Fannie Mae upwardly revised its GDP forecast for the year from 6.8 percent to 7.0 percent in its May report on economic development. The company's economists say first quarter growth was stronger than expected and the outlook for near-term consumer spending has improved. They have, however, revised their 2022 growth forecast down 0.2 point to 2.8 percent.

They note that supply chain disruptions, labor scarcity, and inflationary pressures are increasing risks to future growth. The inflation forecast was revised upward, and they now expect the annual change will not fall below the Federal Reserve's long-run 2.0 percent target within the forecast time horizon.

The authors tend to discount much of the 4.2 percent surge in the Consumer Price Index as due to "one-off" readjustments, with a 10.0 percent jump in the price of used cars because of supply chain problems and because businesses, with reopening, had the leverage to raise prices on such items as airline tickets, restaurant meals, and hotel stays. Fannie Mae believes that, for now, the Fed will see the recent jump in inflation as a "transitory" increase and will be unlikely to change its guidance.

The report also sees the disappointing April jobs report, in part, as an anomaly. "A combination of volatility in the recovery path, sampling issues with firm openings and closures, and atypical seasonal patterns may have led to the weaker number." The ADP measure of private sector payroll employment showed a much stronger 742,000 jobs gain over the month along with continued acceleration.

The housing outlook faces greater uncertainty. The economists continue to believe that the abnormally high home purchase demand over this last year was largely due to a combination of last year's delayed homebuying season and households pulling forward their plans to move. Also, stimulus checks have helped homebuyers make down payments. As these factors dissipate, homebuyer demand will likely begin to wane later in the year. However, if consumers increasingly reassess their desired housing arrangements post-COVID it could sustain demand for a longer period. Another factor is the timing and implications of an end to forbearance policies. However, continued improvement in the labor market and higher levels of home equity will likely help limit distressed sales.

Fannie Mae downgraded second quarter existing home sales expectations but upgraded sales later in the year for both new and existing homes. Existing home sales fell 3.7 percent in March, to an annualized pace of 6.0 million units. Limited inventory was partially to blame but so were the cold weather and related power outages in February which held down sales contracts.

While that decline was expected, recent data suggest that the forecast rebound in April sales will be smaller than anticipated. Pending sales rose only slightly and purchase mortgage applications have also trended lower in recent weeks. This has led to a downgrade for second quarter existing sales to 5.88 million from 6.16 million annualized units.

The months' supply of homes for sale at the end of March, even with the sales pace slowdown, was only 2.1 months, a near record low. Weekly data from Redfin indicates a record-high 48 percent of homes sold above list price in April and a record 45 percent of pending home sales under contract within 7 days of listing. For comparison, these metrics for the 2019 spring buying season were around 24 percent and 28 percent, respectively.

