The National Association of Realtors released the Pending Home Sales Index data today.

NAR's Pending Home Sales Index measures housing sales contract activity. A sale is listed as "pending" when a contract to purchase an existing home (single-family, condos, and co-ops) has been signed but the transaction has not closed. A signed contract is not counted as an actual existing home sale until the transaction

closes.

The index is based on a large national sample, typically representing about 20 percent of transactions for existing-home sales. It is designed to be a leading indicator of housing activity. In developing the model for the index, it was demonstrated that the level of monthly pending home sales parallels the level of closed existing-home sales in the following two months.

From the release...

Pending home sales increased again in March, affirming that a surge of home sales is unfolding for the spring home buying season.

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in March, rose 5.3 percent to 102.9 from 97.7 in February, and is 21.1 percent above March 2009 when it was 85.0; this follows an 8.3 percent increase in February.

While this is definitely positive progress, I want to point out that the extended tax credit is not generating the same amount of buyer enthusiasm as the first homebuyer tax credit did...at least on a seasonally adjusted basis (more on that below).

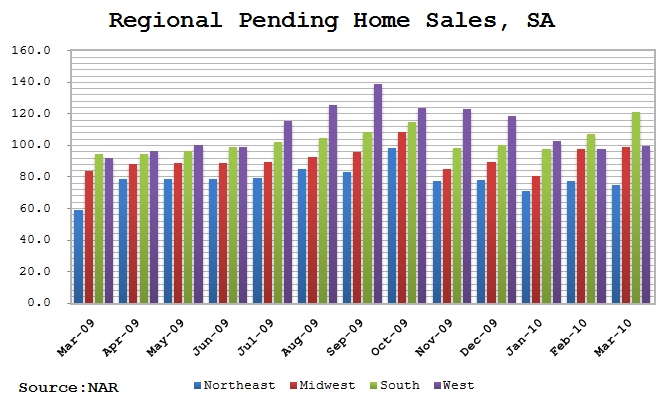

Regionally...

The Northeast declined 3.3 percent to 75.1 but remains 27.2 percent higher than March 2009

The Midwest increased 1.2 percent to 98.9 and is 18.5 percent above a year ago.

The South jumped 12.7 percent to an index of 121.2, which is 28.3 percent higher than March 2009.

The West index rose 1.9 percent to 99.9 and is 8.8 percent above a year ago.

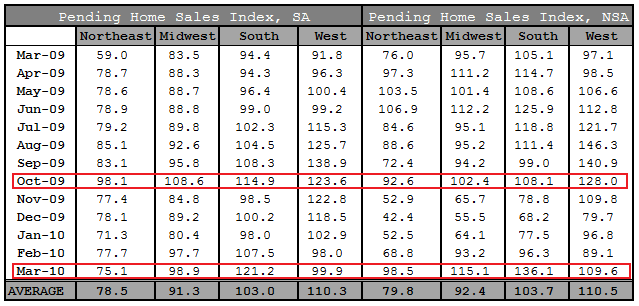

The table below matches up seasonally adjusted data and non-seasonally adjusted data. Let's compare index levels one month before the first tax credit expired and one month before the extended tax credit expired.

On a seasonally unadjusted basis, the March Pending Home Sales Index is worse vs. October 2009 in three regions (all except the South). However when looking at the data on a non-seasonally adjusted basis, all regions expect the West are actually at higher index levels vs. October 2009.

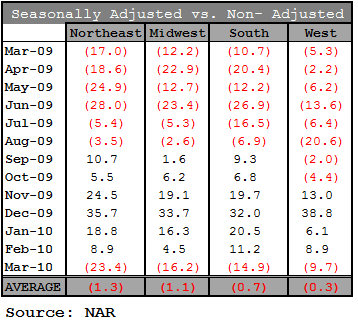

The table below is the difference between seasonally adjusted index values and non-seasonally adjusted values. Red indicates the non-adjusted index is higher than the adjusted. Notice the seasonal adjustments get bigger and bigger as we get deeper unto the summer months. In October, one month before the original tax credit expired, seasonally adjustments actually added to the index values. This month, seasonal adjustments are subtracting from the index. Furthermore seasonal adjustments are bigger this year than they were last year.

My point: Housing demand might not be matching up when compared to buyer demand one month before the original tax credit expired, but only on a seasonally adjusted basis (which are strong this time of year).

From our point of view, buyer demand "feels" strong, this "feeling" is based on anecdotal evidence from Originators, Realtors, and Appraisers. Plus MND site traffic on content channels aimed at consumers has skyrocketed over the past two months.

Lawrence Yun, NAR chief economist is optimistic....

“Clearly the home buyer tax credit has helped stabilize the market. In the months immediately following the expiration of the tax credit, we expect measurably lower sales,”

“Later in the second half of the year, and into 2011, home sales will likely become self-sustaining if the economy can add jobs at a respectable pace, and from a return of buyer demand as they see home values stabilizing.”

“Another encouraging sign is the improvement in the availability for jumbo and second-home mortgages....As bank balance sheets strengthen, it is just a matter of time before lending of non-government-backed mortgages steadily opens up.”

That last quote is probably the most important. While buyer demand may be on the rise heading into the summer months, borrowers still need to qualify to purchase homes. The mortgage industry needs more product to make this happen!

LAST THOUGHT: I've always said the first signs of recovery in housing would be noticeable via an increase in demand for REITs and REO (as opposed to homebuyer demand). Well...REITS are doing quite well and I get about 30 emails a week asking for advice on how to buy REOs.

IT WOULD APPEAR THAT HOUSING IS BUILDING A FOUNDATION FOR STABILIZATION. If job creation can continue, government related or not, housing should continue to pick up momentum in the months ahead. After that it all comes down to how fast banks liquidate REO. One step at a time....READ MORE

PS: If you are looking to buy REO---Stay Local. Knowing the Local Market Keeps You Ahead of the Game. Fannie and Freddie sell their REO too close to retail price. Your best bet for a good deal is visiting the County Courthouse.