CoreLogic has looked at an apparent contradiction in purchase loan originations that has emerged since the housing bubble burst. Why, CoreLogic economist Archana Pradhan asks in an article in the company's Market Trends blog, if credit standards have tightened do we also see a drop in loan denial rates?

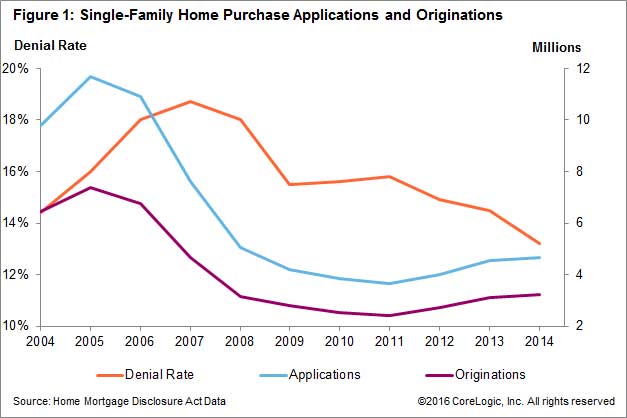

Single-family purchase loan applications numbered 4.6 million in 2014. While this is up from the 3.6 million that set a decade-long low in 2011, it is down 60 percent from the 11.7 million applications submitted in 2005. Similarly, there were 7.4 million single-family purchase loans originated in 2005 and that dropped to 3.2 million by 2014. The denial rate for purchase applications, peaked at 18.7 percent in 2007 but was at 13.2 percent in 2014. If credit standards are relatively tight today, Pradham asks, shouldn't the denial rate be higher than it was in 2005 and 2006? Or is the industry seeing fewer applications from riskier borrowers?

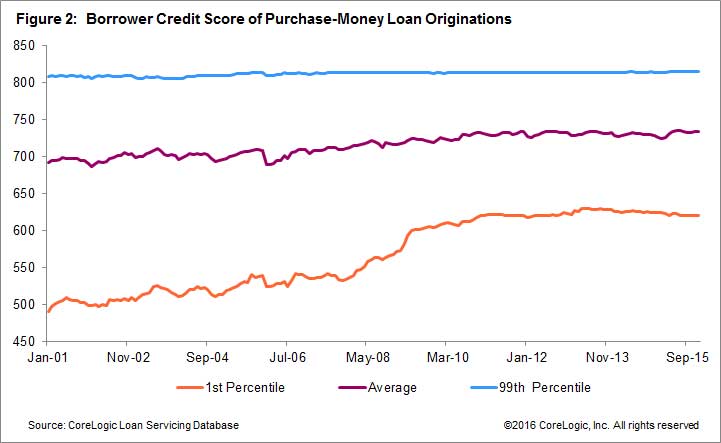

One indication of credit tightening is borrower credit scores. The score for home-purchase originations has increased from roughly 700 in 2005 to almost 750 in 2015. In 2005, the credit score for the first percentile ranged from 520 to 540 then rose dramatically during the Great Recession. It is currently running in a range of 620 to 630. Pradham says that with only a quick look at today's credit score range one might conclude that tight underwriting standards are eliminating borrowing at the low end of the range, but the answer is more complicated. The originations are the end result of an interplay between borrower demand and lender risk tolerance.

Figure 3, shows how the credit score distributions have shifted from 2005 to 2015 for both applications and originations and indicates that the share of applications with lower credit scores has actually declined more sharply than originations. The share of credit scores below 700 for applications has declined and has been offset by a greater share of credit scores above 740.

The author says, that the similarity of distributions for both applications and originations in 2015 suggests that lenders are largely meeting the demand of applicants. "Thus, the observed decline in originations could be a result of potential applicants being either too cautious or discouraged from applying, more so than tight underwriting as the culprit in lower mortgage activity."

She suggests that this caution results in "self-sidelining" that makes it appear that credit is tightening. This means that the policy solutions are quite different than if the cause was credit tightening and that more consumer education could be more successful in raising originations levels than introducing new lending products with lower credit standards.