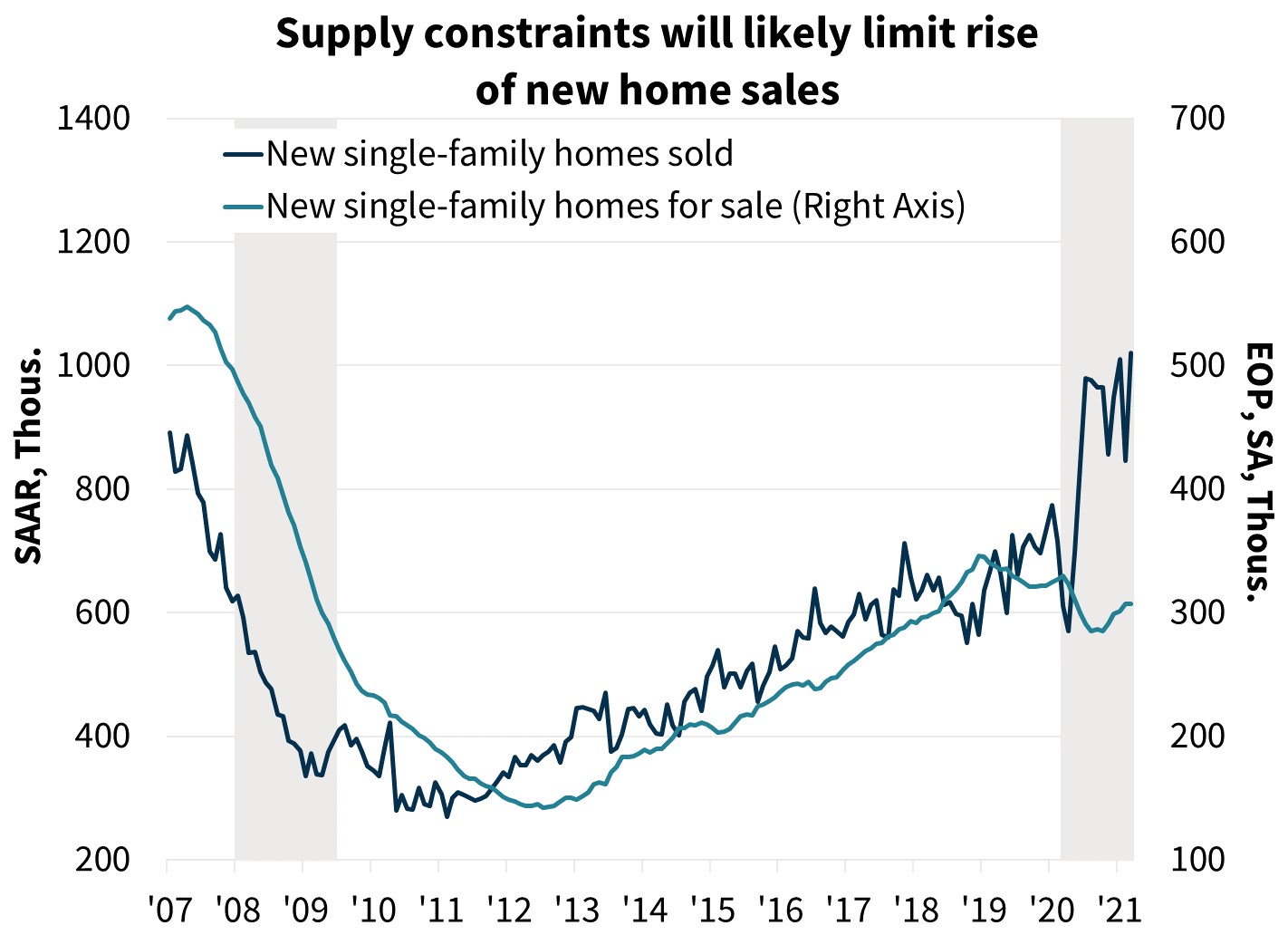

New home sales jumped 20.7 percent in March to an annualized pace of over 1 million units, the fastest pace since August 2006. Single-family housing starts also rose, increasing 15.3 percent and Fannie Mae has upgraded its year-over-year forecast for starts to 24.8 percent in 2021.

Fannie Mae says that homebuilders would probably increase the pace of construction even more if not for the supply constraints they currently face. Lumber prices continue to ascend, now up over 300 percent from February 2020 levels according to the NASDAQ. Meanwhile, a modest residential construction employment gain in April was consistent with difficulty hiring additional labor. The total level of new homes for sale, regardless of the stage of construction, has largely moved sideways over the past year even as sales grew swiftly. Homebuilders are not only limited by material and labor costs, but also by lot availability. Until some of these supply constraints can be alleviated, a further acceleration in starts will likely be limited, even as demand for new home construction remains robust. Fannie Mae now expects total sales to be up 6.3 percent from 2020, compared to the 6.2 percent earlier forecast.

With demand continuing to outstrip the supply of listings available, home prices continue to surge. The CoreLogic National Home Price Index puts the annual increase in March at 11.3 percent, the highest annual growth since 2006.

Interest rates remained in a relatively tight range in April. The 10-year Treasury started the month at 1.69 percent and ended at 1.65 percent with an average of 1.64 percent, a modest 3 basis point increase from March but the highest level since January 2020. The pace of growth in rates has slowed considerably from the rapid rise earlier this year.

Mortgage rates have fallen somewhat since their recent peak of 3.18 percent the week of April 1. The week of May 6, the 30-year fixed mortgage rate sat at 2.96 percent, the third consecutive week of the rate sitting below three percent. Given the decline in mortgage rates and the slight increase in the 10-year Treasury, mortgage spreads compressed over the month, with the primary spread (30-year mortgage contract rate minus the 10-year Treasury yield) narrowing for the twelfth consecutive month to 143 basis points, the smallest gap since April 2011.

The forecast for purchase mortgages were downgraded by $43 billion from last month to $1.8 trillion. The forecast for 2022 purchase volumes remains at $1.9 trillion, essentially unchanged from last month.

Refinance origination volume is predicted at $2.2 trillion in 2021, a $125 billion upward revision. The lower expected interest rate path suggests there could be steam remaining in the current refi boom so refinance volume next year could total $1.1 trillion, an upward revision of $43 billion from the previous forecast, but a decline of 49 percent from 2021. At current interest rates, the economists estimate around 51 percent of all outstanding mortgages have at least a 50-basis point incentive to refinance, up from 42 percent in last month's forecast given the recent rate declines.