The economic consequences of the COVID-19 pandemic are increasingly clear, and so are the results of some efforts to alleviate financial hardships. Ginnie Mae and the Federal Housing Finance Agency have mandated servicers of FHA, VA, and GSE (Fannie Mae and Freddie Mac) loans to offer forbearance plans to their borrowers and this requirement was codified by Congress in the CARES Act. Borrowers using those plans have soared into the millions.

When the mandate was announced, there was concern from several quarters about the advances of principal and interest (P&I) payments servicers are required to make to investors in mortgage-backed securities even when borrowers are not paying on their loans. Servicers are also responsible for homeowner insurance premiums and property taxes.

When these advances are made servicers source the capital from their own balance sheet, typically in the form of a line of credit they hold with another financial institution or even with their own cash reserves. This arrangement is intended to be short-term as the outlays are eventually reimbursed by the applicable guarantor. Eventually, however, this can be a problem when forbearances are granted on a large scale and liabilities may outstrip available assets of some servicers, especially the non-bank type who may hold less capital than bank servicers with their retail deposit base.

Both Ginnie Mae and FHFA have made program and policy changes to provide relief to servicers, especially for the P&I advances but little has been said about the those for tax and insurance advances. Now CoreLogic's Pete Carroll has written an extensive paper on the implications "should a material drop in escrowed tax and insurance advances extend beyond mortgage market and homebuyer disruptions."

Carroll says that municipalities rely on timely receipt of property taxes, whether paid out of escrow accounts by the servicer or directly by the homeowner to fund, at least in part, basic services and public works. His intent is to outline the potential maximum risk exposure municipalities may face at varying levels of forbearance activity.

He first estimates the universe of property tax payments that municipalities expect to collect from March through December of 2020. Figure 1 includes all expected property tax payments on homes with a first mortgages regardless of whether payment is made by the homeowner or the servicer. Revenues for non-mortgages homes are not included in the figure.

Expected payments in the March through September period range between $4 and $10 billion monthly, then spike to $14.95B in October, peak at $29.35B in November, and end the year at $14.04B. If the forbearance requests are less frequent and shorter-term it could be a relative tailwind for municipalities, especially for those not scheduled to receive the bulk of their property tax payments as the impact of the forbearances begin. They would have time to prepare for any disruption to cash flow.

Carroll says in calculating how much risk there is to municipal revenues, it is important to recognize that forbearance does not apply to those property tax payments, but borrowers are used to making a single payment covering P&I as well as their escrow deposit. They may not make a distinction between or be confused about the two parts of that payment and that they should continue to pay the TI portion to their servicer.

Among homeowners with a mortgage, about 17 percent pay their property taxes directly to their municipality while 83 percent make escrow payments. Of the payments from escrows, 61 percent are made by bank servicers and 39 percent by non-bank companies. Knowing this distribution is important to understand how much of the universe of expected property tax payments could be impacted by delays stemming from either potential servicer liquidity disruptions or delinquent borrower-direct payments.

Taking the above segmentation data into account, Figure 4 displays the cumulative expected monthly cash flow expected by municipalities from March through December of 2020, stemming from servicer escrow account disbursements and broken down by bank and non-bank servicers.

Figure 4 shows cumulative monthly cash flows expected from non-bank servicer escrow accounts build from $3.39B in March, to $11.56B in July, capping out at $35.39B in December. The cash flows from bank servicer escrow accounts also build from $4.63B in March, to $12.56B earlier in May, and to $55.96B in December. The total property tax disbursements from escrow accounts is forecast to be $91.36B for the period of March to December of this year.

While his intent is not to forecast municipal cash flows that may actually become delinquent due to forbearance or how the any potential service advance disruptions may precipitate a drop off in revenues, Carroll does attempt to estimate the outer boundaries of property tax payment that have the potential to become delinquent. This will depend on how many borrowers ultimately request forbearance, how quickly and completely borrowers recover through the post-forbearance loss mitigation options offered to them, deterioration of a servicer's available capital and/or inability to raise fresh capital or tap available credit lines (some servicers will be more resilient than others). In the event a servicer is no longer able to fulfill their advance obligation, the federally backed mortgage programs must transfer the MSRs to another mortgage servicers willing to take on the obligations. Other potential drivers of delinquency might also include borrowers unable to sustain their monthly mortgage payments, including their property tax payments, once they exit forbearance and/or enter into a loss mitigation workout option, particularly in the case of non-escrow account borrowers who make their payments directly to the county.

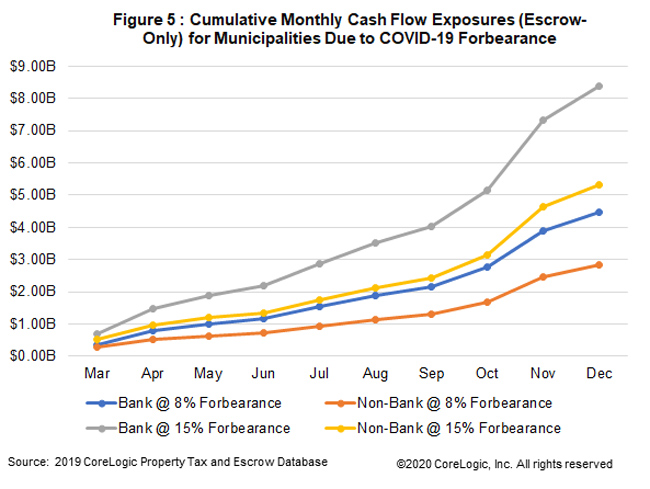

As of April 19, 6.99 percent of mortgage borrowers have requested forbearance (this had risen to 7.3 percent by April 30). Figure 5 is a projection of cumulative forborne property tax payments, assuming an optimistic case of an 8 percent forbearance rate and a pessimistic case of 15 percent.

Given the optimistic rate, total forborne non-bank servicer advances cross the $1B threshold in August, with total forborne advances of $2.83B. Forborne bank servicer advances cross the $1B threshold in May, with total forborne advances of $4.48B.

Under pessimistic parameters, forborne non-bank servicer advances cross the $1B threshold in May, with total forborne advances of $5.31B. Forborne bank servicer advances cross the $1B threshold in April, with total forborne advances of $8.39B.

Carroll says some of the top 20 (and many other) MSAs/Counties are already making contingency plans. Los Angeles County has not extended their expected liquidity date (ELD) for property tax payments but has announced the availability of workout plans for delinquent taxpayers. Philadelphia County has moved their ELD to July to give taxpayers extra time to make their payments and King County (Seattle) has extended its deadline for non-escrow account borrowers from April to June. Carroll says these and other mitigation efforts suggest that municipalities are aware of the risk of a drop in property tax revenues and he expects mitigation efforts to spread over coming weeks.