The majority of the large bank holding companies in the country have successfully completed the latest round of bank stress tests conducted by the Federal Reserve. The tests, formally known as the Comprehensive Capital Analysis and Review (CCAR), evaluates the capital planning processes and capital adequacy of the large bank holding companies, 19 of which participated, and includes a supervisory stress test that looks at capital levels in a hypothetical stress scenario to determine if the banks would be able to continue to lend to households and businesses.

Fifteen of the 19 bank holding companies "passed" the stress test although none failed completely. The banks that fell short on some measures were Citi, Ally, MetLife (although not technically a bank), and SunTrust.

The scenario presumes a peak unemployment rate of 13 percent, a 50 percent drop in equity prices, and a 21 percent decline in housing prices. The capital plans rule stipulates that the firms must demonstrate their ability to maintain tier 1 common ratios above 5 percent. Further, the minimum levels for firms to be considered adequately capitalized are 4 percent for the tier 1 ratio, 8 percent for the total capital ratio, and 3 or 4 percent for the tier 1 leverage ratio, depending on whether the institution is subject to the market risk capital charge.

Under these conditions the 19 companies are estimated to sustain $534 billion in losses during the nine-quarters the scenario is presumed to be in place. The aggregate tier 1 common capital ratio, which compares high quality capital to risk-weighted assets, falls from 10.1 percent in the third quarter of 2011 to 5.3 percent in the fourth quarter to 2013 in the hypothetical stress scenario. The aggregate Tier 1 common capital ratio falls from 10.1 percent in the third quarter of 2011 to 6.3 percent in the hypothetical fourth quarter of 2013. That number incorporates the firms' proposals for planned capital actions such as dividends, share issuance and buybacks.

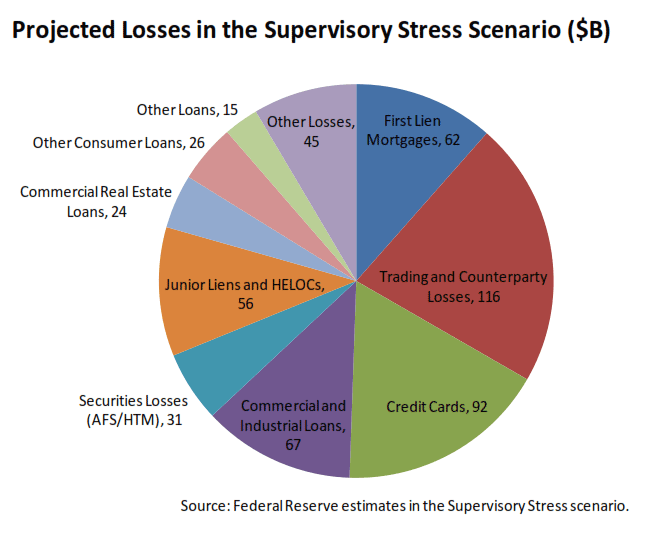

The losses include $341 billion in accrual loan portfolio losses, $31 billion in OTTI and other realized securities losses, $116 billion in trading and counterparty losses at the six banks with large trading portfolios, and $45 billion in additional losses from items such as loans measured under the fair value option (losses on these loans were calculated based on the global financial market shock) and goodwill impairment charges.

Sixty-nine percent of projected loan losses and 44 percent of total projected losses for the 19 banks come from consumer-related lending including residential mortgages, credit cards, and other consumer loans. This is consistent with both the share of these types of loans in the 19 holding company portfolios (55 percent as of Q3 2011) and with the assumptions of the Stress Scenario, i.e. high unemployment and declining home prices.

Losses on residential mortgage loans, senior and

junior liens, are the single largest category at $118 billion, 35 percent of

projected losses. Credit card lending is

next at $92 billion or 25 percent.

Commercial and industrial loans are projected as the third largest

contributor of losses at $67 billion.

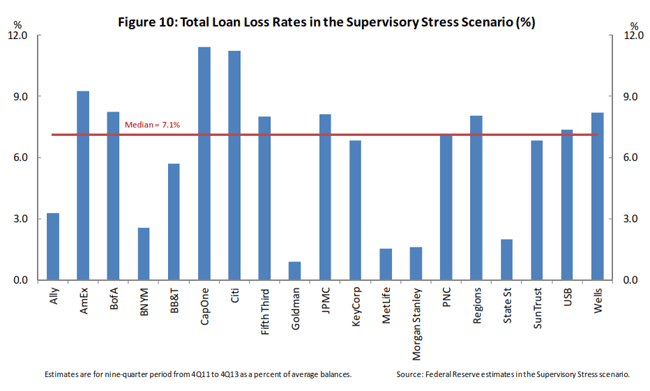

For the 19 bank holding companies as a group the cumulative loss rate on the accrual loan portfolio is 8.1 percent across the nine quarters. This is more severe than in any U.S. recession since the 1930s, but losses vary significantly across banks, from a low of 0.9 percent (Goldman-Sacs) to 11.4 percent (CapOne), largely reflecting the composition of their portfolios and differences in risk characteristics for each type of lending across these firms.

