The Federal Reserve today reported on their weekly purchases of agency mortgage-backed securities (MBS).

In the week ending February 24, 2010, the Federal Reserve purchased a total of $17.3 billion agency MBS. In those five trading days the Federal Reserve sold $6.3 billion (supported the roll market) for a net total of $11.0 billion MBS purchases.

The goal of the Federal Reserve's agency MBS program is to provide support to mortgage and housing markets and to foster improved conditions in financial markets more generally. Only fixed-rate agency MBS securities guaranteed by Fannie Mae, Freddie Mac and Ginnie Mae are eligible assets for the program. The program includes, but is not limited to, 30-year, 20-year and 15-year securities of these issuers. (NY Fed MBS FAQs)

Since the inception of the program in January 2009, the Fed has spent $1.21 trillion in the agency MBS market, or 96.5 percent of the allocated $1.25 trillion, which is scheduled to run out in March 2010. This leaves $44.1 billion left to purchase MBS coupons in the TBA market.

Of the net $11.00 billion purchases made in the week ending February 24, 2010:

- $7.8 billion was used to buy 30 year 4.5 MBS coupons. 70.9 percent of total weekly purchases

- $2.4 billion was used to buy 30 year 5.0 MBS coupons. 21.8 percent of total weekly purchases

- $800 million was used to buy 15 year 4.5 MBS coupons. 7.3 percent of total weekly purchases

39.1 percent of the mortgage-backs purchased were Fannie Mae MBS, 48.6 percent were Freddie Mac coupons, and 12.3 percent were Ginnie Mae. 92.7 percent of purchases were 30 year MBS coupons.

The Fed's daily purchase average during the trading week was $2.2 billion per day. This is less than the previous reporting period daily average, however the previous period was only a four day trading week. Overall, net purchases were the same.

If the Fed were to evenly disperse the remaining $44.1 billion over the next 5 weeks, they would average $1.76 billion purchases per day or $8.82 billion per week.

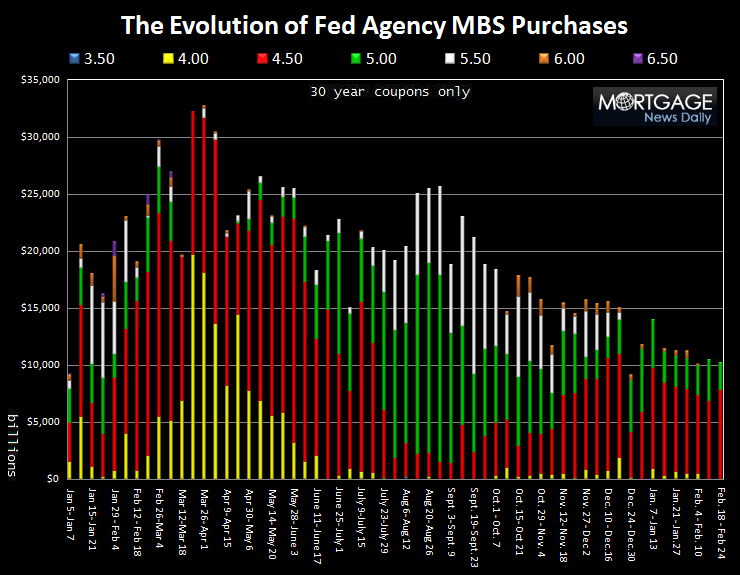

Below is a chart illustrating the evolution of the Federal Reserve's Agency MBS Purchase Program. Notice over the past few months the Fed has reduced their purchases and used remaining funds to offset new loan production supply, 4.50 (RED) and 5.00 (GREEN) MBS coupons specifically, which has helped keep mortgage rates low relative to benchmark Treasury yields. Overall, weekly purchases continue to decline, yet mortgage valuations remain stable at extremely rich levels.

Up until now the gradual reduction in the Fed's weekly purchases has been counter balanced by a slowdown in new loan production. However, going forward, if the amount of funding left to spend is spread out equally over the next 5 weeks, it will not be enough to offset new loan production supply from originators (about $2 billion per day).

This implies we should soon start to see yield spreads widen against benchmark Treasuries.

Currently, the secondary market current coupon (essentially the MBS yield lenders use to derive par mortgage rates after servicing and guarantee fees) is 4.331%. The 10 year Treasury note yield is 3.649%.

Yield Spread Calculation: 4.331% - 3.649% = 68.2 basis points

When the Federal Reserve does exit the agency MBS market, we estimate the secondary market current coupon yield spread will widen to 100 basis points. This would put the MBS yield lenders use to derive par mortgage rates at 4.649%.

If the 10 year Treasury note touches 4.00% and the current coupon yield spread widens to 100 basis points, the MBS yield lenders would use to derive the par mortgage rate would be 5.00%. This is the base yield used to set mortgage rates. If 10 year Treasury yields do touch 4.00% in the months ahead, we expect the average par 30 year fixed mortgage rate to approach 5.50%