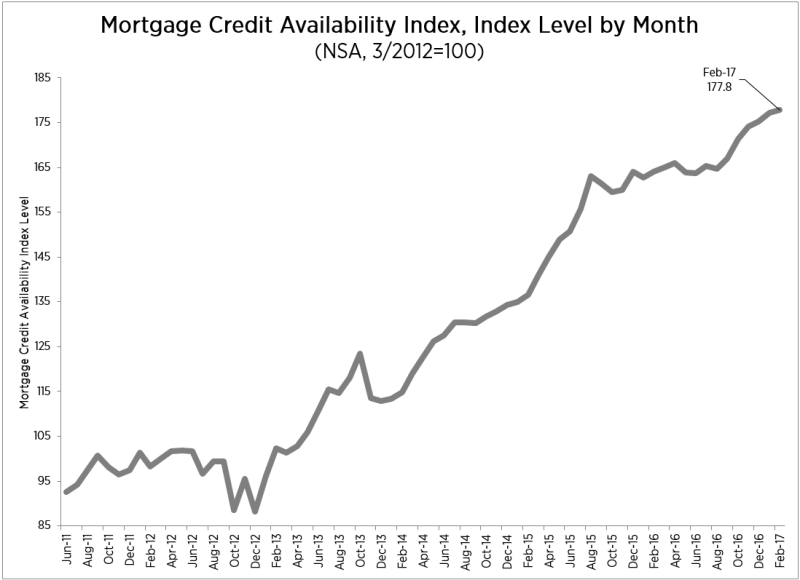

There was a slight loosening of mortgage credit access in February, as FHA and VA instituted more streamlined documentation requirements for their loans. Access also improved as more investors offered affordable low downpayment mortgages. The Mortgage Bankers Association (MBA) said its Mortgage Credit Availability Index (MCAI) ticked up by 0.4 percent compared to January and now stands at 177.8. A decline in the MCAI indicates a tightening of credit standards, an increase signifies a loosening.

The increased offerings and FHA/VA underwriting changes resulted in an increase of 2.3 percent in the Government MCAI and a slight uptick of 0.1 percent in the Conforming MCAI. However, Lynn Fisher MBA's Vice President of Research and Economics, noted the impacts of those increases on the overall index was partially offset by the first downturn in the availability of jumbo credit in a year due to the consolidation of some large loan programs. The Conventional MCAI was down 2.2 percent and the Jumbo lost 4.4 percent.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available from a proprietary Ellie Mae's product. Base period and values for the total and the Conforming indices is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.