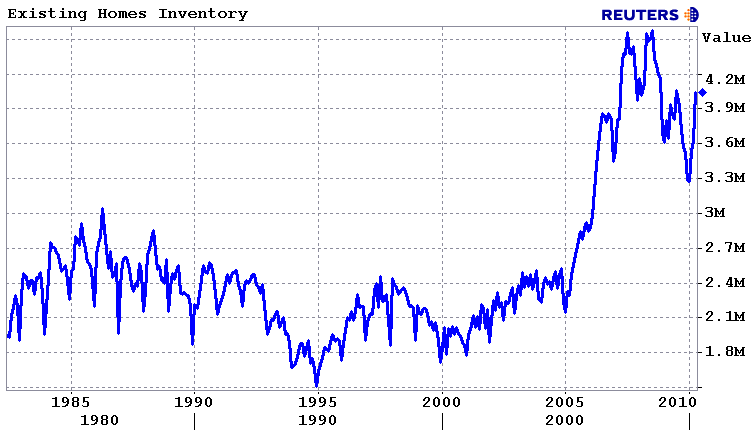

Total housing inventory at the end of April rose 11.5 percent to 4.04 million existing homes available for sale, which represents an 8.4-month supply at the current sales pace, up from an 8.1-month supply in March.

Raw unsold inventory is 2.7 percent above a year ago, but remains 11.6 percent below the record of 4.58 million in July 2008.

Lawrence Yun says:

“Although inventory levels remain above normal and much of the gain last month was seasonal, the housing price correction appears essentially over....a return to old-fashioned responsible lending and buying will help the housing market avoid disruptive and painful bubble-bust cycles.”

A parallel NAR practitioner survey shows first-time buyers purchased 49 percent of homes in April, up from 44 percent in March. Investors accounted for 15 percent of transactions in April, down from 19 percent in March; the remaining sales were to repeat buyers.

All-cash sales stood at 26 percent in April; they were 27 percent in March.

Distressed homes accounted for 33 percent of sales last month, compared with 35 percent in March.

More to come....