Is flipping back in vogue? CoreLogic, in a two-part article published in its blog says activity is up, but so far we are seeing nothing like the level of activity in 2005. Flipping is defined as an investor purchasing a home, renovating and repairing it, and selling it at a profit within a short period of time.

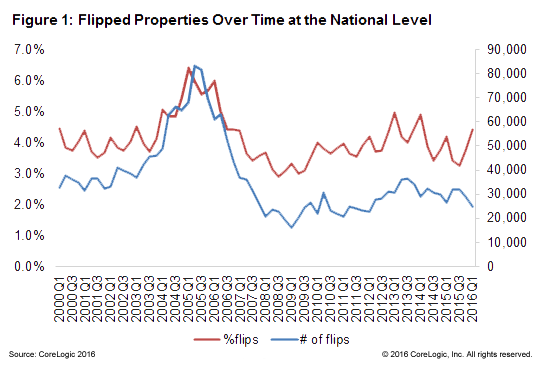

Easy access to credit and home prices that were steadily marching upward fueled record levels of flipping before the housing bubble burst. At the peak in the first quarter of 2005 there were an estimated 80,000 units "flipped," accounting for 6.4 percent of home sales. By the first quarter of 2009 the number of flips had slipped to under 20,000, a little over a 1 percent share.

Now prices have been appreciating at a relatively high rate for the last four years and have set new price peaks in some states. Is flipping back and in what markets?

CoreLogic analyst Bin He recently looked at flipping on both the state and metro levels. As of the first quarter of 2016 flipping made up 4.4 percent of sales but in actual unit numbers flipping is down 70 percent due to a much lower volume of all sale than during the peak quarter.

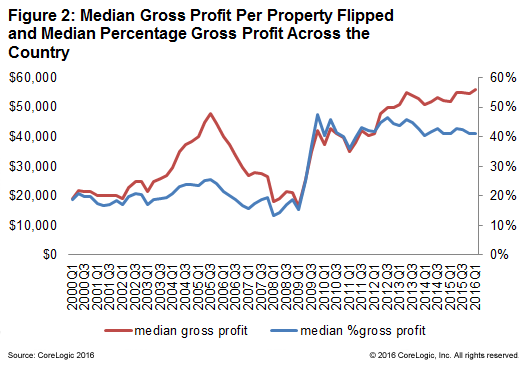

But if the numbers are down, profits are not. Flips in the first quarter of this year brought in a median gross profit of $56,000, up 17 percent from the $48,000 profit in 2005. However, investors were making a bigger percentage profit in 2009 when the volume was lowest - 47.7 percent compared to 41.1 percent this year - possibly because of a decline in the share of distressed sales which were often purchased at a significant discount.

It takes an investor longer to make to realize that quick profit than before the housing crisis. CoreLogic says the average time to flip during the housing bubble was 150 days, now the average is 154 days and that number appears to be rising.

On the local level CoreLogic found the highest share of flipped properties in Memphis, following by Fresno, California and WinterHaven, Florida. Florida was the strongest state for flipping with seven of the top 10 markets and eight of the top 20 located in the state and seven of the top eight markets in the state (the exception being Winter Haven) are seeing increasing sales. The company said it is too early to label it speculative behavior as activity in all of these areas is well below its pre-crash peak.

There are many factors that contribute to the level of flipping activity in a market, Ben He says. A future blog will look at these factors and discuss the correlation between flipping activity, home price appreciation