Housing remains the bright spot in a darkening economic outlook according to Freddie Mac's economists. Though they have revised their forecast for economic growth downward in the latest edition of the company's Outlook they are still forecasting housing will retain its momentum in 2016.

First quarter data painted "a bleak picture" of economic growth the report says. Information on consumer spending, manufacturing, auto and retail sales have led to successive downward revisions in real GDP growth estimates for the first quarter from others and Freddie Mac is revising its forecast from 1.8 percent to 1.1 percent. The company is looking for consumer spending, wage growth, and residential and business investment to pick up in the following quarters and for the GDP growth to be 2 percent for the entire year and 2.3 percent in 2017.

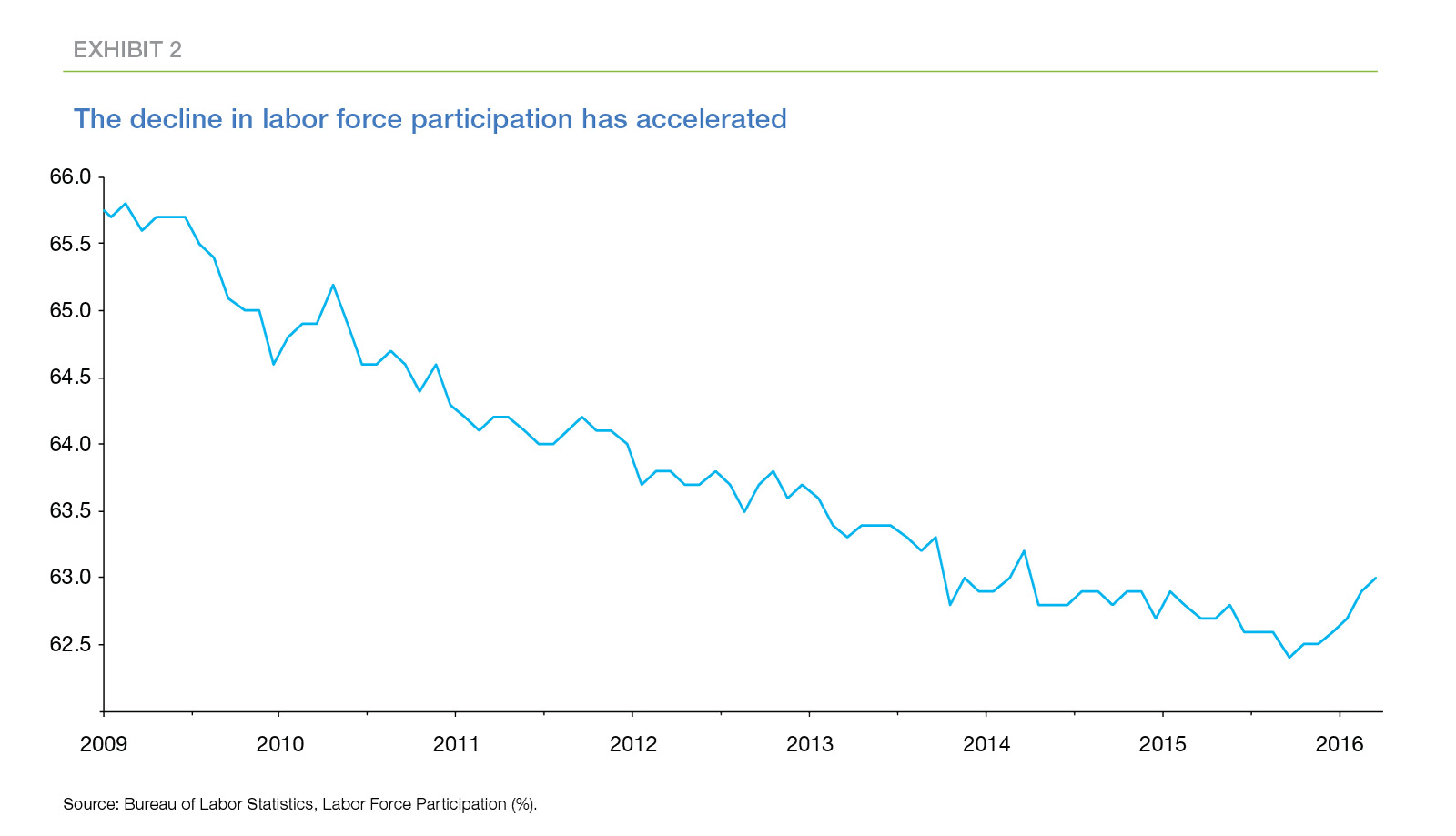

Even though job growth has been solid, Freddie Mac says wage growth has yet to materialize because of remaining slack in the labor market. However, labor participation did rise slightly in March as discouraged workers, seeing hope, again sought employment. The 0.6 percentage point increase since September 2015 means 1.5 million more workers. This more than offset the job gains over the same period so the unemployment rate ticked up 0.1 point to 5.0 percent in March.

This increase in participation suggests there is remaining slack in the labor force but perhaps not much; both the median weeks of unemployment and the share of those unemployed for 27 weeks or more have been declining, and unemployment should drop back below 5 percent for the rest of 2016 and 2017. "Stronger economic growth for the remainder of 2016 and reduced slack in the labor market will drive wage gains above inflation, though the gains are likely to be modest."

Freddie's economists maintain their positive view on housing and expect that the declines in long-term interest rates that accompanies much of the recent gloomier news should increase mortgage market activity, particularly refinancing, and housing will be an engine of growth. Construction activity will pick up as we enter the spring and summer and rising home values will help support renewed confidence in the remaining months of the year.

