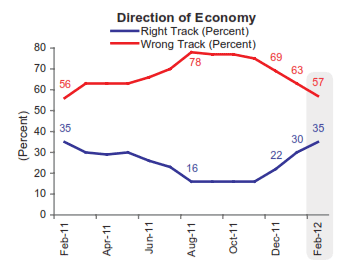

Consumer attitudes about the economy have risen considerably over the past few months while their confidence in their own financial situations have stabilized according to Fannie Mae's February National Housing Survey. Thirty-five percent of Americans now feel that the economy is on the right track, up 6 points since January and 19 points since November, while 57 percent say it is on the wrong track, a 6 percent drop in a month and 18 points since November.

Respondents' confidence about their own household income and expenses as well as attitudes about homeownership and renting are holding at steady levels. The numbers of people who are not concerned about losing their job over the next year has risen from 70 percent in November to 76 percent in February.

"The pickup in the pace of hiring over the past few months has helped soothe consumer concerns, lifting their moods regarding their personal finances, the direction of the economy, and their views on the housing market," said Doug Duncan, vice president and chief economist of Fannie Mae. "As a result, we've seen more potential for economic upside, creating a more balanced near-term outlook."

Fannie Mae polls a panel of 1003 Americans, both renters and homeowners, by telephone every month to assess their attitudes toward owning and renting a home, mortgage rates, homeownership distress, the economy, household finances, and overall consumer confidence. The panel is a rolling one with respondents completing more than one survey over their tenure on the panel.

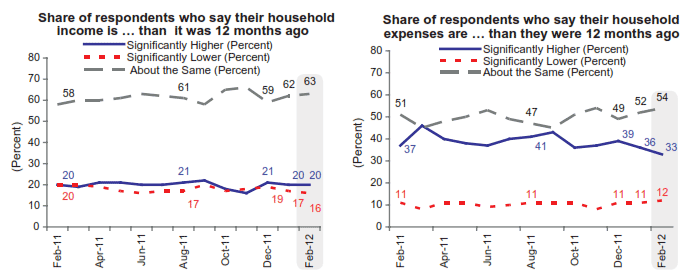

Twelve percent of those surveyed expected their personal financial situation to worsen over the next 12 months compared to 15 percent in January and the lowest number in over a year. Sixteen percent say their income is lower than a year ago, down one percentage point in a month, while 63 percent report no change, an increase of one point.

Thirty-three percent say their expenses have increased significantly over the past 12 months, a 3 percentage point decrease from last month and the lowest level in the past 12 months while 54 percent reported little or no change, up from 52 percent.

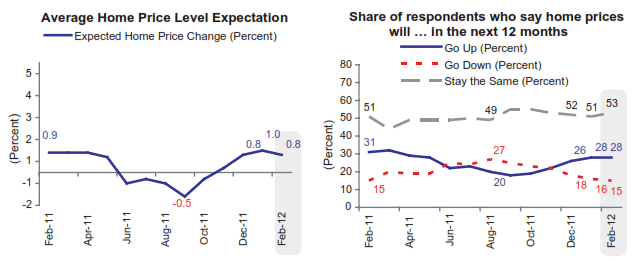

When it comes to attitudes about homeownership and renting the majority of Americans feel prices home prices have stabilized and that it is a good time to buy. Further home price losses are expected by only 15 percent of respondents, down one point from January while 53 percent expect that prices will not change over the next year and 28 percent are looking for higher prices. Expectations about house prices over the next year average out to a 0.8 percent increase compared to a 1.0 percent increase last month.

Asked whether it is a good time to buy a home 70 percent responded that it was (down 1 percentage point) while the respondents who thought it is a good time to sell increased from 10 percent to 13 percent.

Fifty percent of Americans feel that mortgage rates will remain unchanged over the next year while 34 percent expect an increase. Each of these metrics was down 1 percentage point while the numbers of respondents looking for further rate increases rose from 8 to 10 percent.

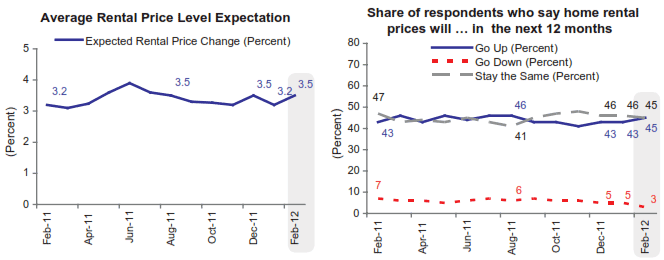

Expectations about rentals were nearly evenly divided with 45 percent expecting rents to rise and the same percent looking for little or no change. Only a few respondents expected rent decreases. On average respondents expect home rental prices to increase by 3.5 percent over the next year, a slight increase since January.