The perceptions, expectations, and plans of prospective homebuyers appear to be undergoing a transition according to results from the most recent Housing Trends survey report from the National Association of Homebuilders (NAHB). Rose Quint writes about the fourth quarter 2018 survey in a five-part series in the association's Eye on Housing Blog. She says that, for starters, there has been a steady erosion in the percentage of adults who said they planned to purchase a home within a year. That share slipped quarterly from 24 percent in the fourth quarter of 2017 to 13 percent in both the third and fourth quarters of 2018.

Quint says the decline provides additional evidence that housing affordability has become a serious concern. Its deterioration has been driven by several years of strong home price appreciation and interest rate increases throughout much of 2018.

There has also been a change in the composition of prospective homeowners. In Q4 2017 60 percent were first-time buyers. In the fourth quarter of 2018 that had slipped to 53 percent.

The intention to buy is inversely related to age. Twenty-two percent of Millennials plan to purchase within the next year but only 14 percent of Gen X'ers, 7 percent of Baby Boomers and 4 percent of seniors. As might be expected, most of the Millennials (77 percent) who plan to buy would be doing so for the first time, but surprisingly so were 47 percent of Gen X'ers and 28 percent of Boomers.

Quint says that most people start thinking about and planning a home purchase well in advance of actually engaging in the process of finding a home. In the fourth quarter of 2018 54 percent of those who said they planned to buy a home within the next year had actually started the process. This is also way down from a year earlier when 67 percent of the 24 percent who planned to buy were actively looking. The generation most likely to already be engaged trying to buy a home are Millennials (61% of prospective buyers in this group), followed by Gen X'ers (50%) and Boomers (48%).

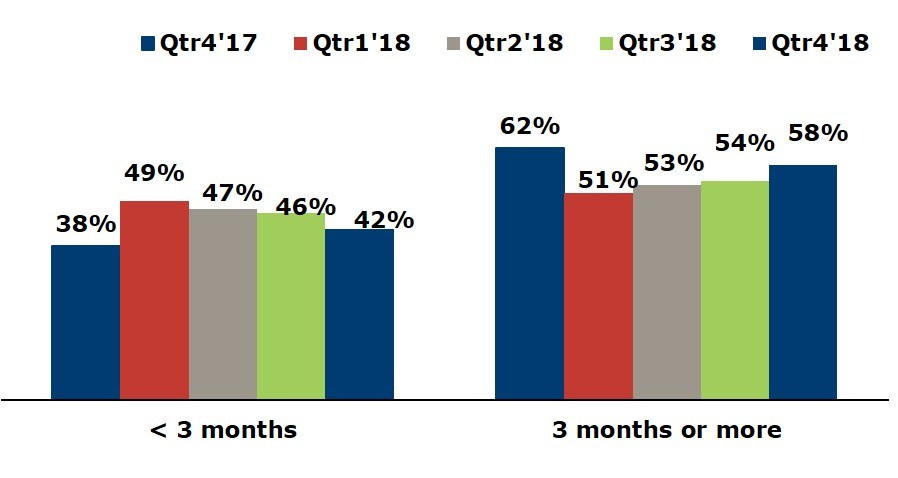

These active seekers are spending significant amounts of time looking. In the final quarter of 2018, 58% said they have already spent at least three months engages in the search. That share is somewhat smaller than the 62% who had spent three months or more in the final quarter of 2017

Prospective homebuyers don't expect that, by delaying a purchase, things will get any easier. In the fourth quarter of 2017, 27 percent of those planning to buy thought it would, but that share had fallen to 19 percent a year later while the share who figured it would get harder or stay the saw grew from 65 percent to 72 percent. These attitudes were fairly consistent across generations.

