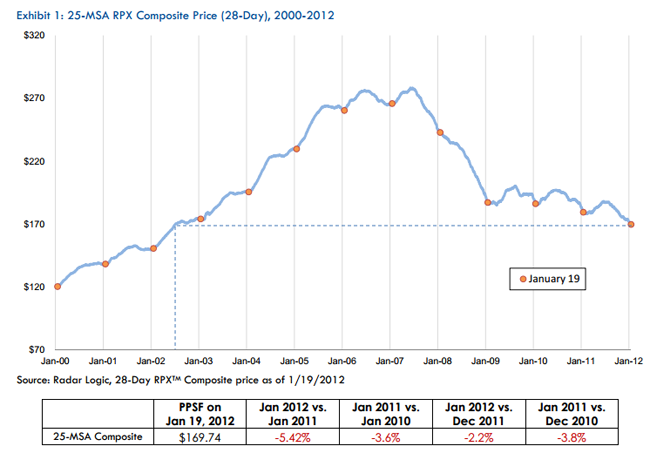

The rate of decline in housing prices has slowed recently according to the RPX Composite Index released today by RadarLogic, but the bottom for prices may still be a ways off. The RPX Composite price, which tracks 25 major metropolitan areas, declined to $169.75 per square foot in January, the lowest price for the Composite since July 2002.

The year-over-year rate of decline has been increasing since mid-2010 and reached the most rapid growth in several years in December 2011. The rate of decline then began to slow. On December 19 the rate was 7 percent and on January 19 it was 5.42 percent.

The decline from December to January was 2.2 percent, the lowest since 2007. RadarLogic discounted the seasonality of the decrease by pointing out the declines in January for the years 2008 to 2010 averaged 3.6 percent.

RadarLogic said that while the slowing rate of decline is promising it is still too early to say that prices are nearing the bottom. The company referenced a similar slowing in the rate of decline in 2009 only to see acceleration again in 2010.

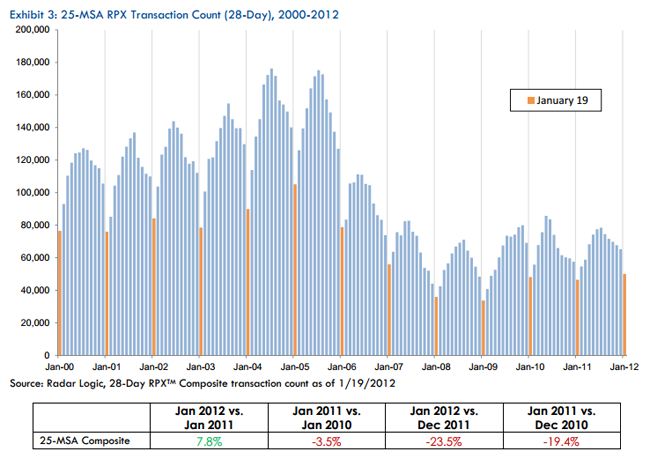

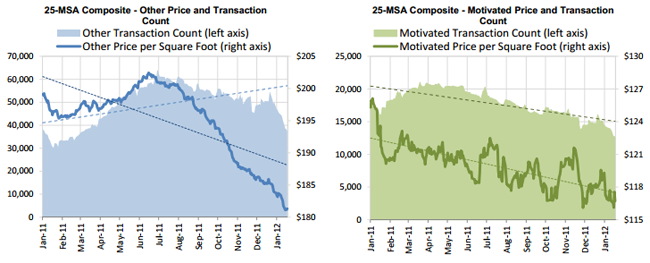

The RPX transaction count for the 25 metropolitan areas increased 7.7 percent year-over-year to the highest January level since 2007. The increase was driven by a 23.4 percent increase in non-distressed or "other" sales. At the same time the composite price for these sales dropped 7.7 percent which the company suggestions may indicate that sellers are dropping their prices to move the properties.

Motivated sales, defined as sales at foreclosure auction and liquidation sales by lenders declined by 21.8 percent year over year and those prices also declined.

On a monthly basis counts of "other" sales declined 25.9 percent while motivated sales were down 15 percent over the same period resulting in motivated sales comprising a larger percentage of total sales; the percentage increased from 22.6 percent in the month ending on December 19 to 25.1 percent for the following month. "This relative increase in motivated sales put downward pressure on the overall 25-MSA RPX Composite price, exacerbating its month-over-month decline."

RPX says that the existing home sales figures released this week and continued signs of weakness in mortgage application numbers suggest that the country has yet to find the "psychological" bottom in the housing market. "Until buyers, of whom we suspect there are many, believe the imbalance of supply and demand is correcting, they will continue to push prices down by bidding below asking prices. It would seem that home builders agree with this sentiment as starts and permits for single family homes are weak. Most new builder activity appears to be in apartment structures."