Home remodeling remains strong throughout the country although it has begun to experience some of the moderation that has been predicted since late last year. The Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University said its LIRA (Leading Indicator of Remodeling Activity) continues to show solid growth in the market this year but momentum should begin to moderate in the fourth quarter.

According to the Joint Center, "Sluggishness in the housing market and specifically in home sales may result in a deceleration of home improvement spending from double-digit annual growth through the third quarter to a year-over-year gain in the high single digits by the end of the year."

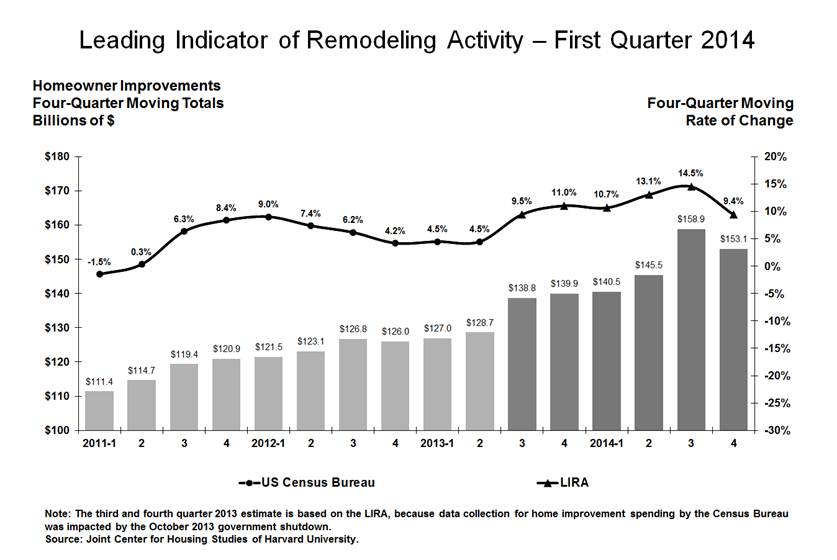

The LIRA is a moving average designed to estimate national homeowner spending on improvements for the current quarter and subsequent three quarters. The indicator, measured as an annual rate-of-change of its components, provides a short-term outlook of homeowner remodeling activity and is intended to help identify future turning points in the business cycle of the home improvement industry.

This is the second consecutive quarter that the duration of the recovery anticipated by the LIRA has been extended. The model released in October 2013 anticipated a slowdown beginning in the second quarter of 2014. That was extended to the third quarter in the January although the rate of that growth was downgraded from October estimates. The Center now projects that growth in the moving average will continue into the third quarter, increasing 6 basis points to 14.5 percent. It will then slow in the fourth quarter, with spending decreasing from $158.9 billion to $153.1 billion, a decrease of 5.8 percentage points.

"Home improvement spending has already recovered a significant share of its losses from the downturn," says Kermit Baker, director of the Remodeling Futures Program at the Joint Center. "As spending moves into the next phase, we expect to see recent double-digit growth tail off to its longer-term average in the mid-single-digit range."

The Center also announced that, because of the upheaval in financial markets over recent years, it has found the traditional relationship between interest rates and home improvement spending has significantly deteriorated. As a consequence, starting this quarter long-term rates have been removed from the LIRA estimation model.