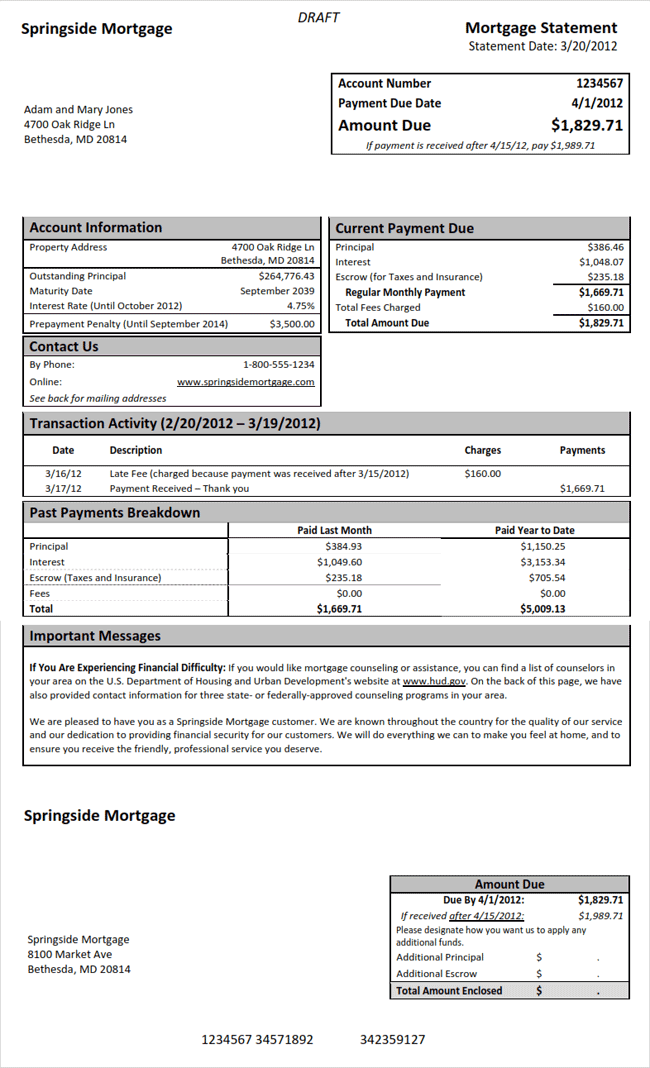

The Consumer Financial Protection Bureau (CFPB) has rolled out a prototype of a form for mortgage lenders to send to borrowers during each billing cycle to keep those borrowers abreast of crucial information about their loan. The prototype was published on CFPB's blog on Monday and the Bureau is asking for consumer and lender reaction.

The new model statement, designed for sending by mail or by electronic transmission, is based on a set of information that lenders are required, under the Dodd-Frank Wall Street Reform Act, to provide to their borrowers. CFPB is seeking to provide lenders a model for displaying that information in a clear and easily understandable format.

Dodd-Frank requires that consumers be notified on a regular basis about:

- Their principal loan amount

- Current interest rate

- The date on which that interest rate may reset

- A description of any late payment fees or potential prepayment fee

- Information about how to seek help from housing counselors

- Contact information for the lender.

The model form proposed by CFPB goes beyond that outline. It shows the borrower how the current payment will be applied, interest, principal, escrow, or special fees, and gives an accounting both of the previous month's activity and activity for the year to date and how those funds were applied as well. It also gives the borrower the ability to designate how to apply any extra payment amounts. In addition to the amount of any prepayment fee it also gives the expiration date of such penalties. It does not inform the borrower of the current balance in escrow accounts which would be a nice addition for planning purposes.

Lenders who provide coupon books to their borrowers are not required to use the form, but the coupon book must contain essentially the same information. Once the final form is adopted lenders will have some flexibility to adapt it to their own needs.

Lenders

and borrowers can comment about the form on CRPB's website.

Early Draft of Model Mortgage Statement