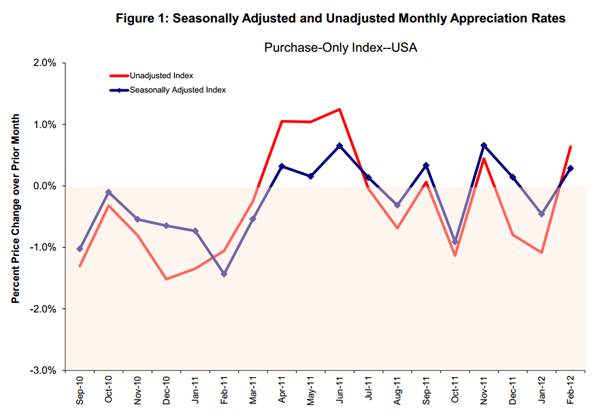

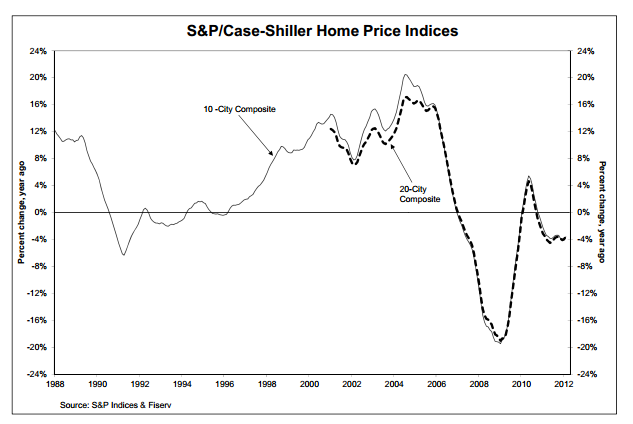

Two major home price indices released this morning indicate that, while home prices are improving the changes are slow and relative. The Federal Housing Finance Agency's (FHFA) Home Price Index rose 0.3 percent on a seasonally adjusted basis from January to February while S&P/Case Shiller 10-City and 20-City Composite indices showed annual losses of 3.6 percent and 3.5 percent respectively, an improvement over losses posted in January of 4.1 and 3.9 percent.

The FHFA Index is calculated using purchase prices of houses financed by mortgages sold to or guaranteed by Fannie Mae or Freddie Mac. The index was revised to reflect a 0.5 percent decrease in home prices in January rather than a 0 percent change as originally reported. Prices over the previous 12 months rose 0.4 percent according to the index and are now at the same level as in January 2004, 19.4 percent below the April 2007 peak.

Five of the nine census divisions posted positive monthly increases. Seasonally adjusted monthly price changes from January to February ranged from -1.0 percent in the West North Central and Middle Atlantic divisions to +1.9 percent in the Mountain division.

According to the S&P/Case Shiller Home Price Indices, fifteen of the 20 cities mirrored the composites with better year-over-year results in February than in January and Washington, DC was unchanged. The four cities where annual rates deteriorated were Chicago, Cleveland, Detroit, and Atlanta.

Five cities saw positive annual returns, Denver, Detroit (despite poor February results), Miami, Minneapolis, and Phoenix which, after years on the list of worst performing cities has now posted five consecutive positive monthly returns and two months of improving annual results.

Chairman of the Index Committee at S&P Indices, David M. Blitzer said, "While there might be pieces of good news in this report, such as some improvement in any annual rates of return, February 2012 data confirm that, broadly speaking, home prices continued to decline in the early months of the year. Nine MSAs - Atlanta, Charlotte, Chicago, Cleveland, Las Vegas, New York, Portland, Seattle, and Tampa - and both Composites hit new post-crisis lows. Atlanta continued its downward spiral, posting its lowest annual rate of decline in the 20-year history of the index at -17.3 percent."

The January report had omitted Charlotte North Carolina because of reporting delays, but the two months data now available for that city showed it still reaching new lows.

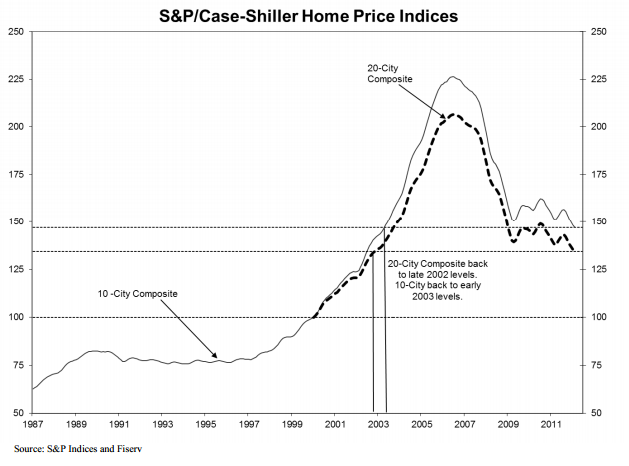

As of February average home prices across the U.S. are back to the levels of late 2002 for the 20-City Composite and early 2003 for the 10-City Index. Measured from their June/July 2006 peaks both composites are down about 35 percent. February's figures are new lows for both Composites in the current housing cycle.

"At the end of the day, this data is still weaker-than-expected," according to Kathy Lien, Director of Research GFT FOREX. "We're still seeing a very sluggish recovery in housing and we will probably see the same in the new home sales report later today. Even though we had a modest uptick in prices, it's too soon to factor in acceleration in the housing market. So there's nothing here that will make the Federal Reserve more optimistic."

Paul Nolte, Managing Director, Dearborn Partners in Chicago concurs. "More of the same. We still have a lot of inventory to go through, and unfortunately unlike manufacturing inventory, which is easy to destroy, housing just sits there. We've got a long way to go. This underscores that, but today is all about earnings and Europe."

"There is a tie-in in home prices with once depressed manufacturing regions, Michael Strauss, Chief Market Strategist, Commonfund said. "With the strength in manufacturing, you are seeing some stabilization in home prices in those manufacturing-heavy areas. The two do go hand-in-hand. It's more than just weather distortion."

Tom Porcelli, Chief U.S. Economist for RBC Capital Markets called broad prospect for home prices this year flat at best. "As much as we have had progress with the supply and demand imbalance, it is still a challenge to gather any momentum here. Moreover, we are in an environment of still lax demand for mortgages and lending standards remain tight, which will continue to be an impediment for materially higher home prices at this stage."