A lot has been written over the past few weeks about the Millennial generation and what it is and is not doing in the housing market. CoreLogic recently completed a two-part series of articles on the role of these younger buyers (generally under age 35) and their role as first time buyers and the National Association of Realtors just published results of its 2016 Home Buyer and Seller Generational Trends survey. Finally, Freddie Mac is speculating that misinformation was yet another factor keeping first-time homebuyers, the majority of which should at this point be Millennials, away from the housing market.

Freddie Mac vice president Danny Gardner says that given current housing market conditions "Millennials and other new households should be camping out at open houses." He cites record low interest rates, growing stability of housing markets, and that the millennial generation and growing immigrant communities are expected to produce about 1.2 million new households in each of the next ten years. Yet first-time homebuyers made up only 32 percent of primary home buyers last year compared to an average of 40 percent in the years before the housing crisis.

What, he asks, will he take to get this first-timers into the market? His answer is information. The industry has to "drive a stake through a few stubborn myths that are draining life out of the market." Myths that lead potential buyers to overestimate the credit, income, and downpayment savings they need for an affordable mortgage.

He talked about a radio call-in show he recently listened to where listeners didn't know about low downpayment options, the flexibility of underwriting standards when buying in an underserved market, or that gifts and grants can be used to supplement downpayment savings.

He concluded that there is a need to get myth-dispelling information into the hands of families who don't know how ready they are to buy their first homes and to get this same information to families who gave up trying after being rejected for a mortgage once.

To assist real estate agents Freddie Mac has launched an online Real Estate Professionals Resource Center with facts to help them inform their customers about downpayments and affordable mortgages. The company is also teaming up with non-profit organizations that are critical for reaching potential Hispanic and African American Buyers, and starting a special blog series on its website to assist homebuyers in finding, bidding, buying, and closing on their first home.

But Millennials are finally beginning to buy. NAR's survey found that, for the third straight year Millennials comprised the largest group of recent buyers - 35 percent of all buyers compared to 32 percent in 2014. It also found that the generation is beginning to follow the pattern of earlier groups, moving to the suburbs and buying single family homes. Between the 2015 and 2016 surveys the share of millennials buying in an urban or central city area decreased from 21 percent to 17 percent and the share of those buying in a multi-unit building dropped by five percentage points to 10 percent.

Lawrence Yun, NAR chief economist, says while millennials may choose to live in an urban area as renters, the survey reveals that most aren't staying once they're ready to buy. "The median age of a millennial homebuyer is 30 years old, which typically is the time in life where one settles down to marry and raise a family," he said. "Even if an urban setting is where they'd like to buy their first home, the need for more space at an affordable price is for the most part pushing their search further out."

Bret Fortenberry, a CoreLogic analyst, wrote in the company's Insights blog that the huge millennial cohort is a key marketing target. Now that they are finally beginning to buy it is important to understand their buying behavior in order to tap into that market.

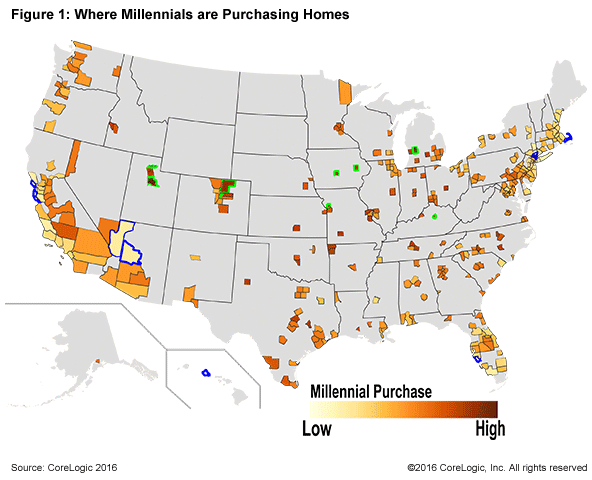

The company looked at more than 70 metrics associated with purchase mortgage taken by millennials nationwide over the previous year. They found that members of the group are buying in markets they can afford; specifically, where home prices are low and good paying jobs exist. This overwhelmingly turns out to be in the middle of the country where affordability is higher than along the coasts. The amount that millennials make is not as much a factor in their choices as is the affordability of the housing market, likely because of limited equity for a down payment.

CoreLogic ranked all counties with a population greater than 200,000 to determine the percentage of millennial mortgage applications. The top ten counties (indicated on the map in green) were Utah and Weber counties in Utah; Denver and Weld in Colorado; Polk and Linn in Iowa; Clay and St. Louis counties, Missouri; Kent, Michigan, and Fayette, Kentucky. These counties have a higher mean millennial income level compared to counties with comparable housing markets. Additionally, the top ten counties contain mortgages in which the borrower has a higher front-end ratio, which highlights affordability as the driving factor for millennials. At the bottom for Millennial purchases (indicated in blue) were two Arizona counties, three in California, two in New York and one each in Florida, Massachusetts and Hawaii.

Fortenberry says one might anticipate the top markets would have a higher rent-to-mortgage cost but indeed the ratio was similar in both the top and bottom counties. Again this suggests that the initial entry cost of homeownership is determinant rather than the ongoing one. "Many millennials face the challenge of having low to no credit or not having the down payment to qualify for the loan." He also echoes Gardner, "It is also probable that many millennials do not even apply for loans because of a false perception that they will not qualify. "

CoreLogic also found that millennials are more likely to purchase a home when they move away from home to an area with a higher concentration of other millennials. This is driven by job opportunities and colleges with nearby job opportunities that allow graduates to remain in the area following school. There is also a propensity to purchase in counties that neighbor larger cities and may have more affordable housing than the cities themselves.

