Fannie Mae made a few modest changes to its economic projections this month as consumer spending in January was above expectations and interest rates rose. The company's Economic and Strategic Research (ESR) Group expects the growth in GDP in 2021 to be 6.6 percent rather than its prior 6.7 percent forecast and upgrades 2022 to 3.0 percent from 2.8 percent. Compared to last month's forecast, they also expect a modestly stronger consumer recovery, but a more drawn-out expansion of government expenditures and a modestly slower pace of private investment spending.

A downside risk to the forecast is the possibility of a more resistant virus variant emerging, leaving the future path of the virus a near-term risk. The greatest uncertainty, however, is how fast social distancing restricted activities recover. If businesses and consumers are reluctant to resume pre-pandemic activities, the expected strong 2nd and 3rd quarter growth may not materialize. On the upside, household savings are extremely high; checking accounts alone held $3.2 trillion in Q4 2020, $2 trillion more than the pre-COVID baseline. If consumers spend down these balances as well as their stimulus check, consumer spending might be greater than Fannie Mae's robust projections.

The company does not think rising interest rates to date, are a major concern and modest additional increases would likely be a reflection of a healthy, recovering economy. They do, however, see that, if inflation expectations continue to accelerate that could lead to a greater rise in rates. While the absolute level is still modest, market-based measures of inflation expectations, such as the 5-year TIPS/Treasury spread, have moved up considerably in recent months, indicating growing investor apprehension over rising prices.

The economists call the rise in long term interest rates probably the most noteworthy development over the last month. The 10-year Treasury rate as they went to press was 1.63 percent, up from 1.09 percent at the start of February. The level remains modest, the 10-year Treasury rate averaged 2.32 percent from 2011 to 2019, but the increase was rapid. Even if inflation expectations remain subdued, with the forecast for nominal GDP growth, it is entirely plausible that the 10-year Treasury rate could reach the 2.5 to 3.0 percent range by the end of 2022.

They do not think the pace of increases will continue, however, and that rates will drift only modestly higher over the remainder of this year, and that the Fed will keep its accommodative policy until inflation clearly exceeds its 2.0-percent target for a substantial period.

The 30-year fixed mortgage rate will probably increase less rapidly than the 10-year Treasury note in the short-run. The roughly 55 basis point increase in the 10-year Treasury since the beginning of February, corresponded with about a 30-basis point increase in the mortgage rate. Over the past year, a surge in originations led lenders to build out operating capacity. Therefore, in the short run originators will probably absorb some of the increase in funding costs to maintain production volumes.

With a higher forecast for mortgage rates, Fannie Mae has modestly lowered its homes sales forecast for 2021 from a 6.9 increase from 2020 last month to a 6.2 percent, but stress that rates will not be the primary driver of the slowdown. Rather it will be due to waning timing effects of homebuyers' delaying or moving forward purchases due to COVID-19 and an extremely tight inventories limiting transactions. An ample number of homebuyers should be able to absorb modestly higher mortgage rates near term and so an upwardly drifting rate will have only a minimal impact on the sales. The downward revisions in the forecast for mortgage originations is more severe because refinancing activity is highly rate sensitive. Total originations in 2021 have been changed to $3.9 trillion from $4.1 trillion and the 2022 projections have been downgraded from $3.2 trillion to $2.9 trillion.

