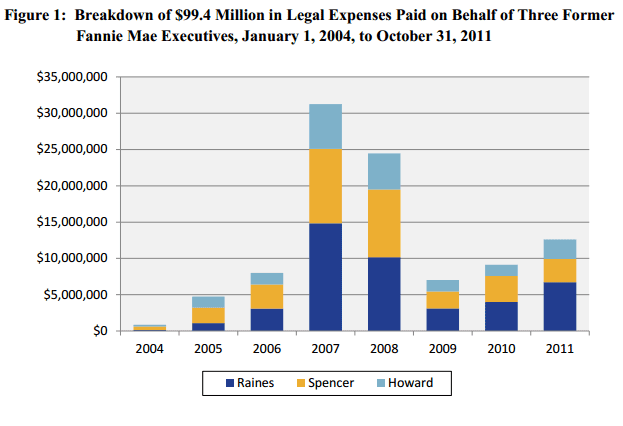

Both before and after they were placed into conservatorship the two government sponsored enterprises Fannie Mae and Freddie Mac (the Enterprises) spent large amounts of money to defend themselves and former senior executives in class action lawsuits and other legal matters. For example, in cases arising out of alleged accounting malpractices in the 2004 to 2006 period, Fannie Mae has advanced $99.4 million for the legal defense of three of its former senior executives. Furthermore, $37 million of those funds have been advanced since the conservatorship began and hence were taxpayer funds and Freddie Mac has paid $10.2 million in legal defense costs for former senior executives since it was placed in conservatorship. In both post-conservator instances the Federal Housing Finance Administration (FHFA), the Enterprises' conservator, has approved the expenditures.

The legal fees are mandated by indemnification agreements which were part of the former executives' employment compensation packages. Under these agreements the Enterprises are obligated to pay all liabilities and expenses of their officers and directors including legal expenses that are incurred during their employment provided the officers were acting within the scope of their authority. As this can only be determined after the proceedings have ended the legal fees are only advances and are subject to requests for repayment. In the case of such large advances, however, it improbable that repayment could or would be made.

FHFA has defended its approval of advances on several grounds.

- Paying defense costs reduces the likelihood of a successful claim against the Enterprises that would have to be borne by taxpayers.

- The protection provided by the indemnification agreements and FHFA's adherence to them is a valuable tool for recruiting new personnel and keeping existing staff.

- These indemnification agreements have been written so as to contractually obligate the Enterprises and, in the case of the three Fannie Mae officers who settled the cases that led to the lawsuits, they did so without admissions of guilt or findings of liability so are entitled to receive the advances of legal fees until a finding that their conduct disqualifies them.

The FHFA Office of Inspector General (OIG) recently evaluated FHFA's oversight of these payments. FHFA, the OIG said, confronts a challenging balance of interests. It wants to avoid potential losses by defending ongoing lawsuits against the Enterprises while at the same time controlling costs. OIG said that while the agency available tools are limited, it can and should do more to limit and control legal expenses.

FHFA was authorized to reject or repudiate contracts within a reasonable period, but made the determination at the inception of the conservatorship not to do so and has not revisited the decision. With the passage of time this option may no longer be available and might subject the agency to additional costs if former officers brought suit challenging such repudiation.

FHFA may possess the ability to limit future indemnification agreements by capping total or specific payments at pre-determined amounts, using preferred providers who agree to limit costs, pre-approving payments, electing to settle FHFA enforcement proceedings only if the officer or director admits to liability, and modifying future indemnification agreements to permit denying indemnification in situations that fall short of final court adjudications.

Obviously none of these proscriptive solutions affect on-going litigation. However, on June 20, 2011, FHFA issued a final rule that provides that claims by shareholders will receive the lowest priority in a receivership behind administrative expenses of the receiver or an immediately preceding conservator, other general or senior liability of the regulated entity, and obligations subordinated to those of general creditors. It also provides that FHFA will not pay securities litigation claims against a regulated entity during conservatorship unless the FHFA Director determines it to be in the best interest of the conservatorship.

FHFA unsuccessfully invoked this regulation in a pending class action suit against Fannie Mae in the District of Colombia and the decision is being litigated. If the regulation survives, it would mean that should the plaintiffs obtain judgment, in any reorganization including receivership that judgment would be subordinated to all other claims by other creditors. This is especially significant as it is unlikely that the Enterprises will ever earn enough to repay current debts including the $183 billion owed to the Treasury, let alone future obligations.

"Accordingly, if the Enterprises are unable to make any payments with respect to legacy securities claims, there would appear to be little value in having them continue to participate in ongoing litigation."

As was stated above, however, this cannot be a definitive answer until the legal challenges involving the regulation are settled and the regulation itself does not necessarily absolve the Enterprises of the obligation to provide indemnification.

The Enterprises have adopted various cost containment measures relative to the current litigation and OIG said that these have resulted in cost savings but FHFA has not independently evaluated them. FHFA-OIG believes that, given the significant amounts of taxpayer money involved and the issue's high visibility, FHFA must continue to scrutinize intensively the Enterprises' advances in order to limit costs.