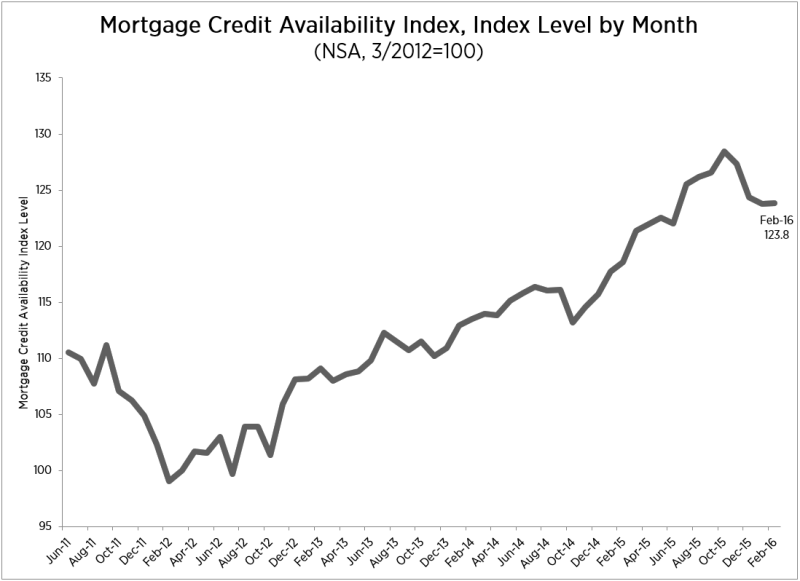

Any loosening of credit access in February was offset by tightening by other programs the Mortgage Bankers Association (MBA) said on Thursday. Consequently the Association's Mortgage Credit Availability Index (MCAI) remained the same as in January, 123.8. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

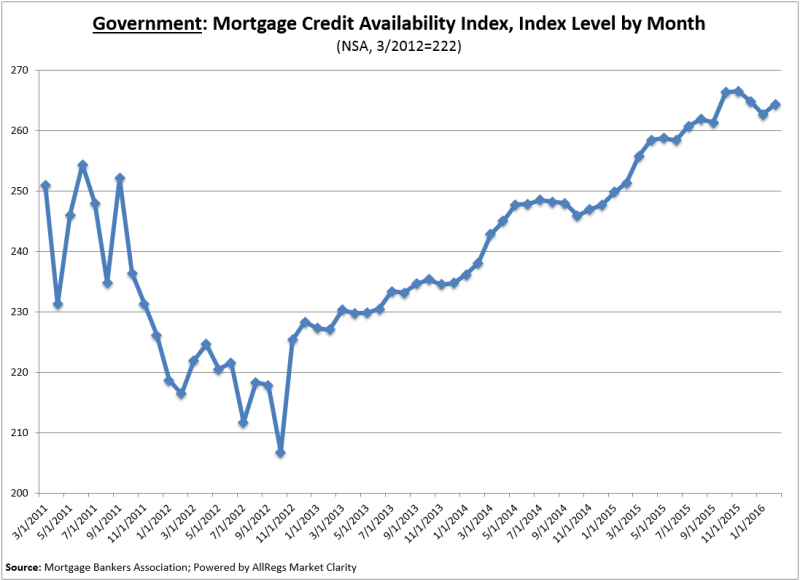

"Credit availability was flat over the month. Slight declines in conventional programs aimed at low-to-moderate income borrowers were offset by increasing availability of government-backed programs," said Lynn Fisher, MBA Vice President of Research and Economics. "More than half of the investors in our credit availability data set are now offering some form of a conventional low down payment loan program which is targeted at lower income borrowers and first time home buyers and generally allows a down payment as low as 3 percent."

