Fannie Mae is backing down slightly on its economic forecast for the remainder of 2018. The first quarter GDP growth of 2.3 percent was the slowest in a year, down from 2.9 percent a year earlier. The company's economists, led by vice president and chief economists Doug Duncan, say they expect growth to pick up later in the year but the economic boost from last December's Tax Cuts and Jobs Act and this February's Bipartisan Budget Act of 2018, will fade next year and the labor market will tighten more than previously thought. The earlier full-year 2018 forecast remains at 2.7 percent, but the company is lowering its projections for 2019 by two-tenths to 2.3 percent.

They see substantial downside risks to their forecast, especially the rising price of oil. Crude prices have risen by about $11 per barrel since December to reach $71. Rising gasoline prices decrease disposable income and are therefore likely to negate some of the increase in disposable income from the tax cuts. They also may push inflation higher, leading the Fed to pick up the pace of interest rate hikes. The administration's protectionist trade policy is also a barrier growth.

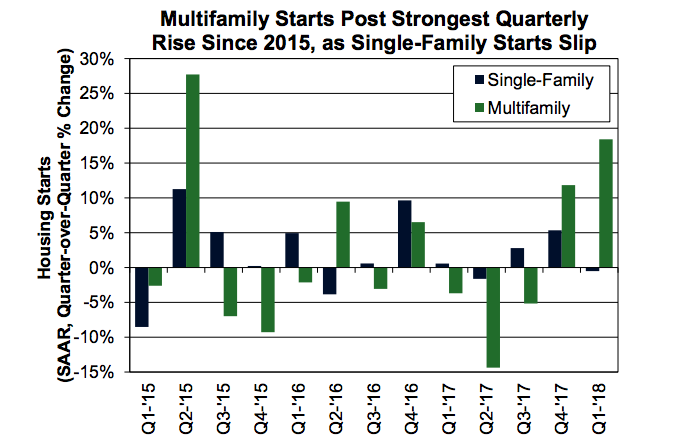

The economists call first quarter housing activity "lackluster." Consequently, real residential investment was not a contributor to the GDP. Homebuilding activity was mixed, with multifamily starts posting the largest quarterly increase since the second quarter of 2016, while single-family starts suffered a slight decline. New home sales increased while the sales of existing homes, which make up 90 percent of the total, fell during the quarter.

The inventory of existing homes for sale has been down on a year-over-year basis for nearly three years, constraining sales while boosting prices. Appreciation, according to the major indices was running between 6.3 percent and 7.2 percent in February.

Leading indicators suggest an improving outlook for home sales going into the spring selling season: pending home sales rose in March for the second consecutive month and purchase applications increased in April for the second time. The company continues to expect total home sales to rise about 2.5 percent this year.

The Census Bureau's Housing Vacancy Survey (HVS) put the homeownership rate at 64.2 percent in the first quarter, unchanged from Q4 2017, but higher on an annual basis for the fifth consecutive quarter. In addition, the annual increase in owner households exceeded one million for the third time in four quarters and significantly outpaced the drop in renter households, which posted a year-over-year decline for the fourth consecutive quarter.

The HVS also showed the for-sale vacancy rate down by two-tenths compared to a year ago, at 1.5 percent it was the lowest for a first quarter reading since 2001. The rental vacancy rate was unchanged from a year ago, remaining at 7.0 percent.

Fannie Mae updated its estimated mortgage purchase originations for 2017 by $42 billion and lowered refinancing originations by $58 billion. The revisions, based on benchmarking of Home Mortgage Disclosure Act Data, resulted in a net decline in total mortgage originations of $16 billion to $1.83 trillion in 2017. The refinance share was revised lower by 2 percentage points from the prior estimate to 36 percent.

Total mortgage originations are expected to decline this year by approximately 9 percent from 2017 to $1.67 trillion, as a 26 percent drop in refinance originations outpaces a 1 percent rise in purchase originations. The refinance share is projected to fall 7 percentage points from 2017 to 29 percent.