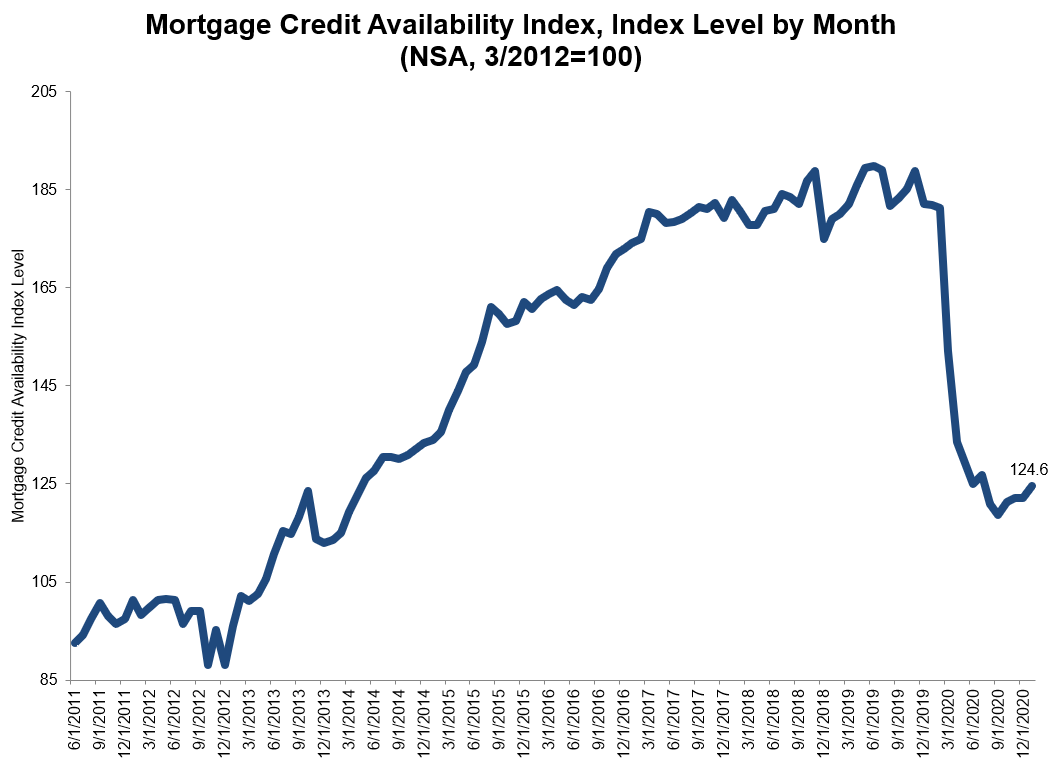

Access to mortgage credit increased again in January. The Mortgage Bankers Association (MBA) said its Mortgage Credit Availability Index (MCAI) rose 2.0 percent to 124.6. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

The two components of the Conventional MCAI posted significant increases. The Conforming MCAI jumped 7.7 percent and the Jumbo component was up 2.2 percent, pushing the parent index up 4.8 percent compared to December. This was slightly offset by an 0.1 percent decline in the Government MCAI.

"The growth in credit availability in January coincides with a housing market that is poised for a strong start to the year. Improvements were driven by the conventional segment of the mortgage market, as lenders added ARM loans with lower credit score and higher LTV requirements," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "Despite ARM loans accounting for a very small share of loan applications in recent months, lenders are likely looking ahead to a strong home buying season by expanding their product offerings."

Added Kan, "Ongoing strength in home-purchase applications and home sales continue to signal robust housing demand, even as low housing inventory remains a constraint. However, even with overall credit availability picking up in three of the past four months, credit supply is still at its tightest level since 2014."

The MCAI was at 181.3 in February 2020 as news of the pandemic broke. It declined by 16.1 percent in March and another 12.2 percent in April. Subsequent smaller decreases ultimately took the index to 118.6 in September before it began what is so far a stop and go recovery.

The MCAI and each of its components are calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via a proprietary product from Ellie Mae. The resulting calculations are summary measures which indicate the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.