The National Association of Home Builders (NAHB) is seeing some softening in the residential remodeling sector. Carmel Ford noted in an article in NAHB's Eye on Housing blog several weeks ago that the association's Remodeling Market Index (RMI) fell three points to 54 in the first quarter of this year. The index is constructed in a manner similar to NAHB's Housing Market Index, but from a survey of remodelers rather than new home builders and has a breakeven point of 50. At that level more remodels report market activity is higher than report it lower than the previous quarter. The RMI has been above that breakeven point since the second quarter of 2013.

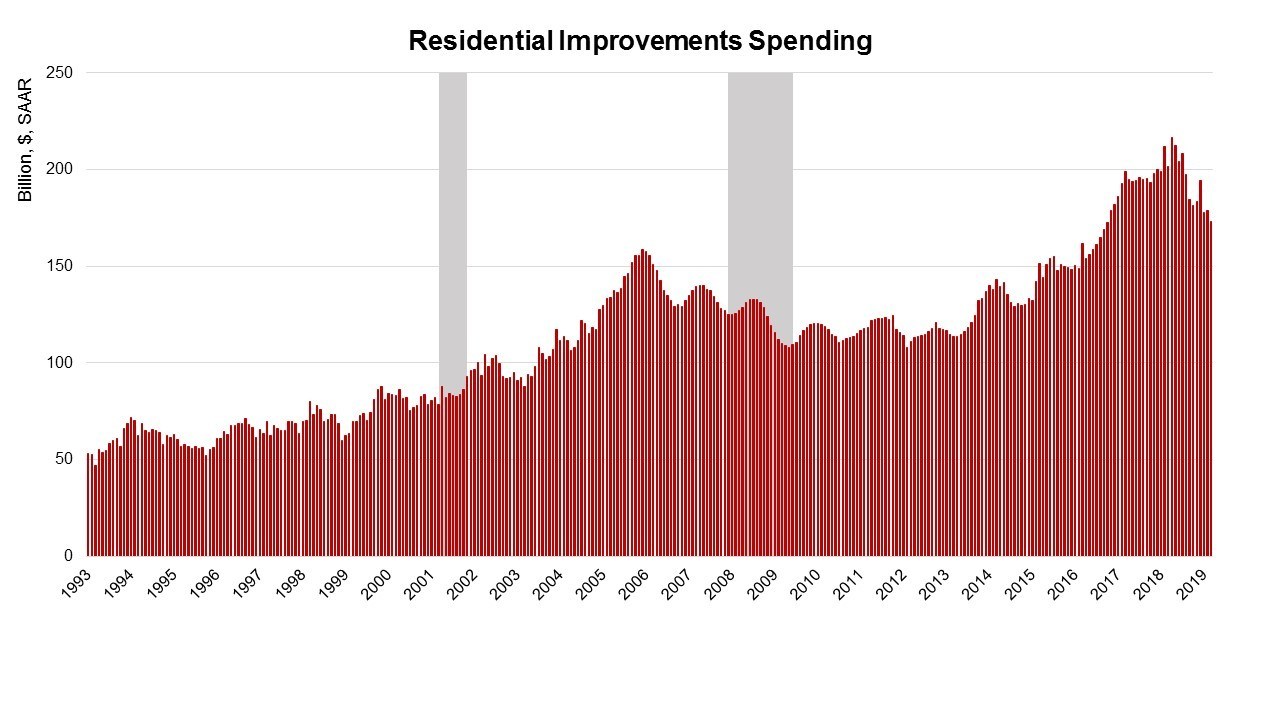

This week another entry in the blog, this one written by Na Zhao, takes data from the U.S. Census Bureau's Construction Spending Report to show a dip of 3.1 percent in expenditures on residential improvements from February to March. The seasonally adjusted annual rate of spending in March was $173 billion. More telling, this was down 14.1 percent from March 2018. Spending reached a peak in April 2018 of $216.7 billion. The Census Bureau defines residential improvements as remodeling, major replacements, and additions to owner occupied housing units. The number excludes maintenance and repair and any spending on rental or vacant properties.

Zhao says improvement spending was relatively stable during the Great Recession, falling 30 percent from the peak before the housing crisis while spending on new single-family construction plummeted 80 percent and multifamily spending was down 50 percent. It began to recover in June 2009 with small monthly increases averaging 0.1 percent until taking off in 2013. From there increases averaged about 13 percent a year until it hit the aforementioned record high last April.

The strong growth of residential improvements in the 2013-2018 period was largely driven by aging - of both homes and their owners. The aging household stock was the result of the low rate of new home construction over the past decade. Half of the nation's owner-occupied homes were built prior to 1980 and require some replacements and/or additions of new amenities. The aging of homeowners motivated many to undertake projects to accommodate their desire to age-in-place.

Zhao says that while census data often undergoes significant revisions in subsequent months it does appear that home improvement spending is experiencing downward pressure from weak existing home sales volume, slowing home price growth and lingering uncertainty in the economy due to the stock market decline at the end of 2018 and the partial government shutdown.

In the survey behind the RMI remodelers are asked to assess current market conditions and demand for various categories of work and their expectations for conditions six months out. In the current release the portion of the index reflecting current conditions dropped 4 points from the previous survey, with respondents especially negative about demand for major additions and alterations work. The forward-looking index was down 2 points.

Ford concludes that the remodeling market will continue to grow in 2019, but at a more modest pace than previously, saying "The RMI is in line with NAHB's remodeling forecast, which projects slower growth as there is declining home price appreciation and existing home sales volume, but rising construction costs."