As of April 14, 2016, the national average for Freddie's 30-year fixed mortgage rate was 3.58 percent, the lowest since May of 2013. Mortgage rates have followed U.S. Treasuries closely, with the mortgage rate decline almost entirely a function of declining Treasury yields spurred by a flight to quality. As goes the 10-year Treasury, so too shall go the 30-year fixed mortgage rate which has fallen more than 40 basis points since the beginning of the year.

Freddie Mac has lowered its forecast for the 30-year rate for the second through fourth quarters by a tenth of a percent and expects that rate to average 4 percent for the year while still anticipating that the Federal Open Market Committee (FOMC) will raise short-term rates twice in 2016.

Both low rates and strong job growth should push home sales to the best year since 2006 even though they started the year slow. Chronically low inventories remain a challenge both for new and existing home sales and the report says, "At the current rate of construction, people should get used to seeing headlines about low inventory of for-sale homes in many markets for years to come. Demographics and demand are only going to increase the pressure on housing stocks."

Housing and Urban Development (HUD) estimates that between 2009 and 2011 there were over 800,000 1-unit housing units lost to conversion, demolition, disaster, condemnation, or other reasons. With approximately 90 million 1-units housing units in the country, about 414,000 must be replaced each year just to keep the stock constant. While single-family housing starts have been accelerating recently and are running above replacement rates, the difference is only about 400,000 units per year which is constraining growth in the single family market. Freddie Mac expects this to increase by another 200,000 over the next two years gradually alleviating tight inventories.

