Back in December the Urban Institute (UI) put a number on the much maligned but somewhat amorphous term "tight credit." It maintained that, between 2009 and 2014, lenders failed to make about 5.2 million mortgages because of rigid underwriting standards. Another 1.1 million loans could have been processed in 2015 "if reasonable lending standards had been in place." That would bring the UI estimate of MIA mortgages to 6.3 million over a six-year period.

This week UI's Laurie Goodman, revisits the issue on the organization's Urban Wire blog. She says UI's Housing Credit Availability Index now stands at 5.1 percent, less than half of its level in 2001.

A large part of the problem in credit access is lending standards imposed by the lenders themselves that go beyond those required by Fannie Mae and Freddie Mac (the GSEs) or FHA, the entities that guarantee or insure the loans. As an example of these overlays, she says the FHA may be willing to underwrite a mortgage with a FICO credit score of 620, but the originator might require a score of 660.

Goodman cites three sources of risks and costs that cause originators to "knowingly drive away business." Representation and warrantees, litigation risk, and the high and uncertain costs of servicing delinquent loans cause lenders to fear that producing and servicing a less than pristine loan will cost them more than they earn originating it.

The GSE's and the Federal Housing Finance Agency (FHFA), their regulator, have moved to reassure lenders that they will be held responsible, under their representations and warrantees, only for errors in underwriting a loan, not for whether the borrower defaults on it. Over the last four years, Goodman says, the GSEs and FHFA have made it clear when lenders will be held responsible for defects, have defined what the penalty will be for different defect types, and have introduced an independent dispute resolution process to settle disagreements between themselves and the lenders. Most importantly, they moved the loan review process up to shortly after loan acquisition so lenders know right away if any defects have been identified. Fannie Mae's Day One Certainty program waives many reps and warrants at origination and both GSEs have addressed many of the servicing cost issues.

The FHA however, has not done as much. Goodman credits the agency with consolidating its 900 mortgagee letters, its main vehicle for communicating with lenders, into one consistent document, and with partially addressing the costs associated with servicing its loans. However, the key problems remain. Lenders continue to fear litigation under the False Claims Act which can impose triple damages for a loan with misstatements.

While the GSE's and their regulator have moved to give lenders the clarity and reassurance they needed, it is FHA which has historically insured borrowers with less than perfect credit because it does not do risk-based pricing while the GSEs do so through their loan level pricing adjustments. Therefore, it is FHA that holds much of the power to loosen credit.

In addition, borrowers with less than a 20 percent downpayment must buy insurance to obtain a loan through the GSEs while the FHA premium is imposed on all borrowers. But the private mortgage insurance required by Fannie and Freddie also varies in price according to the borrower's risk profile while the FHA insurance is based only on the loan amount.

Goodman says lenders prefer dealing with the GSEs because of the FHA threat of suits under the False Claims Act and because of the high costs of servicing FHA loans. But for most low-credit-score, small-down-payment borrowers, FHA rates are so much more favorable that it is the program of choice.

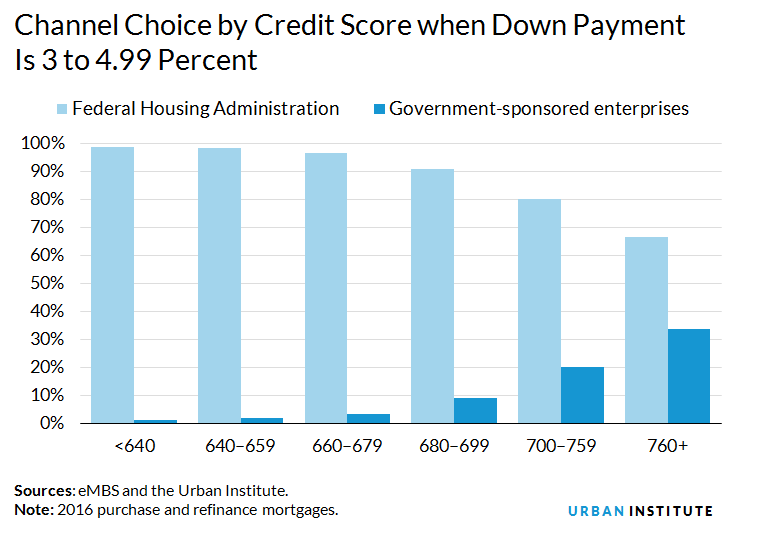

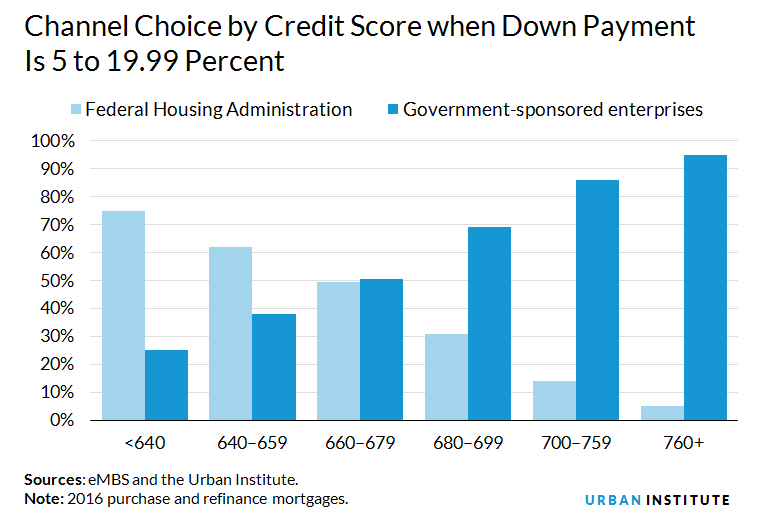

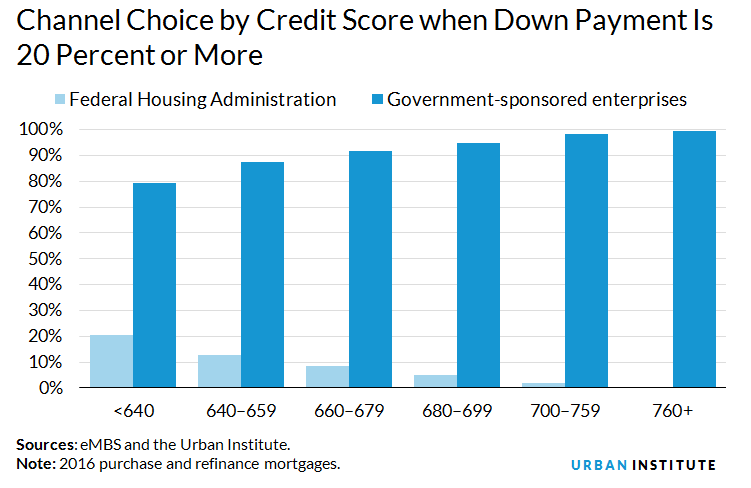

As these charts show, almost all borrowers with a down payment lower than 5 percent and a FICO score less than 700 go with the FHA, a preference that continues even as the FICO score rises above 700. For loans with a 5 to 19.99 percent down payment most borrowers with a FICO score below 660 go with the FHA, while most with a FICO score above 680 go with the GSEs. For any down payment at or over 20 percent. regardless of FICO score, the borrowers seek GSE execution, which is more cost effective because there are no PMI expenses, but the FHA still charges its insurance fee.

Goodman concludes that, "To further expand credit availability, the FHA must give lenders greater assurance that they are only liable for their own errors, not subsequent performance. It's up to the FHA now."