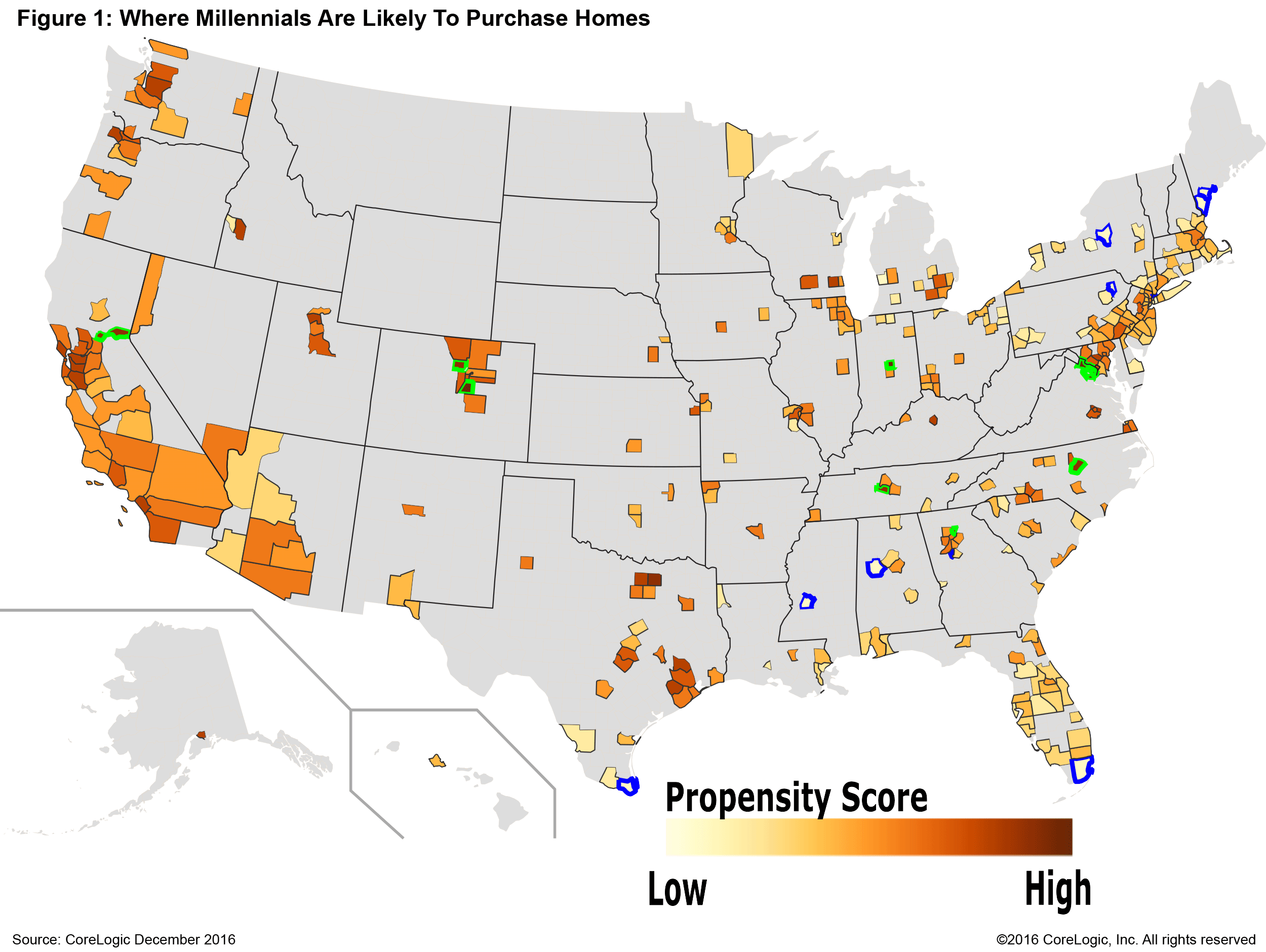

A second CoreLogic article by Fortenberry speculates about where Millennials may be buying in the future. According to CoreLogic analysis, millennials are most likely to buy homes in metropolitan areas with an improving economy; those with a lower unemployment rate, lower foreclosures/delinquency rates and a higher year-over-year GDP increase are the most attractive to this younger demographic.

Using a proprietary model CoreLogic applied a score rating the likelihood an individual would obtain a new purchase mortgage within six months and applied this Propensity to Purchase score to all homes with a household member in the millennial age range. The propensity is evenly distributed across the U.S. with a few exceptions. Fifty percent of the top markets are in Colorado and Virginia and a majority of the bottom ten markets is in northeast and southeast regions.

CoreLogic see a future shift from cheaper areas that border improving counties to the heart of the improving counties in which the housing market is more expensive. "It is possible that this shift is already happening, but we are not seeing the corresponding numbers because of a reduced number of millennials who can afford to purchase homes that are more expensive. It could be the case that there are more millennials with the desire to purchase a home in unaffordable areas than in affordable areas. This suggests the highest demand among millennials is for cheaper housing in counties with improving economies. If this is true then we will begin to see an increased gentrification effect in more affordable neighborhoods within counties that are typically more expensive. Most likely, this gentrification trend will have a "hipster" subculture contributed (sic) to the millennial generation."