Natural disasters were the backdrop for mortgage loan performance in 2017. CoreLogic has previously reported on delinquencies in Houston and throughout Florida in the wake of Hurricanes Harvey and Irma and in Puerto Rico after Hurricane Maria. In the company's Loan Performance Report for December, Chief Economist Frank Nothaft said the West Coast was not immune from the impact of multiple disasters.

"The wildfires in Sonoma and Napa [California] counties began October 8 and destroyed or damaged thousands of homes," Nothaft said. "Two-and three-month delinquency rates have spiked in these two counties, more than doubling between October and December. The after effects of Hurricanes Harvey. Irma, and Maria continue to appear as well. Serious delinquency rates in the Houston and Miami metropolitan areas doubled between September and year-end and quadrupled in the San Juan area of Puerto Rico. "

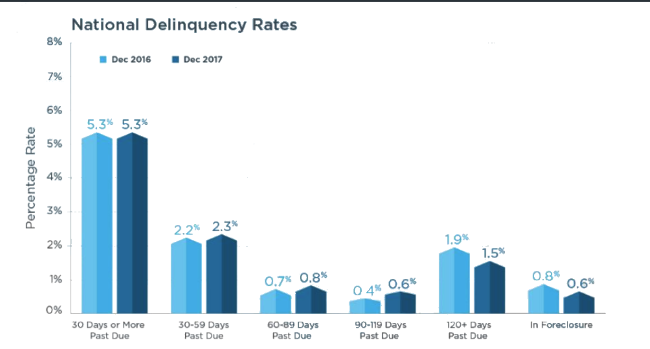

The disasters were felt in nationwide delinquency figures. After declining steadily for several years, the rate of mortgages that were 30 or more days past due, including those in foreclosure, did not budge from December 2016 to December 2017, remaining at 5.3 percent. CoreLogic president and CEO Frank Martell said, "These natural disasters have stalled or reversed the decline in the 30-to-119-day delinquency rates that we had seen previously."

The percentage of mortgages in some stage of foreclosure, that is the foreclosure inventory, did decline on an annual basis, dipping from 0.8 percent in December 2016 to 0.6 percent at the end of 2017.

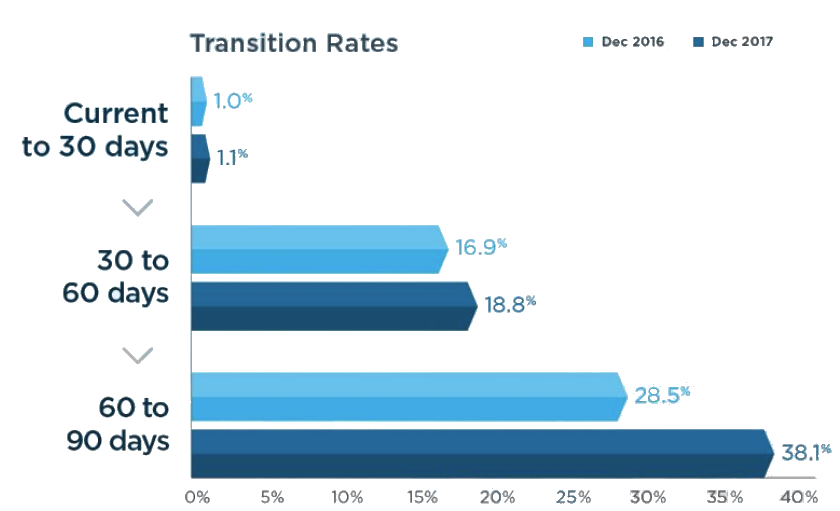

In addition to delinquency rates, CoreLogic also examines transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next. The share of mortgages that transitioned from current to 30-days past due was 1 percent in December 2017, unchanged from December 2016. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent and peaked in November 2008 at 2 percent. The 30-to-60-day transition rose nearly 2 percentage points from December 2016, to 18.8 percent. The transition from 60 to 90 days past due, a period that corresponded with nearly all the natural disasters, jumped nearly 10 points, to 38.1 percent.

Serious delinquencies, defined as 90 days or more past due including loans in foreclosure, declined in every state but Florida and Texas, where they increased, and Alaska and North Dakota where the rates were unchanged. The same situation prevailed in the Core Based Statistical Areas (CBSAs). Delinquencies increased in 33 areas, all in the aforementioned states, with the majority of them in Florida. The rate was unchanged in 11 CBSAs while the remainder saw their rates improve.