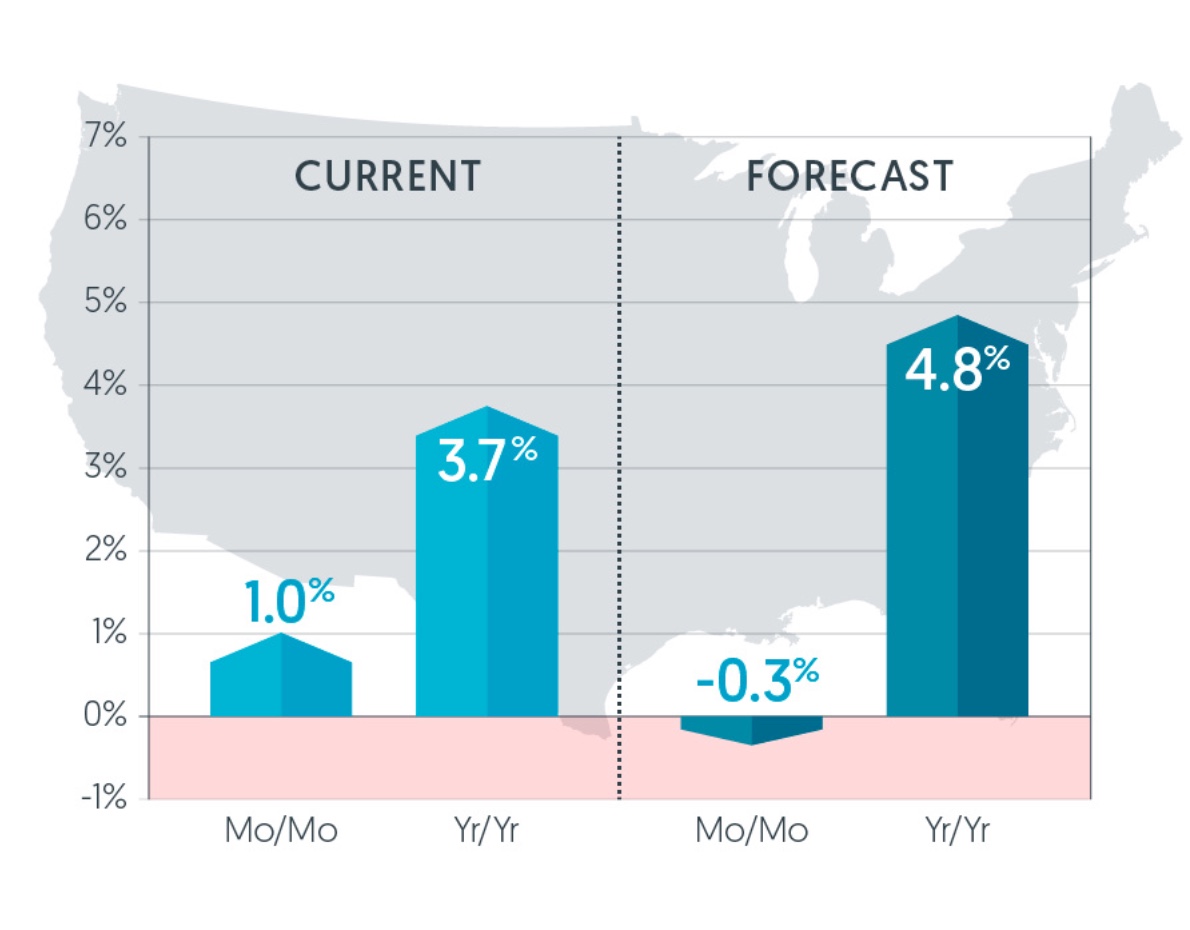

Home price growth continued to slow on an annual basis in March. The CoreLogic Home Price Index (HPI) shows home prices increased from the previous March by 3.7 percent. The annual growth rates in January and February were 4.4 percent and 4.0 percent respectively.

On a month-over-month basis prices grew by 1.0 percent, the same as in January. Prices had spiked by 0.4 percent in February.

The company's deputy chief economist Ralph McLaughlin said, "The U.S. housing market continues to cool, primarily due to some of our priciest markets moving into frigid waters. But the broader market looks more temperate as supply and demand come into balance. With mortgage rates flat and inventory picking up, we expect more buyers to take advantage of easing housing market headwinds."

Price increases continued in every state on an annual basis except North Dakota, with the largest gains in Idaho, up 10.5 percent, Maine (9.1 percent) and Utah (7.8 percent). Nevada leads again among metropolitan areas with an annual gain of 8.0 percent.

The company does not expect the shrinking appreciation rate to last. Its HPI forecast for March 2020 anticipates an annual increase of 4.8 percent. It also expects acceleration as the spring market begins, with a gain of 0.3 percent from March 2018 to April.

The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

The figure below shows a comparison of the national year-over-year percent change for the CoreLogic HPI and CoreLogic Case-Shiller Index from 2000 to present month with forecasts one year into the future. Both the CoreLogic HPI Single Family Combined tier and the CoreLogic Case-Shiller Index are posting positive, but moderating year-over-year percent changes, and forecasting gains for the next year.

Respondents to CoreLogic's 1st Quarter Consumer Housing Sentiment Study indicated that high home prices have an impact on rental prices as well. Nearly 76% of renters and buyers in high-priced markets agreed housing prices in these markets appeared to be driving rental rates up.

Frank Martell, President and CEO of Corelogic says the cost of housing, whether buying or renting, in expensive markets puts a significant strain on most consumers. "Nearly half of survey respondents - 44% of renters - cited the cost to rent in high-priced housing markets as the number one barrier to entry into homeownership. This is potentially forcing renters to wait longer to have the necessary down payment in these communities," he said.

CoreLogic says that 35 percent of the country's 100 largest metropolitan areas based on housing stock, were overvalued in March. The company's Market Conditions Indicators (MCI) categorize home prices in individual markets as undervalued, at value or overvalued by comparing home prices to their long-run, sustainable levels as supported by local market fundamentals such as disposable income. An overvalued housing market as one in which home prices are at least 10 percent higher than the long-term, sustainable level, while an undervalued housing market is one in which home prices are at least 10 percent lower. Twenty-six percent of the markets were undervalued, and 39 percent were at value. Within the top 50 markets based on housing stock, 40 percent were overvalued, 16 percent were undervalued, and 39 percent were at value.