While the March residential construction report from the U.S Census Bureau is grim, one can find a small glimmer of optimism in the fact that, while housing starts fell off a cliff, there was much less damage done to permits. Perhaps this means builders are envisioning a pause in construction rather than a total collapse.

Robert Dietz, an economist with the National Association of Home Builders (NAHB) points out that, despite the mitigation efforts to control spread of the COVID-19 virus, construction can continue in a majority of states, "as home building is deemed an essential business activity. We estimate that approximately 90% of single-family units under construction are located in 'essential' states and 80% of apartment units are located in such states."

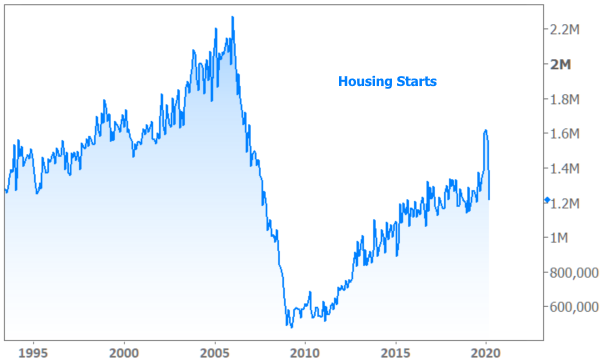

In any case, housing starts, which had been at post crisis highs near 1.6 million in January and February, dropped 22.3 percent in March to 1,216,000 units. This still left the seasonally adjusted rate 1.4 percent higher than a year earlier. The February rate of starts was revised down from 1,599,000 to 1,564,000.

March starts were only slightly below the range of estimates provided by Econoday. Its analysts had forecast over a range from 1,230,000 to 1,450,000. The consensus was 1,350,000 units.

Single-family starts suffered a smaller loss, down 17.5 percent from February's 1,037,00 units to 856,000. February's starts were originally estimated at 1,072,000 units. Single-family starts remained 2.8 percent higher than the previous March. Starts for multifamily construction dropped 32.1 percent to 347,000 units, 3.9 percent below the rate a year earlier.

On a non-adjusted basis, construction was started on 100,100 residential units during the month. The February estimate was 111,300 and there were 98,200 starts in March 2019. Single-family starts totaled 71,700 compared to 72,900 in February and 69,700 a year earlier. For the year to date (YTD) there have been 324,500 starts, a 22.3 percent increase over the first three months of 2019. Single-family starts are up 12.4 percent year-over-year.

The decline in starts compared to February was dramatic in all four regions of the country although two regions maintained an annual margin. Starts were down 42.4 percent in the Northeast on a monthly basis and 16.9 percent year over year. They fell 21.5 percent in the Midwest but were still 15.9 percent higher than in March 2019. The South was down by 21.3 percent from February but with a 5.8 percent annual gain. The West dropped 18.2 percent and 8.5 percent from its two earlier periods.

Permits for construction of residential units were down 6.8 percent from February's revised (from 1,464,000) estimate of 1,452000 to 1,353,000, remaining 5.0 percent higher for the year. The results beat out the consensus estimate from Econoday analysts of 1,300,000 in a range from 950,000 to 1,400,000.

Single family permits took a bigger hit; they fell by 12.0 percent to 884,000 from 1,005,000 the previous month although they remained up 8.7 percent from the rate in March 2019. Permits for multifamily construction rose 5.2 percent from February to 423,000 units although that lagged the March 2019 rate by 3.6 percent.

On a non-adjusted basis there were 116,000 permits issued during the month, up from 100,200 in February and 105,700 the previous March. There were 78,300 single family permits issued compared to 70,800 and 69,000 in the earlier periods. On a YTD basis permits are up 12.1 percent compared to the same period in 2019 to a total of 328,100- and single-family permitting is running 18.6 percent higher.

Permits were also down in the four regions, but the numbers were much smaller than for starts. They fell 7.6 percent for the month and 1.6 percent year-over-year in the Northeast. The Midwest dropped 12.7 percent from February and 3.3 percent on an annual basis. Permitting in the South lost 3.1 percent for the month but maintained a 7.9 percent gain for the year. The West slowed by 10.5 percent in March but permitting was up 6.6 percent on an annual basis.

The rate of residential completions fell 6.1 percent to 1,227,000 in March, a 9.0 percent annual decline. Single family completions were down 15.0 percent and 10.2 percent respectively to 863,000 units but multifamily completions rose 26.1 percent.

On an unadjusted basis there were 95,900 units completed during the month, 68,000 of which were single-family dwellings. The February numbers were 91,800 and 71,200 respectively. YTD, completions are down 2.2 percent from a year earlier to 278,000 units although there has been a 2.4 percent increase in single-family completions.

Completion rates also moved significantly lower in some of the regions. In the Northeast they fell 21.9 percent and 35.4 percent for the month and year and were down 20.5 percent and 14.8 percent in the West. The Midwest improved over the two earlier periods, rising 6.2 and 2.5 percent while the South eked out an 0.6 percent gain from February, but completions were down 4.6 percent from a year earlier.

At the end of March there were an estimated 1,218,000 units under construction, 534,000 of which were single-family houses. In addition, there were 168,000 permits that had been issued but under which construction had not started. Ninety-one thousand were for single-family units.