The Mortgage Bankers Association today released its Weekly Mortgage Applications Survey for the week ending March 26, 2010.

The survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. A rising trend of mortgage applications indicates an increase in home buying interest, a positive for the housing industry and economy as a whole. Furthermore, in a low mortgage rate environment, such a trend implies consumers are seeking out lower monthly payments which can result in increased disposable income and therefore more money to spend on discretionary items or to pay down other debt.

From the release...

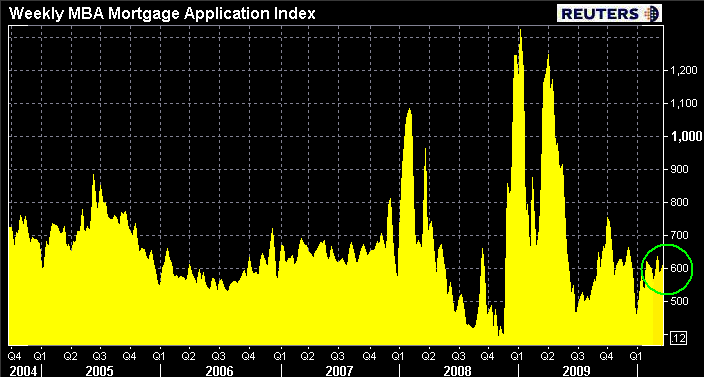

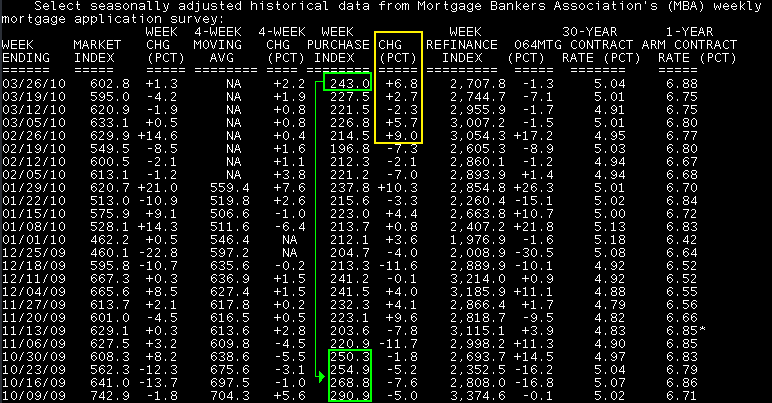

The Market Composite Index, a measure of mortgage loan application volume, increased 1.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 1.5 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index is up 2.2 percent.

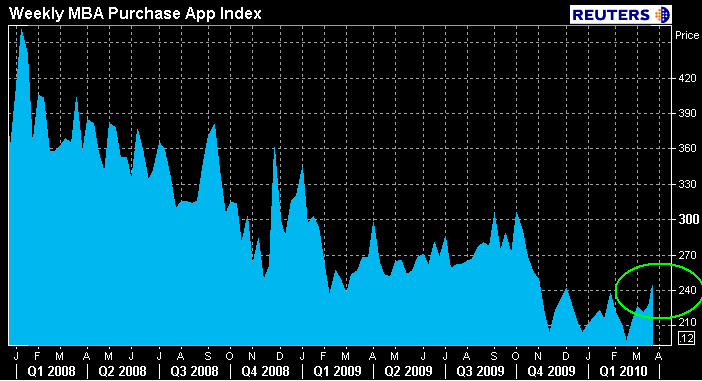

The seasonally adjusted Purchase Index increased 6.8 percent from one week earlier. This is the highest Purchase Index since the week ending October 30, 2009. The unadjusted Purchase Index also increased 6.8 percent compared with the previous week and was 9.3 percent lower than the same week one year ago.

While both conventional and government purchase indexes saw increases this week, the government purchase index and the government share of purchase applications are at their highest levels since October 2009. The government share of purchase applications is currently 47.2 percent.