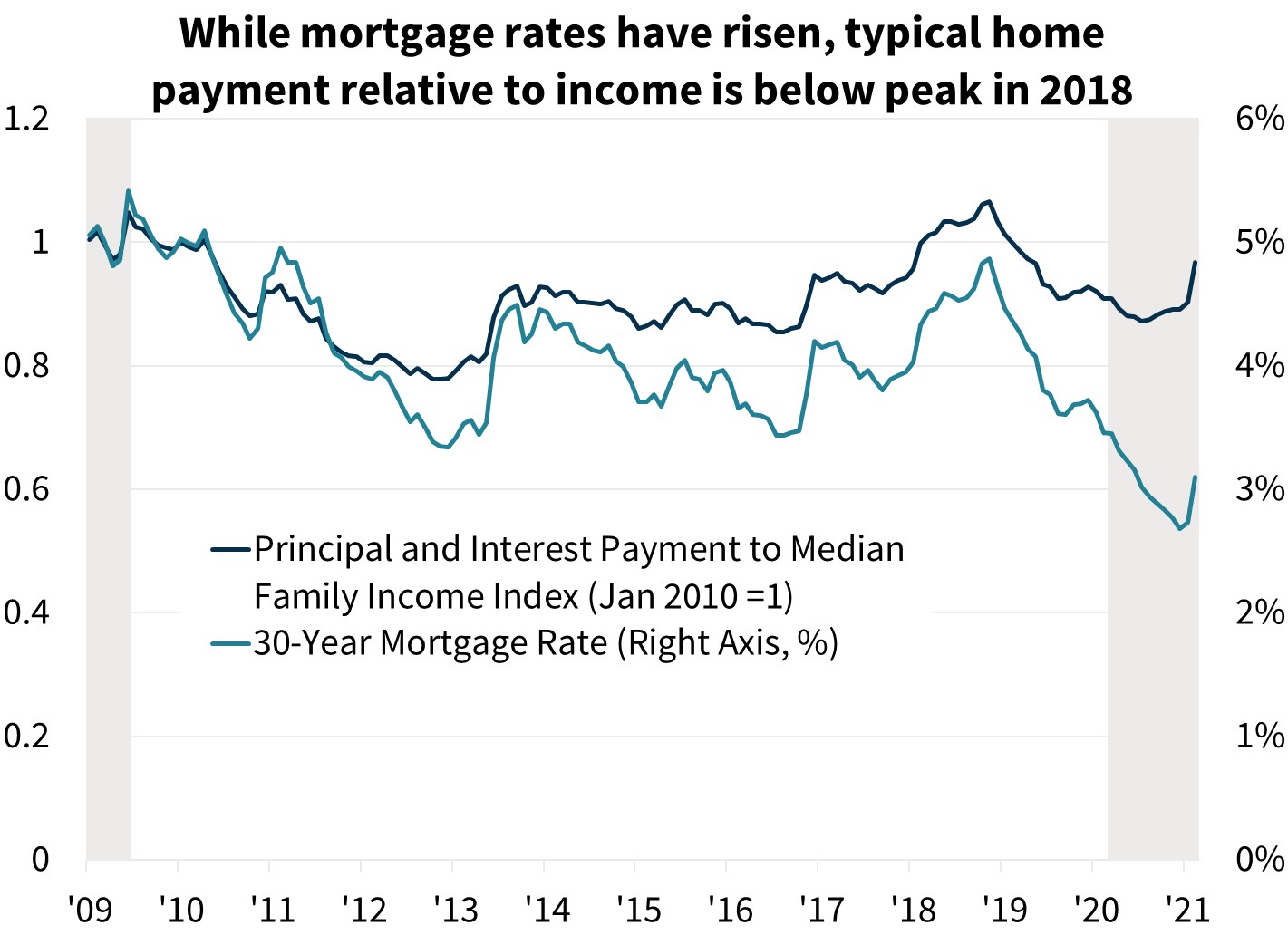

However, if rates move up more aggressively than the baseline forecast, the economists invite a comparison with 2018, the last time rates underwent a period of significant increases. The 30-year mortgage rate rose a little more than 100 basis points in a 14-month period. On a quarterly basis, total home sales fell by about 8 percent peak-to-trough, despite employment and incomes continuing to expand. If something similar were to occur over the next year, there are reasons to believe that the drag on sales would be considerably smaller.

First, "lock in" effect will be weaker. When rates hit 4.9 percent in late 2018, a seven year high, most potential repeat buyers had likely purchased homes or refinanced their notes at rates lower than the going market rate, creating a disincentive to move to a new home. In contrast, even if mortgage rates today rise to 4.0 percent that would still be a lower rate than prevailed over most of the past decade. Most homebuyers do not move within a year or two of purchasing or within a year of refinancing. Thus, the lock-in effect should be comparatively muted for the next couple of years if rates do not move beyond roughly 4 percent.

Second, rates are still historically low, keeping mortgage payments comparatively affordable relative to income and well below the 2018 peak even as home prices have rapidly appreciated. To reach the 2018 payment/income ratio today, the 30-year rate would have to be about 3.9 percent.

More homebuyers are likely able to absorb higher payments. Given the high savings rate, credit card balances that have been paid down by $118 billion over the past year, and stimulus payments, the potential buyer pool has lower back-end debt to income (DTI) ratios, stronger credit scores, and a greater ability to make larger down payments compared to 2018.

The current limited supply of homes for sale is likely holding back transactions with many potential buyers unable to find a suitable home or being outbid. Even if some buyers drop out of the market because of rising rates, there is probably an ample "reserve" of buyers to fill their place in the near-term. Appreciation will likely soften as bidding wars ease, but the effect on transactions would be limited. Additionally, homebuilders are currently struggling to keep up with demand, suggesting they would continue a brisk construction pace even if traffic cooled.

Taking these factors into account and with the future path of interest rates uncertain, one scenario employed by the ESR group was for mortgage rates (relative to the baseline) to rise an additional 50 basis points by the end of 2021 and 85 basis points by the end of 2022. With other relevant factors unchanged, this translates to a 30-year fixed mortgage rate of 3.7 percent and 4.3 percent, respectively, a range more typical of the pre-COVID period previously discussed.

This resulted in only a modest reduction in home sales relative to the baseline of about 1.0 to 2.0 percent in 2021. Declines in 2022 were somewhat larger at 4.0 to 5.0 percent (again relative to baseline), as some of the factors mentioned above diminish, but the softening is still modest compared to the past.

Consistent with this view that home sales will be only modestly affected by recent rate increases, the forecast for purchase mortgage origination volume is up 13 percent from 2020, to $1.8 trillion. This is driven by expectations for higher full-year home sales this year compared to last, as well as continued price appreciation. However, Fannie Mae has revised refinancing estimates down by 6 percent from its February forecast to a yearly volume of $2.1 trillion. Application activity suggests refinance volumes will stay elevated in the first half of 2021 before retreating over the second half as the mortgage rate is now projected to rise faster than previously thought. The forecast for 2022 refinance volume was also revised downward by about $240 billion to $1.1 trillion.

While higher rates led to a downward revision, even at the current 3.1 percent rate, Fannie Mae estimates that 48 percent of all outstanding mortgage balances have at least a half percentage point incentive to refinance. However, returning to the alternate scenario where the 30-year fixed rate is 3.7 percent by year-end 2021 and 4.3 percent by the end of 2022, refinance originations would probably fall by about 14 percent relative to the baseline forecast this year, and about 44 percent lower in 2022.