FHA's mortgage share, which surged following the housing crisis and helped shore up the market, is now in a steady decline. However, the loans written during that period of high volume may become, in a round-about way, good news for conventional mortgage refinancing.

Sam Khater, CoreLogic's Deputy Chief Economist, writes in the company's Insights blog that FHA's share of the purchase market skyrocketed from a low of 4 percent in February 2007 to a peak of 39 percent in November 2009. As private lenders fled, mortgage insurers collapsed, and the government sponsored enterprises Fannie Mae and Freddie Mac tightned lending standards, FHA became about the only option for low downpayment loans.

Since that 2009 peak the FHA's purchase market share has declined to 20 percent (as of last September). This is still 5 percentage points above its late 1990s average.

Khater said the recent rise in interest rates has focused a lot of attention on the negative impact on the refinancing market. But, there are reasons why borrowers might still want to refinance, even perhaps into a higher rate. One reason might be to cash out some of the equity accumulated in the 30 percent national increase in prices since the beginning of 2013. Another reason might be all of those FHA purchase loans taken at the height of the housing crisis.

Homebuyers who bought with FHA low-downpayment loans have also accumulated significant equity, perhaps enough that they now have now reached the critical 20 percent level. Yet, a policy change in 2013 means that they cannot dump their FHA insurance coverage and must keep paying an 85 to 135 basis point annual mortgage premium. This is a not-insignificant reason to refinance into a conventional loan.

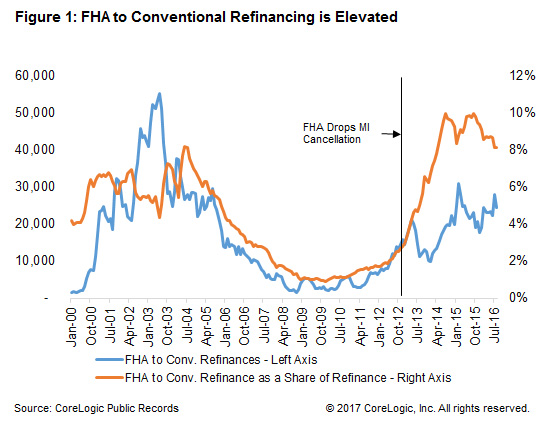

Khater says that is "exactly what in-the-money FHA borrowers are doing." They are taking their equity and using it to refinance into 80 percent or less loan-to-value conventional mortgages. In the first eight months of 2016, FHA to conventional refinances accounted for roughly 8 percent of all refinances or about 20,000 loans per month. Contrast this to 2010, when the rate was less than 1 percent or less than 4,000 loans per month.

CoreLogic is currently forecasting home prices to rise by 5 percent in 2017. Given that 2.9 million borrowers took out an FHA purchase mortgage after January 2013, there could be a steady flow of borrowers looking to refinance from FHA into a Fannie Mae or Freddie Mac loan - perhaps as many as 250,000 in 2017.