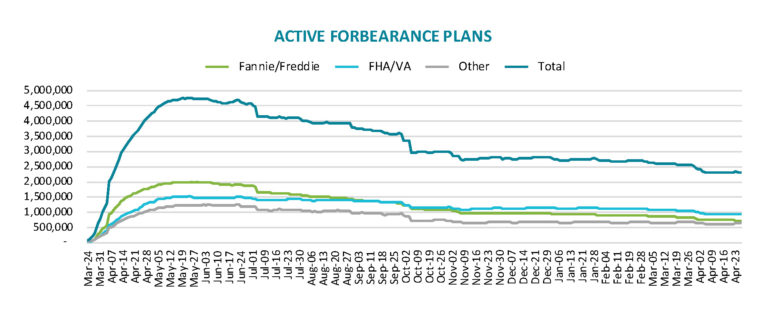

The number of loans in forbearance rose over the past week, driven by increases in those held in bank portfolios and private label securities (PLS). Black Knight said the first uptick in nine weeks netted out to only 20,000 as the number of forbearances serviced for Fannie Mae and Freddie Mac (the GSEs), FHA, and the VA declined. As of April 27, there were an estimated 2.39 million loans in the program, 4.4 percent of the nation's approximately 53 million mortgages.

The company noted that mid-month spikes in forbearances have been common in recent months as the overall trend in improvements continues. Plan volumes have decreased by 228,000 loans, 8.9 percent of the total, over the past month.

The number of forbearances in the GSEs' portfolios fell by 9,000 loans to 736,000 or 2.6 percent of the total, and FHA and VA plans dipped by 2,000 to 944,000 (7.8 percent). The number of forbearances serviced for portfolios and PLS swelled by 31,000. Those plans now total 649,000, 5.0 percent of all those being serviced.

The company says 240,000 plans are set to expire this month so there may be additional improvement this week and in early May. Both inflow and exit activity fell this month with exits hitting their lowest weekly total since late February.