Since the beginning of the housing crisis in 2008 housing experts have cited concern over the "Shadow Inventory" and the pitfalls it could present to any recovery of the housing market. Back then, as every month brought news of mounting delinquencies, rising unemployment, and pending adjustments to adjustable and teaser rate mortgages the shadow inventory had a particular definition; the number of homes with mortgages that are 90 or more days delinquent and that have a reasonable likelihood of ultimately being foreclosed and becoming bank-owned real estate even though they are not yet publicly listed for sale.

While lenders and servicers are still trying to rid themselves of backlogs of REO and there are still concerns over homes which may be held off the market for various reasons, the cry for months has been that there are not enough homes for sale. Sales, appeared to have been hampered by a lack of inventory as new home builders cut back on construction and current homeowners have deferred moving, each awaiting a better market.

The number of homes thought to be in the shadow inventory has dropped from 3 million at the peak in January 2010 to about 1.7 million in January of this year. Mark Fleming, CoreLogic's chief economist, said recently that the traditional view of the shadow inventory doesn't tell the whole story anymore and he puts forth two new ways of looking at how a different version of shadow inventory may still be holding back recovery.

In a CoreLogic Insights piece titled The Rise of Housing Obsolescence and Shadow Demand Fleming points to declining sales of both new and existing homes in March as compared to a year earlier and to an even greater drop in applications for purchase mortgages. He quotes National Association of Realtors (NAR) Chief Economist Lawrence Yun who routinely cites inventory shortages as one cause of both sluggish sales and prices that are rising faster than historical norms. But Fleming says that while there are only 2 million existing homes for sale - similar to the inventory in the early part of the last decade, "There are even fewer homes for sale that do not suffer from housing obsolescence - properties that are no longer desirable because their characteristics do not match what buyers are looking for in a home."

Fleming said these are homes that are located in locations that are no longer popular, or are lacking amenities buyers want. Thus the inventory of homes that buyers actually want to purchase is even smaller than Multiple Listing Service numbers would indicate and many people who are looking and qualified to purchase are holding back, waiting for a home they really want. "Just as shadow inventory is the stock of properties in delinquency or foreclosure that are not yet for sale," he says, "these buyers waiting in the wings are the new "shadow demand."

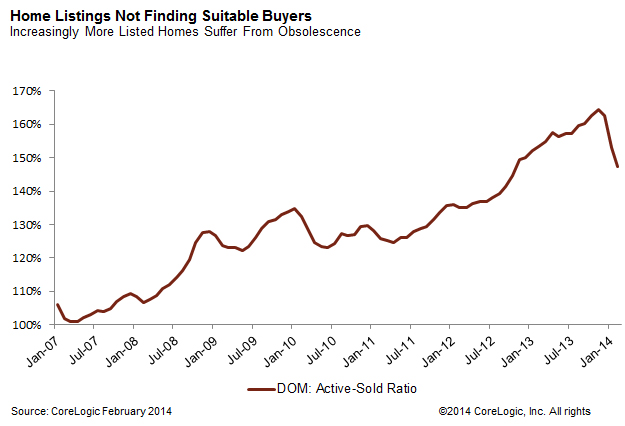

We can see that housing obsolescence is on the rise by looking at the ratio of average days on market (DOM) for all homes for sale to that for homes sold over time, he said. The higher the ratio, the longer all homes take to sell relative to those that actually do sell and indicates that a portion of the inventory is languishing on the market. In 2007 there was barely any difference in DOM for the entire inventory and for sold houses; today homes that sell do so in about two-third the amount of time as the overall inventory average.

Fleming said the housing and financial crisis has forced the industry to come up with new measurements for events and activities that were not previously monitored such as negative equity and shadow inventory. Now he says we need to pay attention to obsolescence. "Maybe the reason that home sales aren't increasing is because buyers can't find anything they want to buy. More viable homes for sale are needed to draw this demand out of the shadows."

In a second article, A New Source of Shadow Inventory, the economist maintains that the definition of the term should be expanded to include non-distressed existing homeowners who have no incentive to sell because the prevailing mortgage rate is higher than the mortgage on their existing home. Roughly half of the 50 million mortgaged homes in the U.S. have below-market-rate mortgages and if as conventional wisdom says, homeowners typically sell once every seven years, there may mean 3.57 million likely sellers who will not list their homes because the cost of financing a new home will be higher.

Fleming says that adding these "rate-disenfranchised sellers" to the traditional shadow inventory results in a new estimate of 5.27 million homes as of January 2014. Compared to one year ago, when the interest rate was 4 percent, only 28 percent of potential sellers or 2 million might have been dissuaded from listing, expanding that shadow inventory from 2.2 million under the traditional definition to 4.2 million homes.

He says this group of potential, inactive buyers could keep growing as mortgage rates continue to edge upward and could put yet another damper on the recovering housing market. "We thought the shadow inventory was improving," he says, "but rising rates may actually be driving a substantial increase instead."