Despite the trauma of the last few years, most Americans still believe that owning a home is preferable to renting according to the latest quarterly National Housing Survey data released by Fannie Mae. Many of these respondents, however, do not act on this belief because they view homeownership as an investment or because of financial constraints or an inability to get a mortgage.

The Fannie Mae survey is conducted by telephone every month among a revolving panel of about 1,000 respondents consisting of renters, homeowners with mortgages, and homeowners without mortgages. A subset of homeowners with mortgages self-identify as being underwater with those mortgages. The panel is asked a number of questions about their attitudes toward homeownership, the economy, and their own personal financial situation. Each month the survey has a particularly focus and the current survey dealt with attitudes toward homeownership.

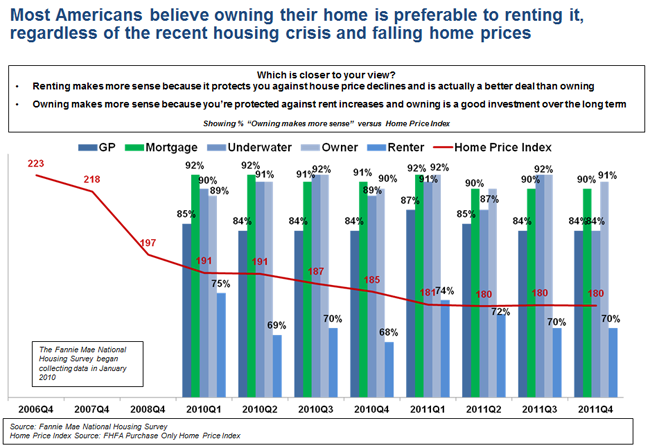

More than 90 percent of homeowners, whether mortgaged or owning outright, believe that homeownership is preferable to renting. Even homeowners who are underwater on their mortgages are proponents of owning rather than renting as are more than two-thirds of renters. These numbers have remained quite stable across the eight quarters Fannie Mae has conducted the survey even as housing prices have declined.

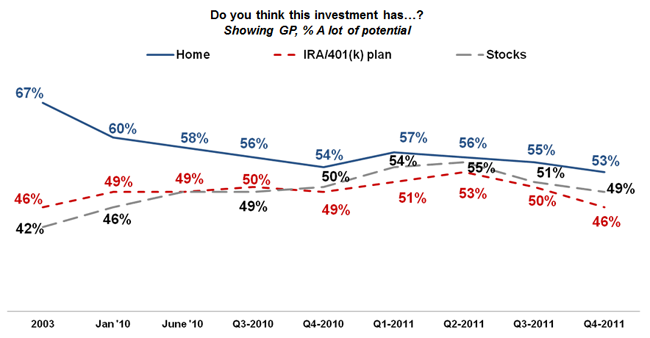

While a slight majority feel that homeownership has a high investment potential, fewer feel that it is a safe investment than did so a few years ago. Apart from the investment potential, respondents cited safety and the quality of local schools as the top reasons for buying homes. African-Americans and Hispanics were more likely to cite other benefits such as a way to build wealth, civic benefits, and a symbol of achievement as benefits of homeownership while lower income groups were more likely to cite the wealth building aspects of homeownership than were those making higher incomes. Sixty-four percent of renters said they would probably purchase a home at some point in time.

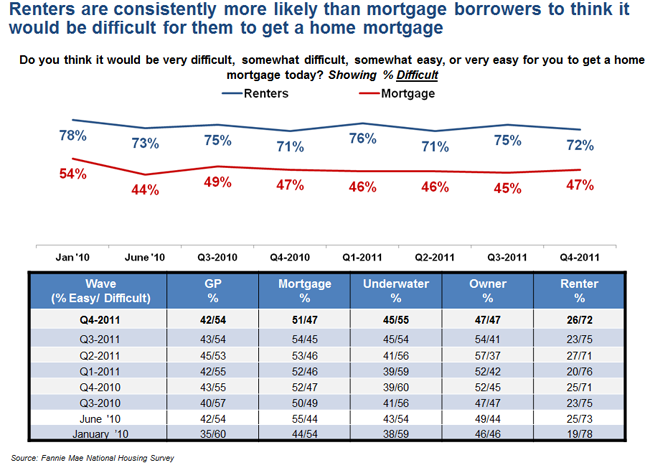

While the majority of respondents viewed homeownership as beneficial, financial constrains or an inability to secure a mortgage may keep many from purchasing. Many of those surveyed citied the difficulty of getting a mortgage as a reason they did not own a home including renters, those with lower levels of education and/or lower income, African-Americans and Hispanics. The latter two groups also said they were not confident that they were getting adequate information to select a loan.

"In spite of the impact of the housing crisis on home values and homeownership rates across the country, Americans by and large still hope to become homeowners," said Doug Duncan, vice president and chief economist of Fannie Mae. "Some may not be financially positioned to own a home in the near future, but Americans may begin to revisit that aspiration as employment and household balance sheets improve over the coming years."

"A point of concern for the industry is that some consumers find the mortgage shopping process difficult to navigate," Duncan continued. "If potential homeowners avoid the process because they believe it to be too complex, we will likely see a continued impact on homeownership rates."