Stocks continue to inch upwards this morning as European concerns ease. The Fed’s commitment yesterday to keep monetary policy at “exceptionally low levels … for an extended period” also helped investor confidence. READ THE FULL STORY

The day ahead is relatively slow with only the weekly labor report set for release. But, according to the Wall Street Journal, President Obama will nominate two economists and a lawyer to the Federal Reserve Board today.

“The White House will tap Janet Yellen, president of the San Francisco Federal Reserve Bank, to be the board's vice chairman, and Massachusetts Institute of Technology economist Peter Diamond and Maryland state banking regulator Sarah Bloom Raskin to sit on the seven-member board, according to people familiar with the matter,” the Journal said.

“The Senate is likely to confirm them. The nominations aren't likely to prompt a major shift in interest-rate policy. But they would reinforce the Fed's activist bent as policy makers overhaul the central bank to monitor and regulate risk-taking across the financial system, review compensation policies at banks and tighten consumer regulation.”

In earnings releases, look for results from Exxon Mobil, Procter & Gamble, Motorola, Aetna, and ConocoPhillips.

Key Events Today:

8:30 ― Initial Jobless Claims are set to fall from 456k claims to 447k in the week ending April 24. The drop will be welcome, but it only represents a return to the March average. Moreover, to reflect overall labor growth in the economy the survey needs to see claims below 450k for a sustained period.

“Initial jobless claims declined sharply in the latest week after a spike in the first two weeks of April,” noted economists from Nomura. “The decline confirms that the early rise had reflected technical factors – seasonal adjustment problems around the Easter holiday and the clearing of a filing backlog in some areas – rather than a fundamental deterioration in job market conditions. This week, we expect the steady downward trend in claims to resume.”

Meantime, continuing claims are anticipate to fall 28k to 4.618 million for the week ending April 17, marking their lowest point since December 2008.

Treasury Auctions:

- 1:00 ― $32 billion 7-Year Notes

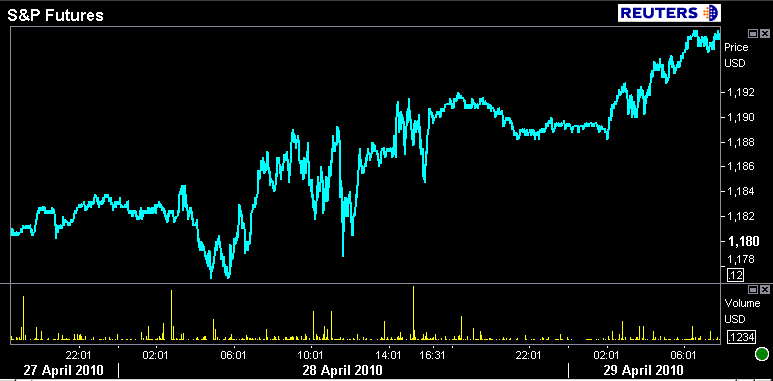

Ahead of the opening bell, Dow futures are up 43 points to 10,058 and S&P 500 futures are trading 6.50 points higher at 1,196.50.

The 1.00% coupon bearing 2 year Treasury note is -0-01 at 99-29 yielding 1.048% and the 3.625% coupon bearing 10 year Treasury note is -0-02 at 98-24 yielding 3.776%

Commodities are also pointing upwards: WTI crude oil is up 87 cents to $84.09 per barrel, while Spot Gold is trading $1.60 higher to $1,167.30.