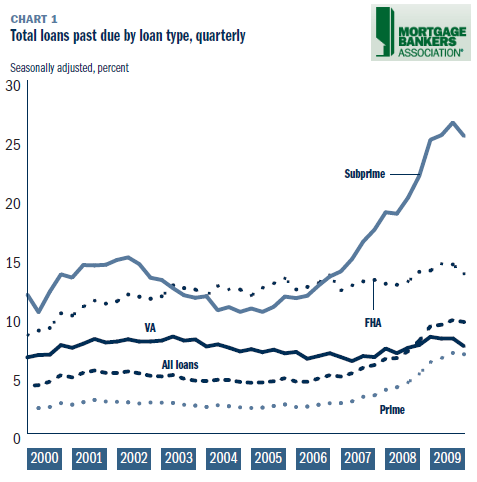

The Mortgage Bankers Association released the National Delinquency Survey for Q4 2009 today. Total mortgage delinquency rates, seasonally adjusted, were down 17 basis points during the fourth quarter, but up year-over-year by 159 basis points.

9.47 percent of all mortgages on one- to four-family homes are now in some state of delinquency.

While that was the headline on the press release accompanying the results of the Mortgage Bankers Association's National Delinquency Survey, the real news was the 16 basis point drop in new delinquencies recorded during the 4th quarter.

In a telephone press conference accompanying release of the survey this morning, Jay Brinkmann, MBA's chief economist said that delinquencies in the 30 day plus "bucket" traditionally represent the largest category of troubled loans as many people have short term problems, quickly recover and bring their loans current.

In the present scenario, that is not the case. The number of loans 90+ days in arrears is now the largest category of delinquency and growing, the MBA believes the drop in new delinquencies may be a sign "we are beginning to work our way out of the problem."

The timing of this drop, Brinkman pointed out, is especially significant as the fourth quarter usually sees an increase in the 30+ bucket because of seasonal factors such as the holiday season and the arrival of the first heating bills. Only a few times since MBA has been keeping records has there been a 3rd to 4th quarter decline "and never as large as this one." The 4th quarter number follows a 22 point decline in the 3rd quarter. This was also a drop of 22 basis points from 4th quarter 2008 figures.

Loans in the 60+ day bucket were down 4 basis points, the second consecutive quarter that category had shrunk.

Long term delinquencies were 71 basis points higher than in the 3rd quarter and 209 basis points higher than the year before and now represent 30 percent of all loans.

The drop in the 30 day bucket was consistent across all loans as was the growth in longer term arrearages. The latter, Brinkmann said, is paired with a drop in foreclosure starts as many loans in the 90+ bucket are in some type of modification program such as HAMP. Concrete figures are not available, he said, but it is clear that borrowers are staying in that bucket longer than has historically happened. Not only are loans not moving as quickly into foreclosure status because of these programs, but some people are probably also working their way out of delinquency but haven't quite gotten current.

He pointed to a nearly identical parallel between new and continued delinquencies and employment figures. Persons who have been out of work for more than 6 months represent 41 percent of all unemployed while new unemployment claims have been steadily dropping - they are now down about a third since their peak in March 2009. Long term and short term mortgage delinquencies have exactly mirrored this pattern.

“The pattern of mortgage delinquencies now very much follows the pattern of unemployment. Just as short-term delinquencies have fallen during the latter part of 2009, first-time claims for unemployment insurance have declined by about a third since their peak in March 2009. Just as long-term delinquencies now dominate total mortgage delinquencies, long-term unemployment now dominates the total unemployment number. People who have been unemployed for six months or more now constitute over 40 percent of the total unemployed, the highest share in the history of the unemployment survey. In addition, over the last several months we have seen a large number of people simply drop out of the work force, many who are discouraged about being able to find work. Until the issue of this large segment of long-term unemployed is resolved, many of the longer-term mortgage delinquencies will remain a problem with a strong likelihood of turning into foreclosures,” Brinkmann said.

Only a few states are really driving delinquency and foreclosure statistics. Nevada continues to have the highest overall delinquency rates at 14.92 percent followed by Mississippi (14.69 percent) and Georgia (13.53 percent). Leading in foreclosure inventory are Florida (13.44 percent), Nevada (9.76) percent, and Arizona (6.07 Percent.) The highest rates of foreclosure starts are found in Nevada (3.04 percent), Florida (2.41 percent) and Arizona (2.18 percent.)

Brinkmann was asked to comment on the possible effect of President Obama's newly announced program to pump $1.5 billion into housing agencies in five states, California, Arizona, Nevada, Florida, and Michigan to fund programs for people who are unemployed or underwater with their mortgages. He said he had not had a chance to study the program but that the current problems are not structural mortgage problems, they are employment related. READ MORE

Subprime adjustable rate mortgages had a 90+ day delinquency rate compared to 16.10 in the third quarter and 11.60 percent one year earlier. Subprime fixed rate mortgages increased from 11.30 percent in the third quarter to 13.04 percent. One year earlier that 90 day rate was 7.43 percent. Prime ARM mortgages had a delinquency rate of 7.84 percent compared to 6.63 percent the previous quarter and 4.74 one year earlier and prime 2.91 percent of prime FRMs were over 90 days delinquent compared to 2.34 percent in the third quarter and 1.20 percent in the 4th quarter of 2008. Delinquent FHA loans increased 50 basis points to 5.85 percent in the fourth quarter. The rate was 4.55 percent one year earlier.

Brinkmann said he did not expect that problems resulting from option mortgage resets were going to be "the tidal wave that was expected". Many of the people who had those mortgages are thought to have refinanced already and some people defaulted before their loans reset. A lot of option loans have already reset so those people may be included in present foreclosure statistics or they may be paying their loans.

The Federal Reserve's rate increase announced yesterday was generally anticipated by the financial community, he said, and he did not expect it would have any immediate effect on mortgage rates. The termination of the Federal Reserve's bond purchase program will have a bigger impact and he expects that mortgage rates will begin to rise gradually in April. READ MORE