Freddie Mac's economists see low interest rates continuing, at least through the end of next year. The company's Economic and Strategic Research Group's February Forecast, released on Thursday, also sees more economic growth, albeit at a slower rate, and a bounce back in the housing market.

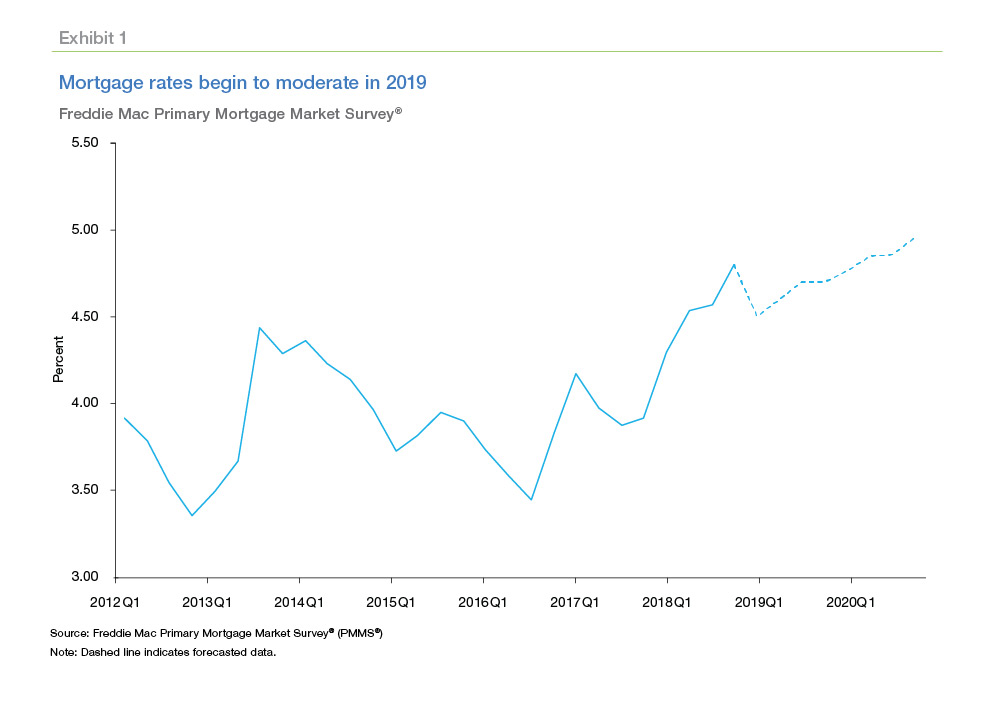

The 30-year fixed-rate mortgage (FRM) averaged 4.6 percent over 2018. After peaking last fall mortgage rates began to decline and by mid-February were at a 12-month low of 4.4 percent. Freddie Mac's economists expect the 30-year FRM to average 4.6 percent in 2019 before increasing to 4.9 percent in 2020.

Housing starts averaged a 1.26 million rate in 2018. The forecast is for total starts to increase over the next two years with both single-family and multifamily units gaining each year. Total starts will grow to 1.29 million units this year and 1.36 million units in 2020. This is still well below what is needed to meet long-term demand, and a lack of labor and other factors will continue to hamper construction.

Those lower mortgage rates should stoke lagging home sales, estimated to finish 2018 at 5.97 million. The report predicts an increase in total sales to 6.10 million units this year and 6.12 million next year, with the growth coming from existing home sales. New home sales will remain at current levels.

In addition to lower rates the housing market will be helped by home prices; their growth has finally begun to decelerate. The growth rate of the Freddie Mac House Price Index fell slightly to 0.7 percent in the fourth quarter of 2018 and was 4.7 percent for the year. The forecast is for appreciation of 4.1 percent and 2.8 percent in 2019 and 2020, respectively. This moderation in house price growth along with an increase in household income will help bring house prices back in line with long-term fundamentals.

Mortgage originations are expected to increase 2.6 percent to $1.69 trillion in 2019 and remain around that level in 2020. With mortgage rates sliding back to lower levels, Freddie Mac has revised its predictions for the refinance share of originations to 27 percent and 24 percent in 2019 and 2020, respectively.

The economists note that the U.S. labor market has continued to hold strong despite uncertainty in other areas of the economy. Job openings are still increasing faster than hiring. Moreover, the number of employees that quit at the end of 2018 has increased, which indicates confidence in the labor market. After reaching its highest level in a year and a half at 253,000 at the end of January, jobless claims eased to 239,000 in the second week of February, mainly due to the end of the partial government shutdown. The unemployment rate is expected to drop slightly to 3.6 percent in 2019 before returning to a more sustainable long-term rate of 3.9 percent in 2020.