Michael Fratantoni, MBA's Vice President of Research and Economics says:

"Purchase applications have increased over the past month, and are now at their highest level since last October when many homebuyers were rushing to get loans closed before the expected expiration of the homebuyer tax credit.....We may be seeing a similar pattern now, as the extended version of the tax credit ends next month."

This confirms anecdotal evidence we've been hearing from Loan Originators, Realtors, and Appraisers. READ MORE

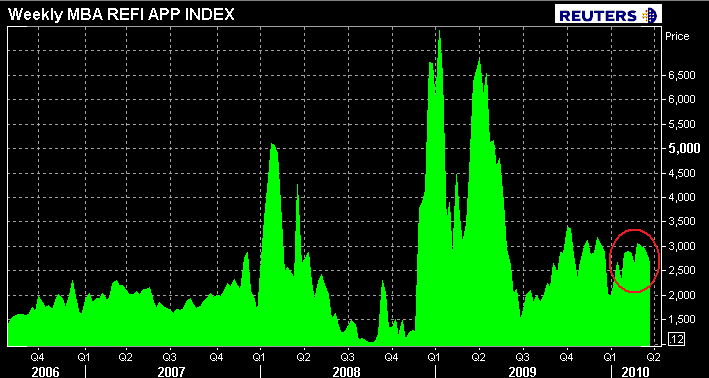

The Refinance Index decreased 1.3 percent form the previous week. The four week moving average is up 0.9 percent for the Refinance Index. The refinance share of mortgage activity decreased to 63.2 percent of total applications from 65.0 percent the previous week.

This is the lowest refinance share recorded in the survey since the week ending October 23, 2009.

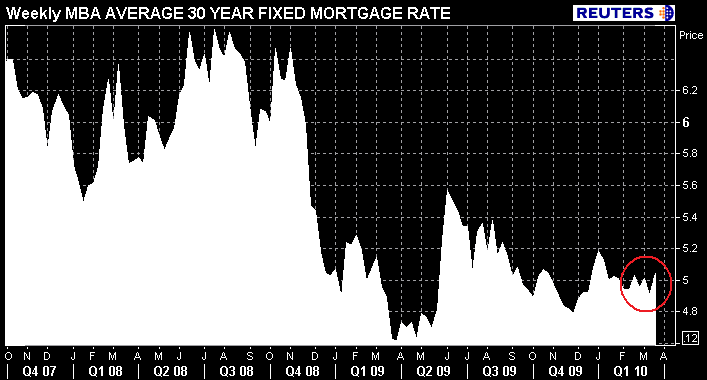

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.04 percent from 5.01 percent, with points increasing to 1.07 from 0.76 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective 30-year rate also increased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to 4.34 percent from 4.33 percent, with points increasing to 0.98 from 0.77 (including the origination fee) for 80 percent LTV loans. The effective 15-year rate also slightly increased from last week.

The average contract interest rate for one-year ARMs increased to 6.88 percent from 6.75 percent, with points decreasing to 0.31 from 0.32 (including the origination fee) for 80 percent LTV loans. The adjustable-rate mortgage (ARM) share of activity increased to 5.2

percent from 4.8 percent of total applications from the previous week.

Plain and Simple: the reality of a purchase driven housing market is setting in as the refinance index failed to make much progress in Q1 2010 even as mortgage rates held below 5.00% (for the most part). On the bright side, purchase loan demand is now picking up as the expiration of the home buyer tax credit draws closer and closer (April 30). This confirms reports I get from the street. My own mother, a real estate appraiser, went from being marginally busy to super swamped in a two week period, with a broad majority of her business coming from purchase applications. My dad, a consistently busy loan originator, has been spending more and more time educating interested first time homebuyers and pre-qualifying borrowers. Beyond that, in the past week alone I have received a considerable amount of comments from Realtors, Loan Originators, and Appraisers that corroborate my family's feedback. Furthermore, it is likely that home buyers are nervous about rising interest rates, this sentiment is probably providing a proverbial "kick in the butt" to prospective home buyers. The time to act is now!

Are you seeing an increase in purchase app demand too? Where are you doing business?

Applications are coming in....now we gotta get 'em qualified.