Freddie Mac's Insight forecast for February looks at reports that consumer price inflation is rising, and the ensuing debate over "whether or not we are shifting from a world of low consumer price inflation to one of moderate inflation." The company's Economic and Housing Research Group says rising inflation would have a significant impact on housing markets by driving up mortgage interest rates.

They look at the arguments regarding reflation in the form of three scenarios illustrating higher inflation, lower inflation, and stable inflation and include a qualitative assessment of the probability each might occur and how the housing markets would respond.

In a sidebar separate from the Insight piece they describe the two primary ways of measuring inflation. The one familiar to most people because the media covers it is the Consumer Price Index (CPI), the second is the Personal Consumption Expenditures Chain-type Price Index (PCE) which is tracked by the Federal Reserve. Each measures the changes in the price of a basket of goods and services but they differ as to the types of goods and services (CPI captures only direct spending by households; PCE also includes expenditures made on behalf of consumers of employers and government), the formulas used to compute the index, and the weights assigned to the goods and services.

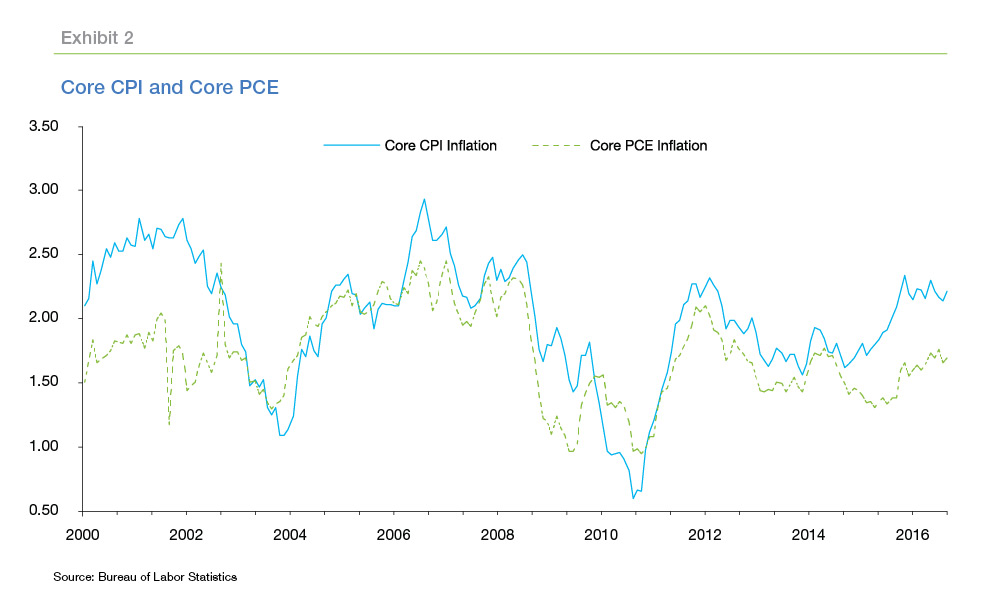

The PCE's chained approach allows substitution of goods - for example a shift in buying shoes, from more expensive to less expensive ones - to capture the changing nature of household spending where the CPI basket is fixed, the weighting of goods is updated biannually. Both CPI and PCI are buffeted by volatile changes of food and energy prices. To smooth volatility each has a "core" inflation measure which excludes those two components. There is a persistent gap between core CPI and core PCE inflation, but most of the difference can be explained by the different weights assigned to the components of each.

The Fed had long made a 2 percent core inflation rate as one of its parameters for raising interest rates, and it was the core PCE it was waiting for. Core CPI has been rising at above two percent on a year-over-year basis since late 2015 while core PCE has not been above two percent since 2012. The reason for the gap is almost exclusively shelter.

Shelter has been rising well above general inflation for the past 4 years at an average year over year rate of 2.75 percent. If things continue as they have, we might expect to see CPI inflation remain above two percent while PCE remains below two percent. Freddie Mac says a persistent shortfall of housing supply relative to demand could keep the pressure on shelter prices and maintain the wedge between CPI and PCE for an extended period, which would have important implications for how Fed policy may evolve over the next two years, and all that it implies for the future of the housing and mortgage markets.

Low consumer price inflation has helped to keep long-term interest rates low. Over the past few years, forecasts for rising inflation and interest rates have been off the mark and the persistence of both at low levels have led some economists to question whether this has become permanent in our modern economy.

Inflation remains low even with national unemployment at 4.8 percent, generally considered the natural rate, i.e. the level of unemployment consistent with stable inflation, and despite the continuation of the Fed's Open Market Committee's (FOMC's) monetary accommodation and qualitative easing instituted during the Great Recession. These factors all would traditionally lead to higher inflation but, until the end of the third quarter of 2016, it remained low. Then it recent months it has stirred. What has changed?