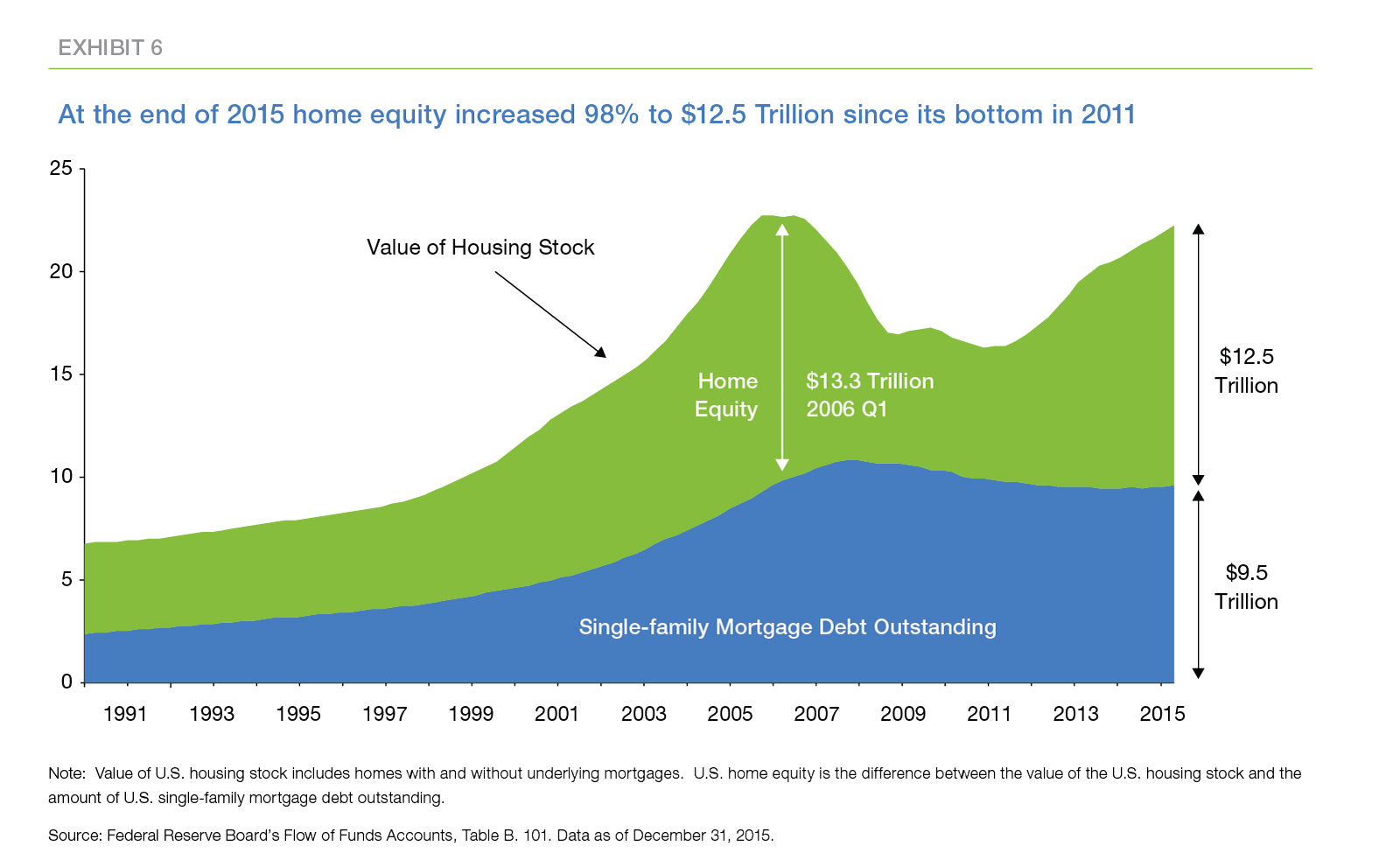

Tight supply along with demand driven by low rates and solid job gains will keep prices rising above historic average rates - an estimated 4.8 percent this year and 3.5 percent next year. This will also drive up homeowner equity from an estimated $12.4 trillion at the end of 2015, slightly below the not-inflation-adjusted peak of $13.3 trillion in 2006. The current surge in equity has not, like the earlier figure, been accompanied by a surge in mortgage debt but has gone almost exclusively to bolstering household balance sheets.

Mortgage debt will increase 3.5 percent this year and 4.0 percent in 2017, higher than in recent years but still well below the historic average of an annual 10 percentage point increase. There is also opportunity, given the low rates, for increased refinancing and since the recent drop Freddie Mac has refigured its February estimate that rates dipping below 4 percent would increase refinance potential by $122 billion.

They say the contract rate on most loans clusters around every eighth of a percentage point. For example, there are clusters of loans around 3 percent, 3.125 percent, 3.25 percent, and 3.5 percent, but not many loans with contract rates in between. If borrowers react to specific rate incentives, e.g., refinance if market rates drop 1 full percentage point below the borrower's contract rate, then refinance activity will tend to ratchet higher with each eighth point rate reduction. In the week of April 7, 2016, mortgage rates had their biggest one-week decline in over a year of 0.12 percentage points (nearly one eighth). Replicating its February analysis, the company says that one-week decline increased in-the-money refinance potential by $66 billion.

They also ran a macro simulation of the U.S. economy, housing, and mortgage market. That showed the decline relative to the February analysis increased refinance activity by about $50 billion. Based on these calculations, Freddie Mac revised its 1-4 family mortgage originations estimate for 2016 up by $50 billion to $1.70 trillion.