Standard and Poor's released the Case-Shiller Home Price Index this morning.

The S&P/Case-Shiller Home Price Indices are constructed to accurately track the price path of typical single-family homes located in each metropolitan area provided. Each index combines matched price pairs for thousands of individual houses from the available universe of arms-length single family homes sales data. The indices have a base value of 100 in January 2000; thus, for example, a current index value of 150 translates to a 50% appreciation rate since January 2000 for a typical home located within the subject market.

NOVEMBER S&P/CASE-SHILLER HOME PRICE INDEX

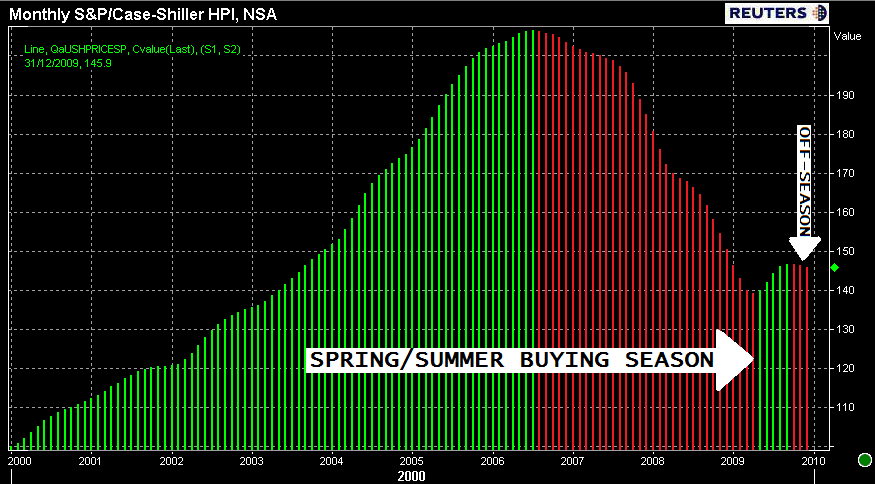

In last month's release, which reported on home price changes in November, both the 20 city index and 10 city index fell 0.2% on a month over month seasonally unadjusted basis. Year over year, home prices were down 4.5% while the 10 city index fell 5.3%. Seasonal influences were again obvious in last month's release. On an adjusted basis both the 10 city and 20 city were up 0.2% in November. Fall and Winter is a slow time of the year for housing, generally home prices have less support during this time of year.

DECEMBER S&P/CASE-SHILLER HOME PRICE INDEX

20-CITY CONSENSUS ESTIMATE: +0.0% Month over month. -3.2% Year over Year

SEASONALLY UNADJUSTED (how the data is presented): In raw, unadjusted form, home prices in 20 U.S. cities fell 0.2% in Decemeber. Home prices are down 3.1% since last December. The month over month print was slightly worse than expected, the YoY was marginally better than anticipated but not far from forecasts.

In the chart below, the effects of seasonal demand had a clear effect on home prices... as did government housing initiatives.

SEASONALLY ADJUSTED:

When adjusting the data for seasonal factors, which is how most economic data is published, home prices in 20 cities rose 0.3% in December. The table below summarizes.

On a seasonally adjusted basis, 15 cities grew or stayed the same in December. On a non-seasonally adjusted basis, 5 cities improved or stayed the same.

Comments from David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s:

“As measured by prices, the housing market is definitely in better shape than it was this time last year, as the pace of deterioration has stabilized for now. However, the rate of improvement seen during the summer of 2009 has not been sustained,”

“In the most recent months we are seeing fewer and fewer MSAs reporting monthly gains in prices. Only four cities saw month to month improvements in December over November, when you look at the raw data.

"We are in a seasonally slow period for home prices, however, so it is not surprising to see better statistics in the seasonally-adjusted data, where 14 of the markets and the two monthly composites all rose in December."

Housing is going through a seasonally slow time, so unadjusted price declines are not necessarily setting off alarm bells. What does increase skepticism about the health of housing is the fact that home buyer demand has really failed to react to outlooks for rising interest rates and the soon to expire home buyer tax credit (which might be extended again).

Here is some content on threats to the health of housing and home prices:

The Fed's Exit from the Agency MBS market. READ MORE

The Perception that the Worst Case Economic Scenario has been Avoided. READ MORE

The Future of the GSEs. READ MORE

The Timing of Bank Evictions and Shadow Inventory Accumulation. READ MORE

Consumer Credit Needs Time for Repair. READ MORE

The Long Term Sucess of HAMP and the Labor Market. 57.4% of permanent loan mods were given to borrowers who are out of work or underemployed. They better get jobs! READ MORE