There were also significant differences among loan types and across loan types for each bank holding company. Nine-quarter loss rates range from a low of 2.5 percent on other loans to 17.2 percent on credit cards reflecting both differences in typical performance of these loans and differences in the sensitivity of lending to the assumptions of the Stress Scenario. Those lending categories sensitive to employment rates or housing prices may experience loss rates due to the stress assumed for those factors in the Scenario.

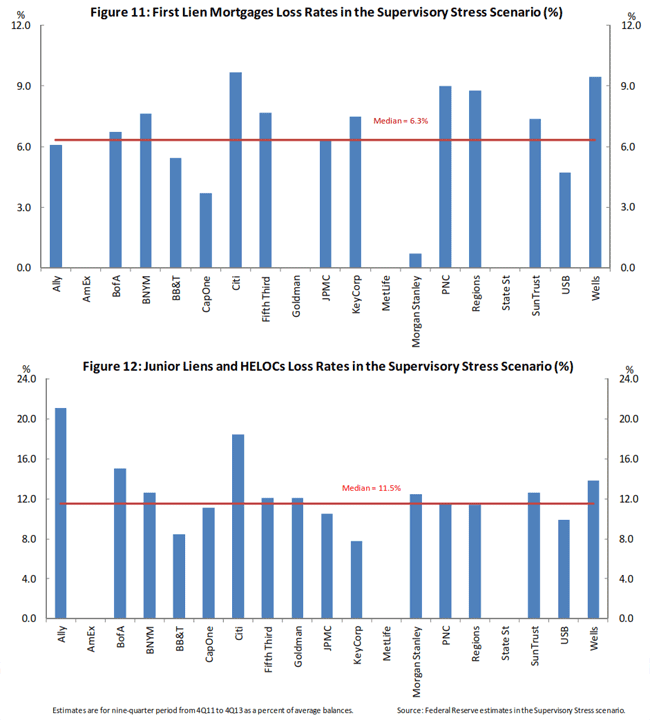

The losses on first mortgage portfolios ranged from less than 1 percent (Morgan Stanley) to about 10 percent (Citi) with a median loss of 6.3 percent. The projected losses for junior liens and HELOCs ranged from about 8 percent (Key Corporation) to over 20 percent (Ally) with a median loss of 11.5 percent.

Median loses for other types of loans were: commercial and industrial, 7 percent; commercial real estate, 5.5 percent; credit cards, 15.5; other consumer loans, 3.6 percent; and other loans, 2.4 percent.

Despite the large hypothetical declines, the post-stress capital level in the test exceeds the actual aggregate tier 1 common ratio for the 19 firms prior to the government stress tests conducted in the midst of the financial crisis in early 2009, and reflects a significant increase in capital during the past three years. In fact, despite the significant projected capital declines, 15 of the 19 bank holding companies were estimated to maintain capital ratios above all four of the regulatory minimum levels under the hypothetical stress scenario, even after considering the proposed capital actions, such as dividend increases or share buybacks.

The Federal Reserve notes that strong capital levels are critical to ensuring that banking organizations have the ability to lend and to continue to meet their financial obligations and that U.S. firms have built up their capital levels considerably since the government stress tests in 2009. The 19 bank holding companies that participated in those tests and in the 2011 and 2012 CCAR have increased their tier 1 common capital levels to $759 billion in the fourth quarter of 2011 from $420 billion in the first quarter of 2009. The tier 1 common ratio for these firms, which compares high-quality capital to risk-weighted assets, has increased to a weighted average of 10.4 percent from 5.4 percent.

These increases have come, in part, because of the lower distributions of bank holding companies to their investors. The Federal Reserve had insisted that the firms reduce or eliminated dividends during the banking crisis to maintain safety and soundness but allowed those with well-developed capital plans and positions to increase distributions following the first CCAR in 2011. The 19 institutions paid out 15 percent of net income in common dividends in 2011 compared with a payout of 38 percent of net income in 2006. They also raised more in common equity than they repurchased in 2011.

As news of the results began to leak late Tuesday (the report came out two days ahead of schedule), financial sector stocks began to soar with many of the stocks of the 19 holding companies finishing up 4 to 6 percent.