While home prices are still falling, Clear Capital is predicting that the country will finally see a turn-around this year and a modest increase by the end of 2012. According to the company's latest Home Data Index (HDI) Market Report released on Thursday, home prices fell 0.2 percent over the first quarter although three regions posted positive numbers.

Clear Capital reports its data in rolling quarter intervals that compare the most recent four months to the previous three months. The current report covers data through March.

The modest loss in the recent period marked the fifth time in six months that the price changes from quarter to quarter were less than 1 percent but Clear Capital cautions that the most recent results "may be attributed to the beginning of spring after a very mild winter, resulting in the start of an early buying season."

On a year-over-year basis prices were down 1.4 percent, an improvement over the results in February when the year-over-year results were -1.9 percent.

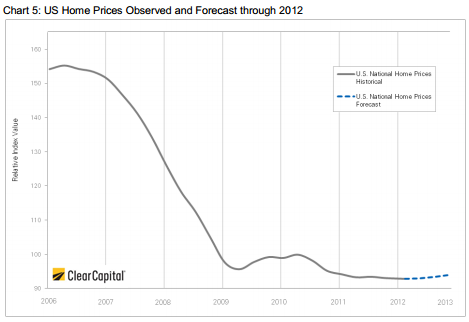

Clear Capital's forecast models predict that prices will increase modestly over the next three months, resulting in 1.2 percent growth by the end of the year. This charter shows the valley shape with current prices at the bottom and an upward trend from now (March) through December of 2012.

The West, South, and Northeast posted small gains during the period but these were wiped out by the Midwest where prices declined by 2.4 percent and were down 3.8 percent year over year. The Western region, which has been very weak throughout the housing crisis, gained 0.1 percent during the period compared to losses of 0.4 percent last month and 2.5 percent year over year.

The stable Northeast held true to form and turned in a modest 0.3 percent increase in prices, which was a 0.4 percentage point improvement over the quarterly loss of -0.1 percent posted last month. Year-over-year the region is up 0.6 percent.

The South turned in the strongest short term gains across the nation, with prices climbing 0.6%, due in part to impressive results in Florida, Texas, and Virginia. This gain was a healthy 0.8 percentage point improvement over the loss of 0.2 percent posted last month. Year-over-year results are -0.4 percent.

The strongest of the regions throughout much of 2011, the Northeast, is expected to gain a modest 0.3 percent over the next three months, but pick up momentum and end the year up 1.3 percent. The South is expected to perform best in the short term, growing 0.5 percent over the next three months to end the year up 1.6 percent, exceeding the national forecast by 0.4 percentage points.

The forecast shows the Western Region could be turning a corner. The three month numbers show the region gaining 0.2 percent, and pushing that to a positive 1percent to end the year. The Midwest is expected to drop -0.6 percent over the next three months, but move into positive territory with a 0.7 percent gain by December.

"With the exception of the Midwest, positive growth in rolling quarter-over-quarter prices is an encouraging sign that markets are rebounding from the winter slow down earlier than usual," said Dr. Alex Villacorta, Director of Research and Analytics at Clear Capital. "Even with the relatively modest declines seen over the last few months, markets have continued to show signs of bottoming out. The projections we made at the beginning of the year are playing out and we expect to see the nation gain just over 1 percent through the year's end.

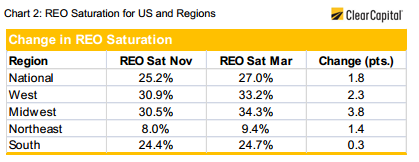

Clear Capital said that, for the second month in a row there have been increases in REO saturation, helping to confirm speculation the Attorneys General settlement has empowered servicers to become more aggressive in moving their REO backlog. In March the national REO rate increased 1.2 points over February to hit 27 percent. The Midwest contributed the most to the increase, jumping 3.8 points over the quarter to 34.3%, with the other regions all seeing softer increases.

REO saturation usually has an inverse relationship with price but the report points out that the country saw increases in REO saturation over the most recent quarter, changes in prices over the same period shown in chart 1 were positive for the West, Northeast, and South, describing an unexpected direct relationship. The US and Midwest's changes in prices over the same period were downward, describing the expected inverse relationship.

"We are continuing to see, overall short term home value strength against the rising REO saturation." Villacorta said. "This is an indication of market stability, and bodes well for the continued growth we're expecting over the rest of the year."

Clear Capital follows 50 metropolitan statistical areas (MSAs) and lists the highest and lowest performing micro-markets in rolling quarter-over-quarter performance. Among the leaders 47 percent are located in the South with three MSAs each in Virginia and Florida. The Phoenix area turned in the best performance at 7.3 percent followed by Dayton, Ohio (6.3 percent) and Pittsburgh (6.1 percent.)

The South also had a large share of the worst performing MSAs, tied at six with the Midwest. Leading the list of low performers was Birmingham (-14.0 percent) followed by Milwaukee and Detroit (-9.5 and -6.9 percent).

The 50 MSAs tracked by Clear Capital are forecasted to show mixed gains and losses, with 30 markets expected to see gains and 20 markets projected to post losses through the end of 2012. A full 52 percent of the 50 metros should see prices move less than 2 percent in either direction. No double digit declines are expected, and only Phoenix and Tampa are expected to see double digit gains.