Per Freddie Mac, the shift in the inflation outlook is partially due to the recent presidential election. While few details of emerging fiscal policy are known, most analysts expect some combination of lower taxes and increased spending on defense and infrastructure, financed primarily by larger deficits. The expected new trade policy with higher import tariffs and renegotiation of existing trade deals could also contribute to higher inflation through higher import prices, some of the impact of which could be mitigated by a stronger dollar, immigration reform, deficit spending, and near-full employment.

Rising inflation and expectations for it could prompt the FOMC to increase short-term rates which could, in anticipation, push up long-term rates as well. Thus, the outlook for interest rates and housing depends critically on whether inflation increases or if the notion it will is "overwrought."

Freddie Mac sees three possible tracks; inflation could head materially higher, retrench from its initial reaction to the election and drift back toward the lows of recent years, or it is possible the recent reactions have already priced in future events. In that case, inflation and interest rates will stay about where they are.

Higher inflation would mean that the reactions to the presidential election did not adequately price in the future. Expansionary fiscal policies could exceed what has been projected both in magnitude and speed. A large tax cut and a major infrastructure bill passed in the early part of 2017 could surprise the markets and stoke more inflation. If they ignite increased confidence and economic growth they could move it even more.

Freddie says inflation expectations could come unmoored. Rates surged immediately after the election, and remained higher than a year ago, and inflation expectations have been on the rise. The Federal Reserve Bank of New York's Survey of Consumer Expectations has reached its highest level since mid-2015; increased expectations can be a self -fulfilling prophecy.

Under this scenario, inflation increases more than a full percentage point from where it is today and passes one-for-one into higher long-term interest rates. The 30-year fixed rate mortgage (FRM) rises above 5.5 percent by the end of the year to the highest level since 2008. Higher income growth would only partially offset higher mortgage rates.

This will have a dramatic negative impact on housing and mortgage markets. Home sales decline significantly and mortgage originations fall by more than $800 billion from 2016 levels to less than $1.2 trillion in 2017.

Freddie Mac does not see this dramatic outcome as likely. Expansionary fiscal policy is unlikely to move quickly through Congress and even if a major bill is passed, most of the impact is would probably take effect in 2018 or later. Although inflation expectations have ticked up, they remain contained and the Federal Reserve would probably respond quickly to signs of a faster increase.

The second scenario sees reflation possibilities as overplayed. The president is not all-powerful, he does need Congress to approve any major fiscal policy changes, and divisions within the majority party could delay any such legislation. Rather than shifting into higher growth and inflation, the economy could persist in middling growth and low inflation and the reinflation trade could unwind. Interest rates could drift back down to pre-election levels with the 30-year FRM falling back below 4 percent.

Housing and mortgage markets would perform well under this scenario. Dropping rates would spur home sales and increase affordability in the face of rising home prices. Refinance activity would again be higher than expected as happened in 2015 and 2016 with only a modest decline. Total mortgage originations could top $2 trillion in 2017.

The economists also view the likelihood of inflation retrenching as low. A shift toward higher inflation expectations has started to show up in actual numbers such as the January CPI which moved up to 2.5 percent year-over-year and they do expect inflation to be in the above two percent range for 2017.

The final scenario, a more-or-less static situation with major changes already "baked in" is seen as the most likely one. There could be some fiscal stimulus and modest increases in inflation this year and next but financial markets have already anticipated this, so interest rates won't move much over the next two years.

Under this scenario, FOMC will raise rates two or three times in 2017 but long-term rates have already anticipated short term increases and would will move less than short term as the yield curve flattens. Housing takes a small step back with sales down about 3 percent from 2016 levels. Home prices will continue to rise but at a slower pace and construction, which is already short of demand, will be only slightly impacted.

Mortgage activity however will be hurt. The slowdown in home sales will be offset by higher prices so purchase mortgage volume will increase slightly. Refinancing however will fall 53 percent this year. Total mortgage originations will retreat from over $2.1 trillion in 2016 to $1.5 trillion this year.

Freddie Mac says this scenario is consistent with their current projections. Inflationary pressures are building but they expect increases to be gradual; there will be some expansionary fiscal policy implemented, but most of the impact will be felt after this year.

Housing market fundamentals are strong so there should be only a modest setback in 2017 and higher wages will bolster demand despite rising mortgage rates. Once the shock of higher rates is absorbed, housing markets should rebound in 2018 and mortgage activity will shift to purchase originations with the lowest share of refinancing since the 1980s.

In summary, Freddie Mac sees the risks to higher inflation outweighing lower inflation on balance, but also thinks most of the reflationary factors have been incorporated into current interest rates and they as well as inflation are likely to increase only modestly over the next two years.