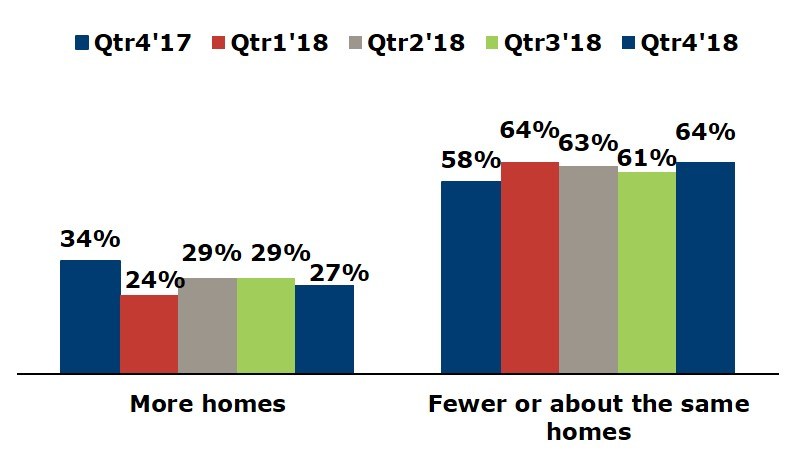

NAHB asked survey respondents for their impressions of how the number of for-sale homes in their area that they like and can afford had changed over the previous three months. In Q4 2018 64 percent said they thought there were fewer such homes on the market or that the number was unchanged. A year earlier 58 percent had that perception. The crunch in housing availability affects buyers of all generations. More than 60% of each group's buyers report seeing fewer/same number of such for-sale homes in the final quarter of 2018.

About three quarters of prospective buyers in the fourth quarter of 2018 estimated that they could afford fewer than half of the homes for sale in their local market, only slightly fewer than felt they could a year earlier. The percentage that expressed this was consistent across all age groups.

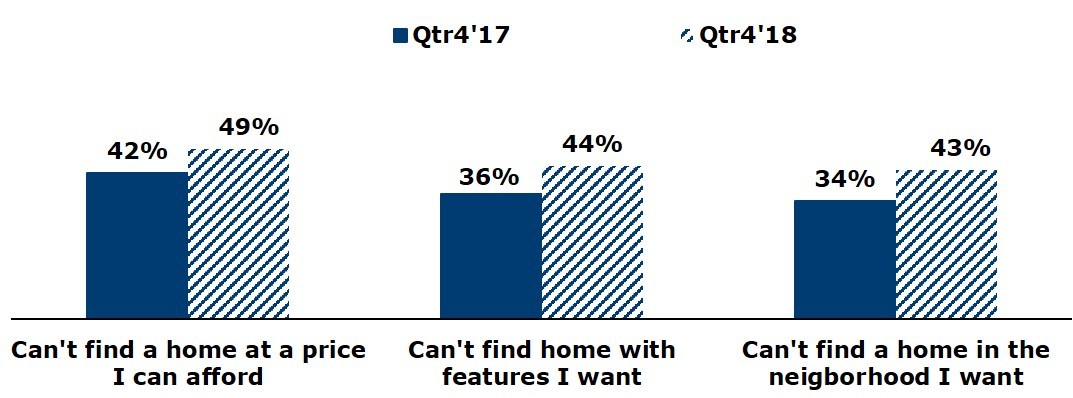

As reported above, 58% of buyers actively searching for a home to buy in the fourth quarter of 2018 have been looking - unsuccessfully - for three months or longer. Quint says the most important reason they give for why they haven't pulled the trigger is that they can't find a home at a price they can afford. This was closely followed by not being able to find a home with the features they want, or in the neighborhood of their choice. Comparing these findings to similar data from the fourth quarter of 2017 shows that these barriers to homeownership only intensified during the year in question.

The survey asked these long-term lookers about their future plans if the right home remains elusive in the months ahead:

- 63% will continue looking for the 'right' home in the same preferred location,

- 44% will expand the search area,

- 23% is willing to accept a smaller/older home,

- 18% might buy a more expensive home

Giving up on homeownership is the least likely outcome. Only 16 percent will stop trying to find a home. Quint says future polls will determine how this propensity to postpone homeownership will change, if at all, given the ongoing affordability challenges buyers continue to face.