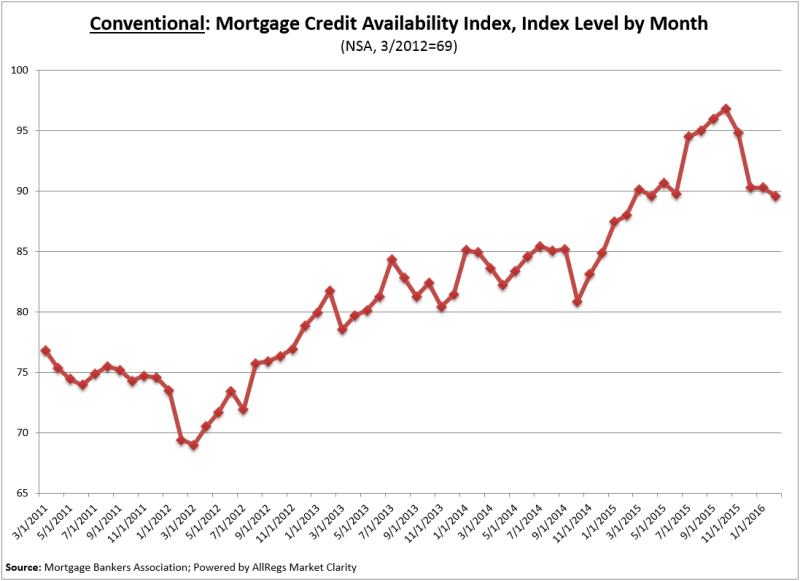

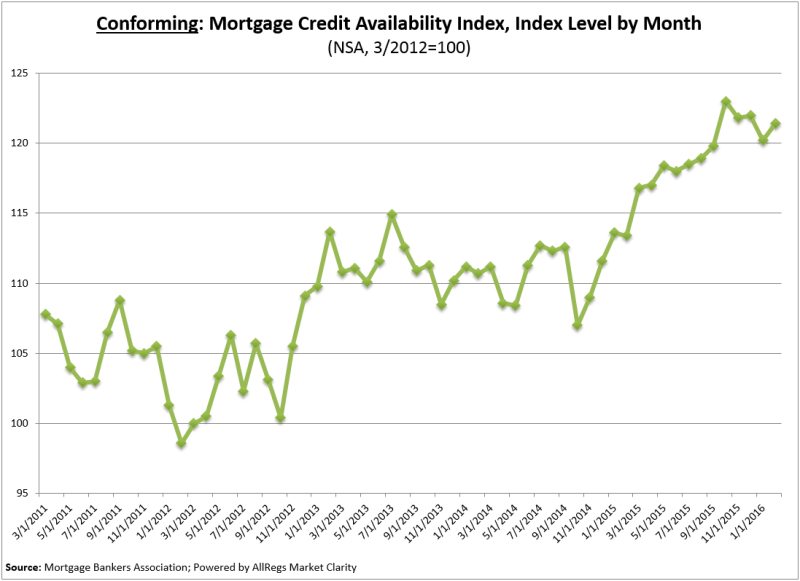

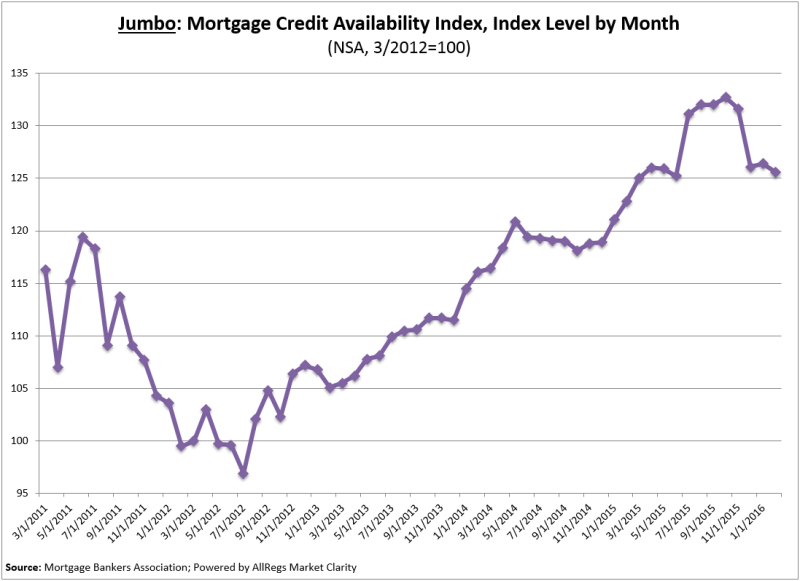

The MCAI, which was benchmarked at 100 I March 2012, consists of four component indices. The Conforming component saw the greatest loosening (up 1.0 percent) over the month followed by the Government MCAI (up 0.6 percent). The Jumbo MCAI decreased 0.6 percent, while the Conventional MCAI decreased 0.8 percent over the month.

The MBA constructs the MCAI using data related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined with data made available via Ellie Mae's AllRegs® Market Clarity® product. The Conforming and Jumbo indices have the same "base levels" as the Total MCAI (March 2012=100). The base period and values for the Conventional component is March 31, 2012=69 and for the Government Index March 31, 2012=222.